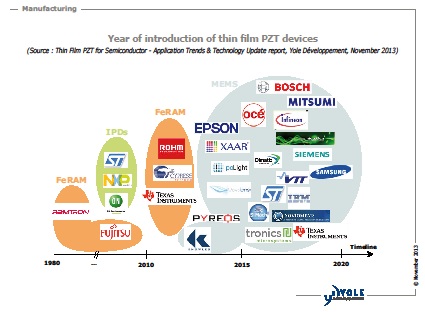

Lyon, France – November 21, 2013: Yole Développement announces its Thin Film PZT for Semiconductor Application Trends & Technology Update report. This technology and market analysis provides an overview of thin film PZT applications, including forecasts. In addition to a detailed study of manufacturing process & challenges ahead including technology roadmaps, Yole Développement delivers key industrial market players’ positioning.

The most promising effect of thin film PZT for future applications would certainly be its piezoelectric effect

In September 2013, EPSON has announced its next generation inkjet technology, PrecisionCore, introducing for the first time MEMS inkjet heads manufactured with thin film PZT technology. This announcement has been highly publicized: first, thin film PZT MEMS applications are now on the market, proving the reliability and maturity of this technology! Second, more inkjet head players will soon follow.

“Thin film piezoelectric materials are gaining increasingly more importance within the MEMS industry. Although semiconductor manufacturing companies are historically reluctant to introduce such exotic materials into their production lines, every major MEMS foundry nowadays is working on the implementation and qualification of piezoelectric thin film in their MEMS manufacturing processes,” explains Claire Troadec, Market & Technology Analyst, Semiconductor Manufacturing, at Yole Développement.

Lead zirconium titanate or PZT (Pb[ZrxTi1-x]O3 with 0=x=1)) is a very interesting ferroelectric material. Depending on its composition, it has the advantage of combining 3 different material properties: high dielectric constant, pyroelectric effect and piezoelectric effect.

Its high dielectric constant property is still extensively being used with the integration of thin film PZT in Integrated Passives Devices (IPDs) and to a lesser extent in Ferroelectric memories (FeRAM). These have been the 2 leading applications for thin film PZT for many years. NXP Semiconductors and STMicroelectronics dominate this IPD market.

The pyroelectric effect of PZT is today being used by Pyreos for thin film PZT based uncooled Infrared detectors, although this thin film PZT based technology remains quite marginal in this field.

The most promising effect of PZT for future applications would certainly be its piezoelectric effect.

Companies like Wavelens and PoLight are extensively working on the introduction of their autofocus based products to the market using thin film PZT technology. This profusion of new MEMS applications using thin film PZT technology is just beginning.

The roadmap for high volume production is still to be built

The main difficulty for thin film PZT technology is the integration of this exotic material into a robust and reproducible process flow. There are major technological challenges associated with thin film PZT integration into a product : deposition, etching, process monitoring, test, reliability.

These are complex topics and although many R&D efforts have been made so far by labs, equipment and material suppliers, and device manufacturers, some work remains to be done to achieve robust products for high volume production.

In deposition, 2 technologies are competing: Sol-Gel and Sputtering.

Sol-Gel gives better intrinsic film properties as deposited thin film PZT, with good uniformity and higher breakdown voltages. But when considering high volume production, throughput becomes a major consideration and this is where Sol-Gel shows some limitations.

Many equipment manufacturers within the semiconductor industry are thus working on a more classical solution: Sputtering.

ULVAC was among the first companies to develop thin film PZT deposition based on a PVD process and today, they have the more reliable PVD technology. Big semiconductor players like Applied Materials started preparing to compete in this market 18 month ago. They are rapidly ramping up their activities on thin film PZT. Meanwhile players like Oerlikon and SolMateS are continuing to improve their deposition technology, be it PVD or Pulsed Laser Deposition technology.

They both show very promising results. SolMateS is a very interesting case: with their recent PLD technology and smaller company size, they end up competing with large PVD equipment manufacturers in this thin film PZT manufacturing area.

The thin film PZT manufacturing battle is only beginning and the next 5 years are going to be very interesting!

In this report, Yole Développement evaluates each thin film PZT deposition technology and compare them. The analysts’ team describes all key thin film PZT based applications. Yole Développement presents a roadmap for each key player with their expected year for market entry. Finally, they present their thin film PZT production forecasts for the 2013-2018 period.

About Thin Film PZT for Semiconductor – Application Trends & Technology Update report:

Authors:

Claire Troadec is a member of the MEMS manufacturing team at Yole Développement. She graduated from INSA Rennes with an engineering degree in Microelectronics and Material Sciences. She then joined NXP Semiconductors, and worked for 7 years as a process integration engineer at the IMEC R&D facility. During this time, she oversaw the isolation and performance boost of CMOS technology node devices from 90nm to 45nm. She has authored or co-authored seven U.S. patents and nine international publications in the semiconductor field and before joining Yole Développement managed her own e-commerce company.

Dr. Eric Mounier has a PhD in microelectronics from the INPG in Grenoble. He previously worked at CEA LETI R&D lab in Grenoble, France in marketing dept. Since 1998 he is a co-founder of Yole Développement, a market research company based in France. At Yole Développement, Dr. Eric Mounier is in charge of market analysis for MEMS, equipment & material. He is Chief Editor of Micronews and MEMS’Trends magazines (Magazine on MEMS Technologies & Markets).

Catalogue price:

Euros 5,990.00 (Full report – Multi user license) – Euros 2,990 (Executive Summary) – Publication date: December 2013.

For special offers and the price in dollars, please contact David Jourdan ( or +33 472 83 01 90).

o

Companies cited in the report:

AIXACT, American Elements, Applied Materials, Argonne Lab, AVX, BAE, Brother, CEA Le Ripault, Cranfield University, Deplhi, DRS, EPCOS – A Member of TDK-EPC Corporation, EPFL, Epichem, Epiphotonics, EPSON, FLIR, Fraunhofer ISIT, Fraunhofer IPMS, Fujifilm Dimatix, Fujitsu, GLOBALFOUNDRIES, Hammamatsu, Heimann, Holst Centre, Hynix, IBM, Imagine Optics, IMEC, Infineon, Ipdia, Irisys, Kojundo lab, Korean Institute of Technology, KTH, L3Com, LAAS, Lemoptix, LG, Matsushita, Maxim, Microsystem lab, Microvision, Mitsubishi Chemical, Murata, Nippon Ceramic, NovioMEMS, NXP, Oce, Oerlikon, OKI, Olympus, ON Semiconductor, OnChip, Panasonic, Paratek, Philips, Philips Research, PoLight, Pulse, Pyreos, Ramtron, Rohm, Samco, Samsung, Semtech, Siemens Medical, Silicon Sensing Systems Japan, Singapore Univ, Sintef, SolMateS, Sonitor, Sound Design Technology, SPTS, STMicroelectronics, SUSS MicroTec, Symetrix Corporation, Tango, Technolas Perfect Vision, Tegal, Texas Instrument, Tezzaron, Thales, Tronics Microsystems, Toshiba, Tyndall, ULIS, ULVAC, US Army lab, Vermont, VTT, Western Digital, WiSpry, Xaar, X-FAB.…

Advertisement

Learn more about Yole Développement