Ranking at the top of all U.S. exporting industries in recent years, the semiconductor industry has grown substantially since its origins in the 1940s. The field kicked off its boom in 1987 when the formation of industry associations such as the Semiconductor Research Corporation (SRC) gave the American industry a boost over the leading Japanese. Maintaining 30% growth per annum throughout the 1990s thanks to the Windows-PC success, the semiconductor field coasted along until the late 2000s before PC demand sharply declined. A lull period then stemmed from an oversupply of materials that became excessive after PC demand slowed. The situation worsened as transistors became smaller and their manufacturing expenses increase, but without the revenue from PC sales to sustain the necessary innovation, growth became unsustainable.

Despite the industry’s global sales hitting a then all-time high in 2000, earning $204 billion, the semiconductor industry has since grown at an overall rate of 5% annual per annum – a stark contrast to that of 22% in the 1980s. As the 21st century continued, acquisitions became essential for survival in the semiconductor industry, enabling companies to pool resources together and adapt to the growth of the Internet of Things. The purchases also increase overall revenue, which impresses stakeholders.

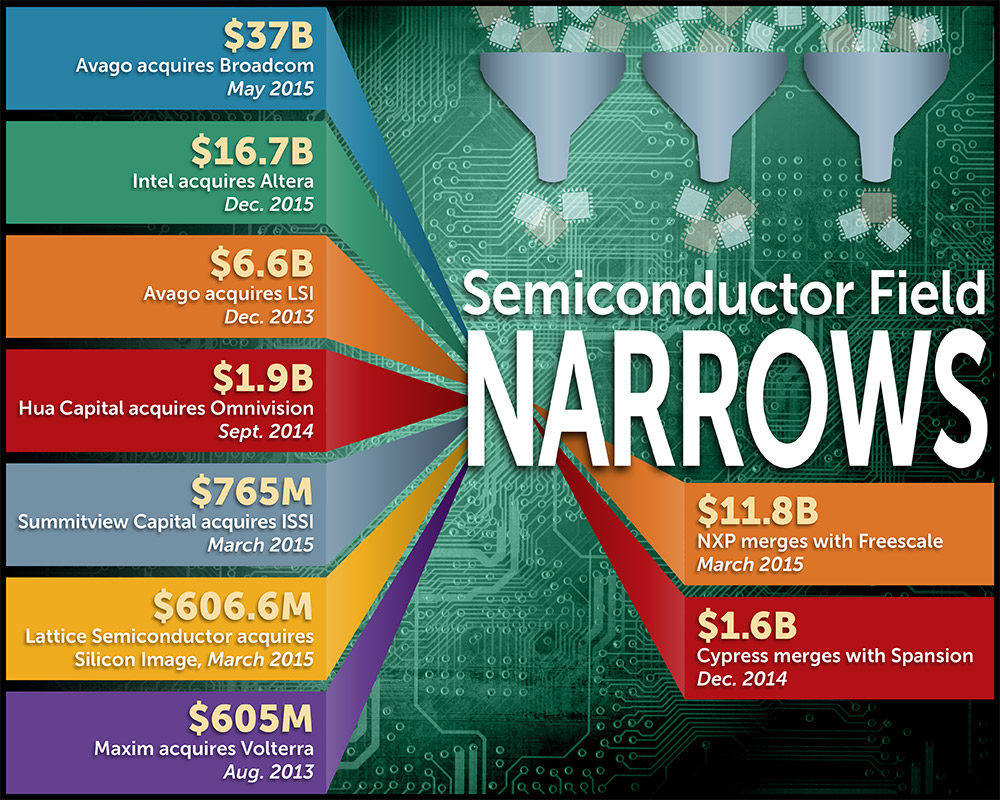

The first half of 2015 alone brought a total value of $72.6 billion in semiconductor merger and acquisition agreements, nearly six times the annual average in previous years. Driven by the nearing Internet of Things era and its demand for embedded chips and sensors, companies have no choice but to acquire one another to fill the gaps in their R & D and production capabilities. The last three years have brought forth increasingly expensive acquisitions, showcasing the action’s necessity to reach success. Even consistent global semiconductor sales leader Intel completed the acquisition of Altera in December 2015, claiming the company known for its field-programmable gate array technology.

The biggest deal yet, however, occurred when Singapore’s Avago Technologies acquired Broadcom, a “major supplier of integrated circuits for the mobile-phone industry,” for $37 billion. The deal displays a monumental growth since Avago’s acquisition of chip company LSI for $6.6 billion in December 2013. Following the purchase, the prices of both companies surged upwards.

Similarly, mergers can bolster a company’s technology, as seen with Cypress Semiconductor merging with Spansion. The move boosted each company’s micro and memory chip offerings but subsequently led to the dismissal of 1600 employees.

Creating powerful new branches even goes beyond the United States, as seen by the Dutch firm NXP’s $11.8 million acquisition of the Texas-based Freescale Semiconductor, Inc. The two companies were combined with the Internet of Things’ “high growth opportunities” in mind, becoming a leader in automotive semiconductor solutions after merging.

While 2016 opened with sluggish global semiconductor sales, the stability that acquisitions can restore to the industry is promising. “There’s been a lot, and a lot more is going to happen,” said Betsy van Hees, a Wedbush Securities analyst. “The industry will continue to consolidate.”

Source: Mercury News, Semiconductor Industry Association, Intel, IC Insights, Forbes 1, Forbes 2, Statista, Semiconductor History Museum of Japan, SelectUSA

Advertisement

Learn more about Electronic Products Magazine