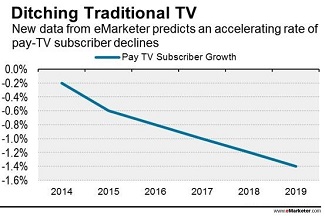

According to data collected from eMarketer, the act of cord-cutting is picking up pace, and it’s largely being driven by rapid proliferation of digital video services.

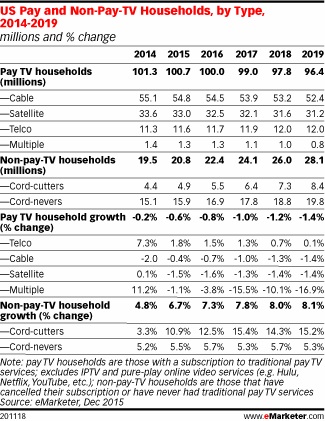

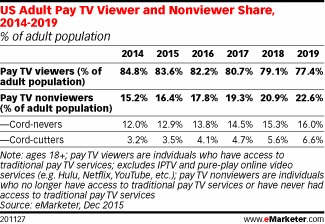

Per the report, the number of TV households that pay for traditional television programming will fall at an accelerating rate over the next four years, reaching a 1.4% decline in 2019. Come this time, eMarketer suggests that nearly 23% of US households will no longer pay for traditional TV.

In terms of where the market is today, the number of households that do not subscribe to paid-for television programming—which, it should be noted is a combination of cord cutters as well as cord nevers (those who never signed up in the first place, which makes up 12.9% of the market this year, and is expect to swell to 13.8% next year) will reach 20.8 million by the end of 2015. That’s about 17% of US households, and a 10.9% jump since last year.

For 2016, cord cutter households are expected to increase by another 12.5%. When the market reaches this benchmark, it is expected the total number of US households subscribing to cable / satellite will officially fall below the 100 million mark.

“This year, the number of digital video services expanded at a faster pace than ever before,” said eMarketer’s senior analyst Paul Verna in a statement. “In addition to standalone offerings from the likes of HBO, there are new digital bundles that include many of the channels consumers could only have received with cable and satellite subscriptions in the past. This widespread availability of digital content makes cord-cutting a viable option for a growing segment of the viewing population.”

Specifically, TV packages put together by telecom providers like Verizon and AT&T are expected to enjoy a period of growth over the next year. Early estimates suggest a 1.8% growth for this segment.

“Telecom companies have done better than cable or satellite providers in selling bundles that include high-speed internet connectivity, phone service and TV,” said Verna. “These all-in-one packages often save customers money and facilitate viewing on mobile devices.”

Via eMarketer

Advertisement

Learn more about Electronic Products Magazine