1. Maxim Integrated’s deal to acquire Volterra Semiconductor is expected to close by early December.

Maxim Integrated announced on August 15, 2013, a definitive agreement to procure Volterra Semiconductor for $23per share in cash. The transaction is valued at $450 million in enterprise and $155 million in net cash; a total of $605 million in equity. Volterra’s directors and officers have signed the tender, and it is slated to launch soon after the announcement.

2. Volterra product portfolio increases Maxim’s leadership position in integrated power management.

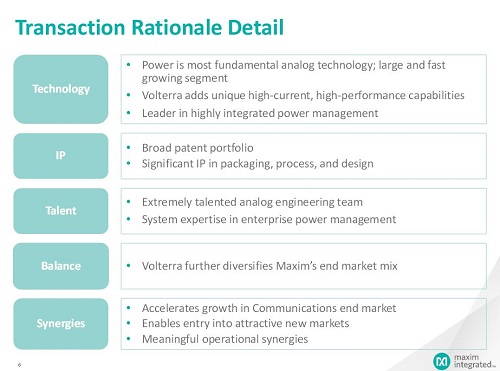

Maxim Integrated is a world leader in highly integrated solutions, featuring a broad IP and product portfolio, strong profitability, solid cash flow and return of capital, well established customer relationships, and diverse market exposure. Acquiring Volterra will leverage Maxim’s globally diverse market exposure and Volterra’s server power management expertise to promote entry into attractive new markets, accelerate growth in communications end markets, and create meaningful operational synergies.

The Investor Presentation includes detailed information justifying the acquisition.

3. Power management is the largest and fastest-growing segment of the analog market, valuing $9 billion.

As an industry leader in highly integrated power management solutions, Volterra features world-class analog engineering teams and seven generations of high-current-density solutions. By harnessing Volterra’s special high-performance capabilities, Maxim will improve its position in the communication and enterprise markets while incidentally enabling better performance, smaller form factors, enhanced scalability, improved system management, and lower total cost of ownership.

4. Volterra operates as a fabless semiconductor company using world-class foundries for silicon supply.

Volterra Semiconductor is actually a fabless semiconductor company; it designs, develops and markets proprietary, high-performance analog and mixed-signal power management semiconductors, but does not actually manufacture its own silicon wafers. A fabless company will outsource the actual manufacturing endeavors to a third-party associate and focus its efforts solely on designing the product. This allows the possibility to save on manufacturing costs by outsourcing to a country with lower labor costs, thus leaving the company with additional capital to invest back into research and development.

5. Joining forces with the innovative Maxim team will present exciting new opportunities for Volterra's employees.

The transaction is mutually beneficial for both companies’ shareholders: employees, customers, and investors. As employees, the Volterra team will have access to Maxim’s global market scale and niche, and Maxim will have access to Volterra’s unique expertise. The economies of scale will allow greater innovation at lower costs, thus benefitting customers, and ultimately investors.

Advertisement

Learn more about Maxim Integrated