By Rick Merritt, Silicon Valley Bureau Chief, EE Times

If you are designing nodes for the frontier of the IoT, the good news is that there are plenty of silicon outfitters. The challenge is figuring out what you need and mapping that to the growing landscape of suppliers.

The following list of 10 processors includes — in no particular order — some of the most interesting recent options that point to major trends in IoT silicon. You may not find the chip that’s an exact fit for your deployment, but hopefully, the list will guide you along some useful pathways.

1. MediaTek MT3620

Microsoft worked with MediaTek to make this processor the reference chip for Azure Sphere, its all-in-one node-to-cloud IoT offering announced in April. It’s part of a wave of integrated solutions emerging from cloud providers including Alibaba and Amazon.

Microsoft distinguished its approach by defining a so-called Pluton security block, implemented in the MT3260 on an Arm Cortex-M4F core that handles security operations. The part also includes a 500-MHz Cortex-A7 apps processor with 4-MB SRAM, a Wi-Fi subsystem, and support for 16-MB external flash.

The architecture is “absurdly heavy” in memory and power consumption, especially given that users can access only 256 KB of the on-board SRAM, said Hugo Fiennes, CEO and co-founder of Electric Imp. The IoT module and service vendor was among the first to deliver hardware for end nodes with connectivity and security built in, and now the cloud giants are catching up.

Cloud giants also hope that the integrated hardware attracts more customers for their massive data centers. That’s, in part, why Alibaba bought chip designer C-Sky in April.

So far, Google is partnering with MCU vendors such as Microchip for devices tied to its IoT cloud offering. It’s not yet clear whether Google will make its Edge TPU, announced in August, a merchant offering for IoT developers interested in machine-learning jobs.

2. ON Semi RSL10

ON Semiconductor is not one of the first names that comes to mind in microcontrollers. Nevertheless, its RSL10 — a Bluetooth Low Energy chip that targets apps such as fitness trackers and smart lights — blew away the competition in the ULP Mark benchmark with scores of 1,090 at 3 V and 1,260 at 2.1 V.

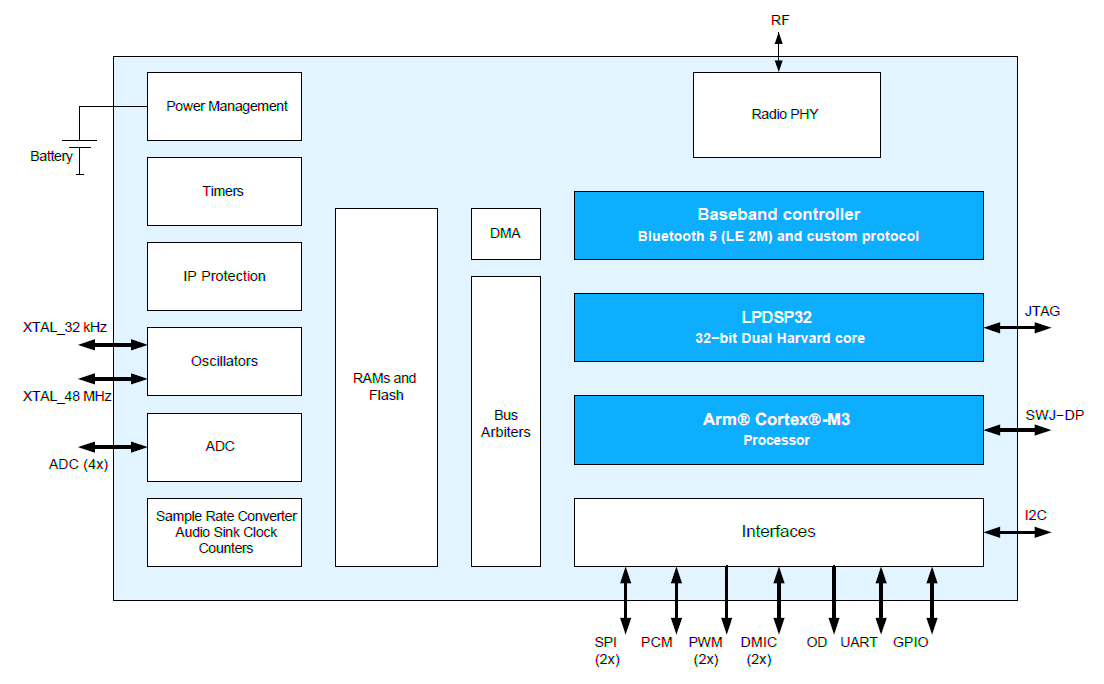

The RSL10 trades low power for performance. The chip’s Cortex-M3 runs at a stately 48 MHz. It’s also skimpy on memory, with just 76 KB SRAM for program memory, 88 KB for data memory, and 384-KB flash. However, it does pack a 32-bit DSP core to run audio codecs.

ON Semi’s RSL10 blew away the competition in EMBC’s ULP Mark scores. (Image: ON Semiconductor)

3. ETA Compute Tensai

Startup ETA Compute debuted in August 2017 as a core vendor with a unique technology for ultra-low-power chips. It described an Arm Cortex-M3 doing useful work while consuming 5 µW based on an asynchronous technique using a novel handshake to wake up circuits resting at power levels below 0.3 mV.

The company could not resist the intense gravity pulling silicon startups into AI at the edge. In October, it announced that its Tensai inference accelerator can run CFAR-10 jobs at just 2 mW.

Tensai pairs ETA’s Cortex-M3 with a CoolFlux DSP16 core licensed from NXP to run convolutional and spiking neural networks. The chip should be in production early next year.

4. Microchip SAM R34/35

Hoping to ride the LoRa wave, Microchip Technology launched its SAM R34/35 in the fall, marrying one of its microcontrollers with a LoRa transceiver in a sub-$5 system-in-package. Microchip is the latest of the top MCU vendors to jump on the LoRa bandwagon. In late 2015, STMicroelectronics announced its support and, more recently, shipped board-level products for LoRa.

The SAM R34/35 aims more at low cost and low power than high performance. Its Cortex-M0+ processor tops out at 48 MHz, although it delivers a CoreMark/MHz score of 2.46. And the chip supports, at most, 256-KB flash and 40-KB SRAM. Interestingly, the radio handles three bands — 137–175 MHz, 410–525 MHz, and the more typically used 862–1,020 MHz.

5. NXP i.MX-RT600

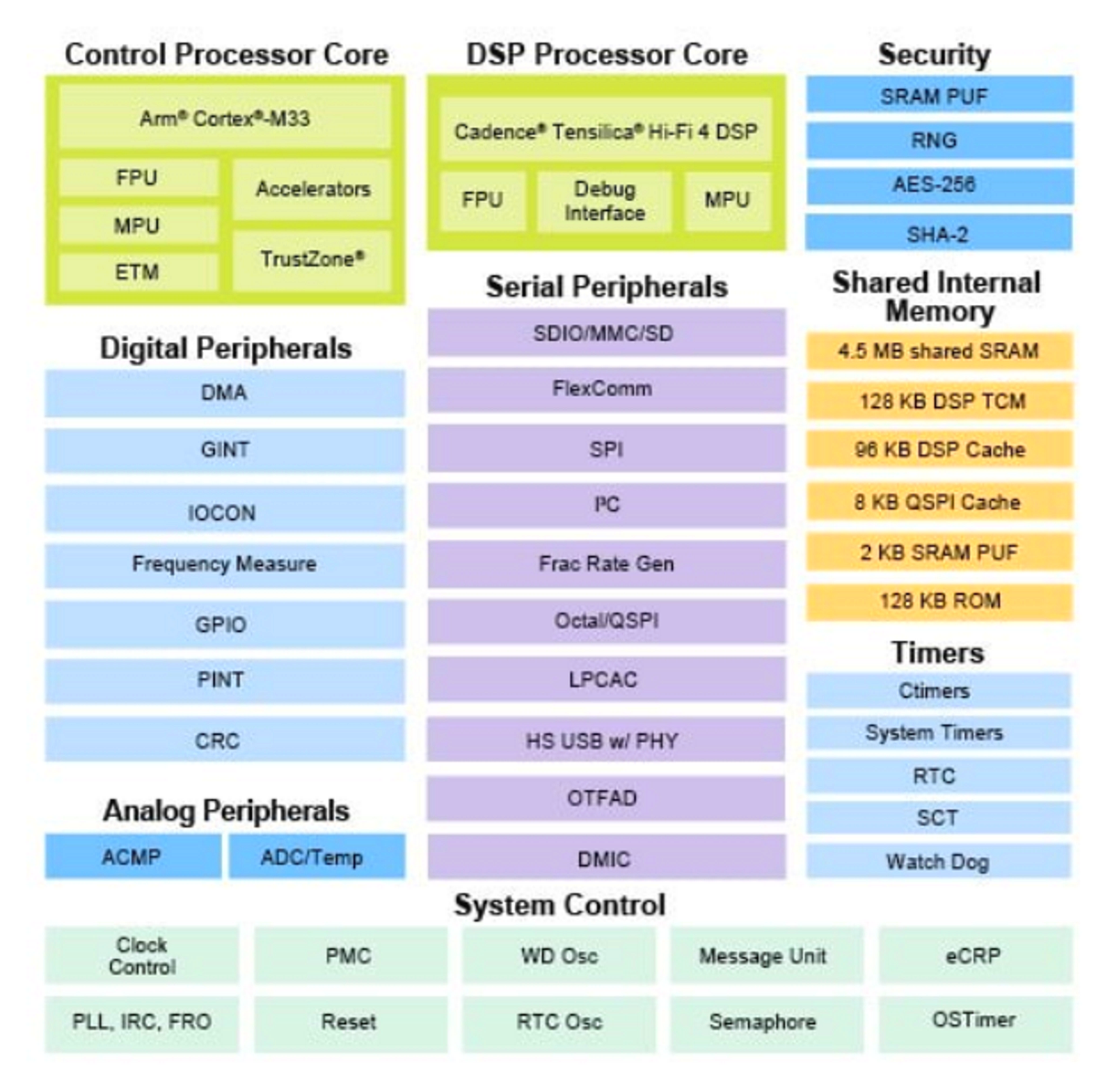

The race to bring machine learning to the edge of the IoT is already getting crowded, but a handful of options stands out. NXP Semiconductors’ planned i.MX-RT600 stakes out a high-performance position for audio apps.

The chip, not yet in production, includes a 600-MHz Tensilica HiFi 4 DSP that can deliver eight 16 × 16 MACs per cycle, according to a report from Bob Wheeler of the Linley Group. It is also among the first crop of SoCs to pack a 300-MHz Cortex-M33, Arm’s new core with built-in hardware security. In addition, it is in the first wave of chips taking advantage of fully depleted silicon-on-insulator process technology.

The high-end focus means that the part will likely require a high-end battery. The RT600 could consume 30× the power of ETA’s Tensai, and it lacks embedded flash, noted Wheeler.

A Tensilica DSP is central to neural-network acceleration on the NXP i.MX-RT600. (Image: NXP Semiconductors)

6. Renesas Electronics RZ/A2M

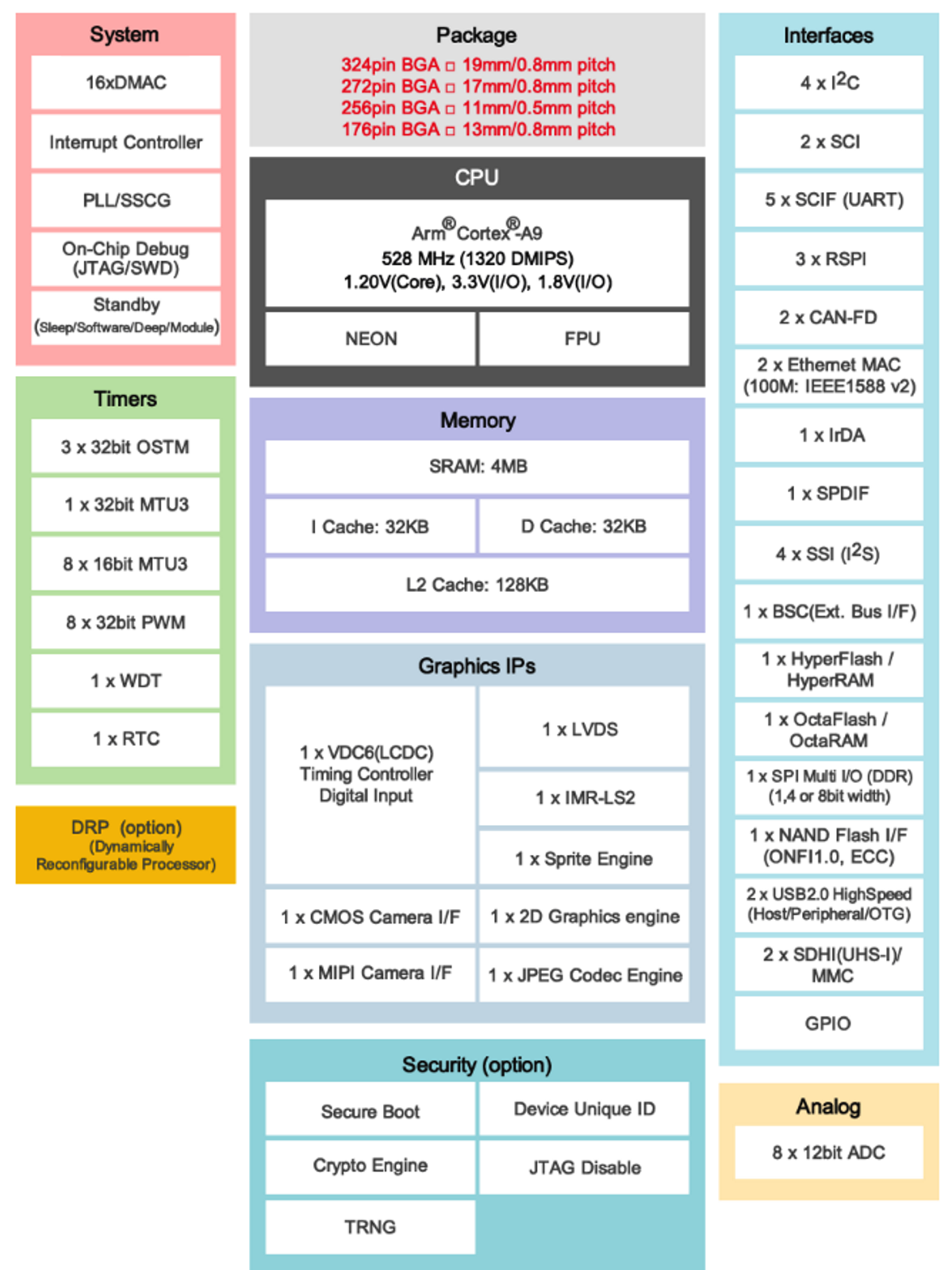

For imaging apps, Renesas previewed in September a unique part. The RZ/A2M combines a proprietary accelerator to process image data with a 528-MHz Arm Cortex-A9 and 4-MB SRAM for machine-vision jobs.

Renesas designed a dynamically reconfigurable processor (DRP) made up of multiple cores that can exploit the parallelism in imaging algorithms. It expects that the DRP, described as similar to a GPU, will handle a wide variety of jobs, initially around inference tasks. Future products will target neural-net training at the edge.

As with all parallel processors, programming can be the big bugaboo. Renesas said that its DRP can be programmed in C using compilers and tools that it provides.

The DRP is an optional part of the Renesas RZ/A2M key for targeting neural-net jobs. (Image: Renesas Electronics)

7. Ambiq Apollo3 Blue

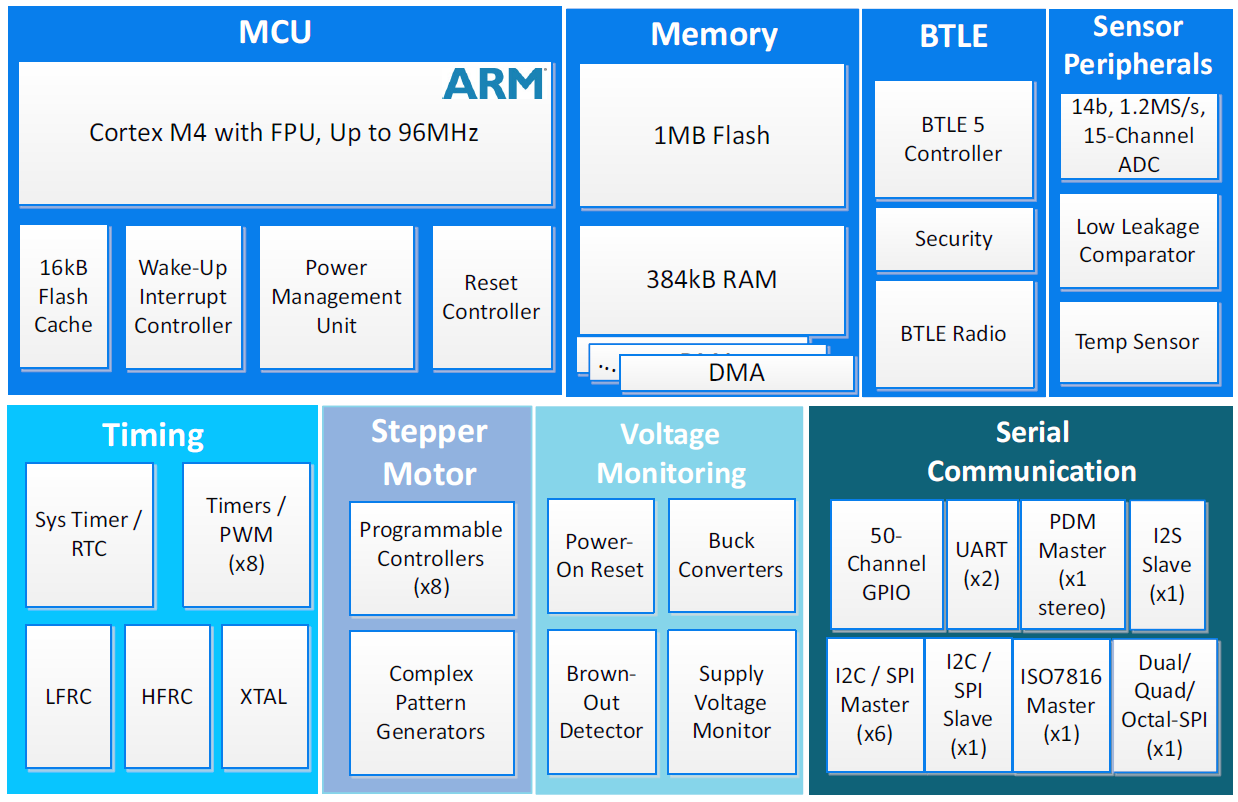

Ambiq Micro was one of the first startups to pioneer sub-threshold processing in the MCU space, driving some operations down to 0.5 V to save power. Its latest device, the Apollo3 Blue, pushes power consumption down to 6 µA/MHz, and it snagged a design win in the Huawei Honor Band 4 fitness tracker.

The device is now in production, but at press time, the company had not yet posted a datasheet. It packs a BLE 5 radio along with 1 MB of flash and 384-KB SRAM in packages as small as 3.3 × 3.2 mm. Ambiq has demoed the part running neural-net inference jobs using models from Sensory for users interested in building it into an always-listening voice assistant.

The Apollo3 Blue includes an embedded Bluetooth 5 controller and temperature sensor. (Image: Ambiq Micro)

8. STMicroelectronics STM32H7

If security is a top priority for your design, Fiennes of Electric Imp recommends the STM32H7.

“It supports ECC on all memories, and that’s unusual for an MCU,” he said. “In general, the STM32s have good security. We talk to the company about security improvements for the next generation and they listen.”

The SoC can drive an Arm Cortex-M7 to 2020 CoreMark and 856 DMIPS at 400 MHz. It includes up to 2-MB flash, 1 MB of SRAM, a TFT-LCD controller, a JPEG codec, and support for double-precision floating-point work.

9. Quectel BG96

One option well worth considering is buying an integrated module so that someone else can do the heavy lifting. Module makers such as Murata are experts at packing components together with minimal device spacing.

These days, you can get a module for whatever wireless network that you plan to use. Cellular modules are the most widely used because the vendor typically takes care of making sure that the devices pass time-consuming regulatory and even carrier certifications.

Fiennes recommends the BG96 module from Quectel Wireless Communications, in part because it supports not only the latest LTE CatM and NB-IoT standards but 2G as well, a good fallback for some global markets. It also supports GPS, comes in a compact 26.5 × 22.5 × 2.3-mm package, and hits prices well below $15 in high volumes.

The Quectel module uses a Qualcomm MDM9206 chip, but Fiennes noted that devices using an Altair cellular modem tend to consume less power. There are plenty of other choices from module vendors including Sierra Wireless, Gemalto, Telit, SIMCom, and u-blox, among others, some using cellular modem chips from Sequans and Samsung.

10. Roll your own

In these days when the IoT and machine learning are still young, you may be able to differentiate yourself with a homemade SoC if you have the time and money. This is an especially good option if you have an eye on a unique emerging application or your own bit of custom in-house IP.

There’s a smorgasbord of CPU, GPU, DSP, and accelerator cores available from companies such as Arm, Andes, Cadence, Ceva, Cortus, Synopsys, and VeriSilicon. Some of the vendors even have their own design service operations that would be happy to build an SoC to your spec.

Partner Content:

Advertisement

Learn more about Electronic Products Magazine