By Jonathan Cassell

SoftBank Group Corp.’s massive all-cash acquisition of ARM Holdings prompted a polarizing reaction in the market. Many tech experts lauded the move to buy the purveyor of invaluable processor intellectual property (IP). However, investors initially panned the purchase, with SoftBank shares falling by more than 10% in Japan following the news.

ARM is undoubtedly valuable, with applications processors using its IP used in 85% of mobile devices, according to an estimate from the company. But is it really worth $32 billion? This question is at the heart of the debate over whether SoftBank bought a white elephant — or the goose that laid the golden egg.

The most prevalent argument made by those in favor of the acquisition is the Internet of things (IoT), where the huge growth of sensor- and processor-based device shipments promises to propel a new wave of demand for ARM’s processor technology. However, even this massive expansion might not be enough to justify SoftBank’s expenditure on its own. Instead, the real reasons for the purchase may be more complex, with the ownership of ARM’s technology aiding SoftBank’s plans in emerging businesses that will grow out of the expansion of the IoT market.

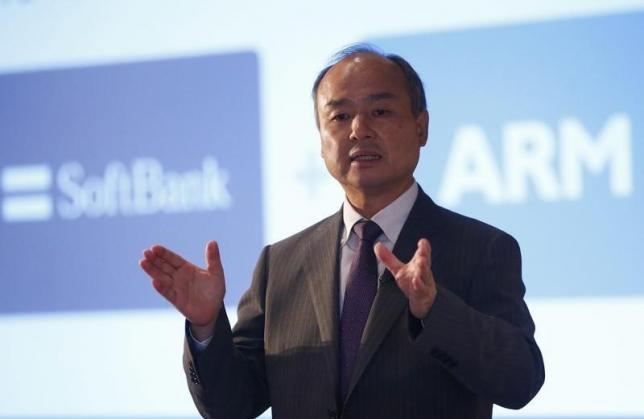

Image Source: Reuters.

Desperately seeking ROI

SoftBank faces a high bar when it comes to attaining financial success on this deal. To achieve a 10% return on investment, SoftBank would have to more than quintuple ARM’s operating profit, according to a New York Times article written by Reuters columnist Dominic Elliott.

Most of ARM’s current business comes from the mobile market, with 45% of ARM-based chips used in devices like smartphones and tablets. However, because growth in smartphones and tablets is flattening, SoftBank is unlikely to generate such massive growth from the once-booming market.

This brings us to the IoT market, which some believe could generate the kind of growth required to justify the investments. Gartner forecasts that the installed base of devices connected to the IoT will rise to 20.8 billion in 2020, up from 4.9 billion in 2015.

ARM already plays in the IoT market. The company said that 38% of ARM-based chip shipments go to the “embedded intelligence” segment, i.e., microcontroller-based embedded systems that increasingly are being connected to the IoT.

Furthermore, in 2014, the company launched its mbed Device Server designed to simplify the connection of ARM-based IoT systems to the cloud. In 2015, ARM entered into partnerships related to mbed with firms involved in IoT technology, including IBM and General Electric.

ARMed for disruption

However, even the explosive growth promised by the IoT by itself may not justify SoftBank’s massive outlay for ARM.

“On its own, I don’t think that just growth in IoT sales supports the price,” said Dale Ford, vice president and chief analyst, technology, at the market research firm IHS Markit. “(The ARM acquisition) has a broader-based benefit that SoftBank can realize by supporting its investments in many areas of communications. I think this larger strategy is what makes ARM worth the price SoftBank is paying for them.”

During the past few years, SoftBank has acquired multiple companies related to the communications market, including Sprint, Vodafone Japan, and Japanese PHS operator EAccess. These companies use technologies, including mobile phones and servers, licensed from ARM.

“SoftBank has grown primarily by acquiring and growing communications companies in mobile and broadband markets, which helped insulate SoftBank from the sluggish PC market in the last decade, thanks to a prescient view of the growth in mobile technologies,” wrote Tom Hackenberg, IHS Markit’s principal analyst for embedded processors, in a research note. “With mobile handsets beginning to enter market saturation in many mature economies, the IoT has become the next great disruptive technology. Softbank’s investment in ARM might not only be paid back by further growth in ARM, but also help protect the company’s other investments and drive future investment strategies.”

The next big thing in the Internet of Things

SoftBank will now seek to leverage the technology it obtained from the ARM acquisition across its broad communications portfolio. This effort will unlock new opportunities that will develop around the IoT.

“Many people have a very narrow view of the IoT being only lots of sensors with basic communications capability,” Ford said. “ARM has solutions targeting cloud servers and many applications involving image processing, virtual reality, augmented reality, etc…. It is this larger development of the overall IoT ecosystem that presents great opportunities for ARM.”

For SoftBank, the acquisition of ARM’s IP business may allow it to cash in on this expanding ecosystem developing in parallel to the IoT, a deal that may turn out to make every penny of the $32 billion worthwhile.

Advertisement

Learn more about Electronic Products Magazine