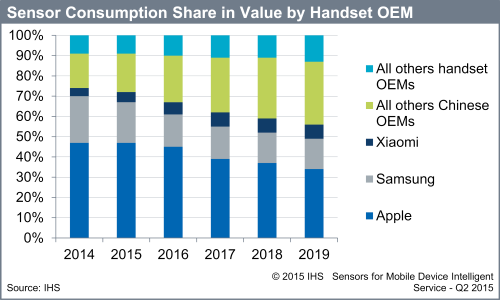

Apple and Samsung will remain the dominant buyers of sensors for smartphones through 2019; however, their share of sensor spending will fall. Bolstered by its fingerprint sensor, Apple represented nearly half (47 percent) of smartphone sensors in 2014, but the company’s share is expected to fall to 34 percent in 2019. At the same time Samsung’s share will decline from 23 percent to 15 percent, according to IHS Inc. (NYSE: IHS), the leading global source of critical information and insight. Chinese original equipment manufacturers (OEMs) comprise an ever-larger share of revenues from sensors sold to the smartphone market, increasing from 20 percent of the market in 2014 to 38 percent in 2019.

According to the IHS Sensors for Mobile Devices Intelligent Service , Apple’s declining share is due to the growth of the overall smartphone market, even though its smartphone unit shipments are on the rise. Samsung’s share decline is due not only to the overall growth in the market, but also because of falling unit shipments. The South Korean company suffers from both Apple’s competition in high-end smartphones, as well as competition from Xiaomi and other Chinese providers of low-end and mid-range smartphones.

“The smartphone market is healthy, dynamic and extremely competitive,” said Marwan Boustany , senior analyst for IHS Technology. “Chinese OEMs have proved willing to try any new technology that allows them to compete more successfully. Of the many Chinese handset manufacturers, Xiaomi will consume the greatest number of sensors in 2019.”

China is proving to be an ideal environment for sensor suppliers seeking to enter the competitive smartphone market, and for smartphone OEMs hoping to differentiate their models with innovative features. The country is generally viewed as the place to test out new ideas and to fine-tune supply chains. Beyond the adoption of new and emerging sensors, more standard sensors are being adopted in very high volumes, thanks to the rapid growth in sales of mid-range and high-end smartphones.

The Chinese government’s decision to support local companies has led to an increase in local manufacturing and sourcing of electronic components. However today there are only a handful of suppliers with a relatively narrow portfolio. These companies include AAC Technologies and GoerTek, for microphones; MEMSIC, for accelerometers and magnetometers; and QST and other emerging start-up companies, for motion sensors.

“With the Chinese government’s strategic goal to increase the share of domestic suppliers, there is an opportunity for Chinese suppliers to expand their portfolios and become the preferred suppliers for Chinese OEMs,” Boustany said. “At the moment, though, it seems that Chinese OEMs are happy to use any supplier that fulfills their volume, performance and price requirements.”

Advertisement

Learn more about Electronic Products Magazine