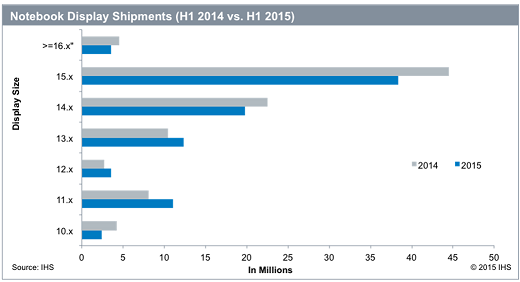

SANTA CLARA, Calif. (August 13, 2015) – Global consumers have lately become less interested in acquiring conventional notebooks with 15-inch displays, and they are instead shifting their spending to smaller product segments. In the first half of 2015, panel shipments in the 15-inch range (i.e., 15.0 inches to 15.9 inches) dropped 14 percent year over year, from 44.5 million to 38.4 million units, according to IHS Inc. (NYSE: IHS), the leading global source of critical information and insight. At the same time, driven by the popularity of Chromebook, notebook display shipments in the 11-inch range have grown from 8 million units to 11 million units.

“Thanks to affordable prices, and a completed ecosystem with a host of hardware and app choices and a user-friendly cloud environment, Chromebook has expanded its customer base from small and medium-sized businesses and the education market to general users,” said Jason Hsu, supply chain senior analyst for IHS Technology. “The Chromebook sales region has also expanded from the United States to emerging countries, where more local brands are launching Chromebook product offerings. There are also more products set to debut in the 12-inch range, thanks to the success of the Microsoft Surface Pro 3 and rumors of Apple’s upcoming 12.9-inch tablets.”

According to the most recent IHS Notebook and Tablet Display Supply Chain Tracker, total notebook panel shipments to Lenovo and Hewlett-Packard fell 27 percent month over month from 6.4 million units in May to 4.7 million units in June, while overall set production increased by 13 percent from 5.4 million units to 6.1 million units. These two leading notebook PC brands have recently taken steps to regulate panel inventory, in order to guard against excess product pre-stocking.

“The currency depreciation in Euro zone and emerging counties earlier this year jeopardized consumer confidence and slowed the purchase of consumer electronics, including notebooks,” Hsu said. “Moreover, in April, Microsoft leaked the announcement of its new Windows 10 operating system. Despite Microsoft’s claims that a free upgrade to the new operating system would be available to Windows 8 users, many consumers still deferred purchases, which increased the brands’ set inventory. Notebook manufacturers could decide to lower set production in the third quarter, after the end market becomes sluggish in May and June.”

With notebook panel prices remaining very low, profitability has become an issue, and many panel makers are facing pressure to maintain fab loading and gain market share. “Panel cost structure has become crucial in the struggle to stay competitive,” Hsu said. “Continuous panel over-supply not only hurts profitability, but could also confuse the real panel market demand in the fourth quarter of 2015 and the first quarter of 2016. It’s time for panel makers to revise their production numbers, and curb capacity utilization, to keep pace with actual market demand.”

IHS Notebook and Tablet Display Supply Chain Tracker provides a monthly quick check of panel shipments, as well as shipment results by brand and production relationships with original equipment manufacturing (OEM) partners. The business plans of notebook and tablet panel makers, OEMs and original design manufacturers (ODMs), and notebook and tablet brands are also included. For information about purchasing this report, contact the sales department at IHS in the Americas at +1 844 301 7334 or ; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or ; or Asia-Pacific (APAC) at +604 291 3600 or .

Advertisement

Learn more about IHS iSuppli