BY PATRICK LE FÈVRE, Marketing and Communication Director, Ericsson Power Modules, www.ericsson.com/powermodules

In just five years, the novel currency Bitcoin has achieved widespread adoption around the world, demonstrating the power of advanced computing to deliver novel ways of creating and storing value. At the same time, it has demonstrated the volatility of such novel cryptocurrencies as governments work out how to react to them and users wrestle with what is the natural value of an entirely virtual form of money, backed neither by commodities nor a central bank.

Even if Bitcoin itself founders, it has shown there is a global demand for a decentralized currency free of political intervention and that robust mechanisms already exist to prevent fraud that can be exploited by future competitors to Bitcoin, some of which are already appearing, such as Litecoin or Namecoin.

Cryptocurrencies present both a major opportunity and a design challenge for companies who wish to enter the market for electronic hardware to create and manage the currency, which has soared in dollar value since its introduction five years ago. Speed of deployment is vital for companies building the specialized hardware that is now almost essential for the successful acquisition of new Bitcoins, or the coins used by its competitors — a process known in the community as “mining” — and which underpins the operation of the currency network itself.

Taking Bitcoin as an example, to provide a way of authenticating transactions, ensuring that only valid Bitcoins are spent and only once by a given user, all transactions are stored in a shared online log of transactions, known as the blockchain. The concept of the blockchain is key to the Bitcoin-mining process as it is the miners that process the algorithms used to authenticate and add transactions to the blockchain.

Transactions are rolled up into blocks that are appended to the blockchain, of which all computers in the network have a copy. To make sure that the blockchain is valid, each block confirms the integrity of the previous one and is identified by a short hash – a code that acts as a signature for a block of data that is produced by a one-way function.

Making the slightest change to the block’s core data will result in an entirely different hash. It is practically impossible to create a different block of transactions that will contain the same hash as an existing block, preventing fraudsters from inserting fake transactions into the blockchain. The hash identifies each block and, as each block refers to the previous one in the chain, users can assure themselves they are working with the true Bitcoin blockchain.

The hash is created during the mining process and is designed to be computationally expensive. And it is becoming increasingly so as a function of the design of the Bitcoin system. To ensure that Bitcoins are generated at a rate that does not flood the network, the Bitcoin algorithm uses a difficulty factor that rises as more computer resources are deployed to mine the coins. The difficulty factor determines the number of leading zeros that are required in the hash for new blocks. As the value of a hash cannot easily be predicted from the source data, miners have to perform a large number of computations to build a hash that both represents the new block and has the right format. Only when that happens is that block accepted into the blockchain, at which point the miners are rewarded with a number of Bitcoins. It is a competitive process — if another miner achieves the solution first, they will win and all others working on that block will have to start on a fresh, unsolved block.

The power to mine

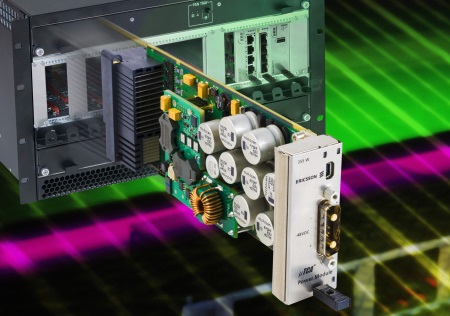

When Bitcoin began, relatively few users were on the network and it was possible to mine profitably using desktop PCs. As mining became more popular, users turned to graphics-processing units (GPUs) and quad-core designs (see Fig. 1 ) for their higher computational performance on the SHA256 algorithm that underpins Bitcoins Hashcash system. And the complexity and computation being deployed continues to rise. As a result, speed of development is key to producing successful Bitcoin mining hardware. Not only that, the systems need to be energy-efficient.

Fig. 1: Graphics processors and even quad-core processors (that require up to 300 A) are needed to keep up with the computational complexity to mine Bitcoins

For cryptocurrency mining to be profitable, valid hashes need not only be generated quickly but using as little electricity as possible. Energy cost is a major factor in determining the lifetime cost and value of a mining system. This has moved the emphasis toward high-speed, low-power silicon in which the core functions of SHA256 are implemented using hardwired logic interconnected by an efficient on-chip network.

The needed hardware

To make cryptocurrency-mining hardware, companies are now using nanometer processes to produce highly parallelized dedicated processors in order to achieve high-speed operation. Like microprocessors and FPGAs built on these process technologies, the Bitcoin processors demand low voltage levels – from below 1 to 3 V – with a tolerance of just ±30 mV. Because of their low-voltage operation, even the most efficient Bitcoin mining will have a significant current draw because of the large number of custom ICs that need to be deployed in parallel. Some systems can require as much as 350 A during peak loads, during which time they are delivering a huge volume of candidate hashes. Such high demands make the selection of the power strategy and its associated power converters critical. High-efficiency power-conversion subsystems (see Fig. 2 ) are essential to avoid the generation of excess heat and to keep electricity costs low.

Fig. 2: High-efficiency power conversion is needed to minimize heat and keep electric costs low

The challenge facing developers of Bitcoin mining hardware mirrors those faced by many other teams working on designs that incorporate advanced custom processors. There are major tradeoffs to be made in terms of supply voltage versus compute efficiency and silicon yield that may not be apparent at the start of the project. A small rise in the nominal supply voltage can improve yield from the fab as it reduces the possibility of circuits failing from voltage droop during periods of high on-chip current demand. Alternatively, the designers may find the device operates well with a slightly reduced voltage, which can improve overall power consumption thanks to the quadratic relationship between voltage and power in CMOS circuits.

These changes need to be reflected in the power delivery subsystem within the required tolerances of today’s process technologies without forcing a redesign of the dc/dc converters and surrounding circuitry each time so that it is ready for the arrival of the new silicon. This way, the mining hardware can be shipped to waiting customers immediately.

Digital power control

Traditional power-converter designs use analog control technologies that are tuned through careful selection of external passive components to provide a control loop that is stable under changing load demands. But even small changes in voltage output call for the passives and their placement to be reassessed.

Advanced digital control provides the answer to this problem. Digital control can deliver high-efficiency energy with the tight voltage tolerances than advanced processors require in the face of changing requirements. Digital control makes it possible to improve and optimize dynamic response to changing loads because the digital protocol does not have to take into account any tolerance problems, which are the case for the capacitive and resistive networks used in analog control loops. However, designers have tended to avoid the use of digital control loops because their setup can be complex and time-consuming if performed manually.

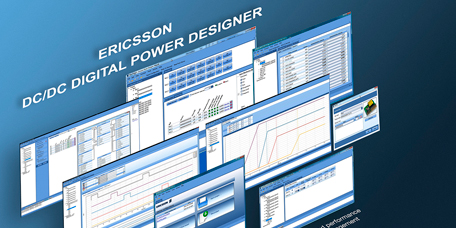

Software tools provide the way to design, simulate, analyze, and configure the voltage regulator. Using a tool such as Ericsson Power Designer. it is possible to build effective control-loop settings within minutes. The software includes simple tools for the robust design of control loops, together with more advanced design and analysis tools to optimize the dynamic response performance (see Fig. 3 ).

Fig. 3: Power Designer suite helps design, simulate, analyze, and configure voltage regulators to optimize power performance

The control-loop tool can also help in the design of the decoupling capacitance network that advanced low-voltage processors require. It can determine the type and number of capacitors and capacitance that is needed to meet the load transient requirements. By entering these parameters, engineers can, in conjunction with the tool, minimize the number of decoupling capacitors needed for a certain load-transient requirement and in doing so reduce PCB complexity and size, allowing more space for the deployment of multiple processors.

Although the rise of fast-paced development projects such as those for Bitcoin mining hardware presents challenges for power converter design, the use of advanced digital control coupled with software tools means that these systems are ready to go the moment silicon arrives back from the fab.

Advertisement

Learn more about Ericsson Power Modules