Qualcomm Inc., the largest maker of semiconductors for the wireless market, announced a definitive agreement to acquire NXP for $39 billion in a deal that will create the second largest chipmaker by revenue after Intel.

The mobile-communications chipmaker will pay $110 a share for NXP, worth an 11.5% premium to the $98.66 that NXP stock was worth on Wednesday evening before the announcement. Excluding debt, the agreement is worth roughly $39 billion — making it the biggest semiconductor deal ever, surpassing Avago’s $37 billion acquisition of Broadcom Corp last year.

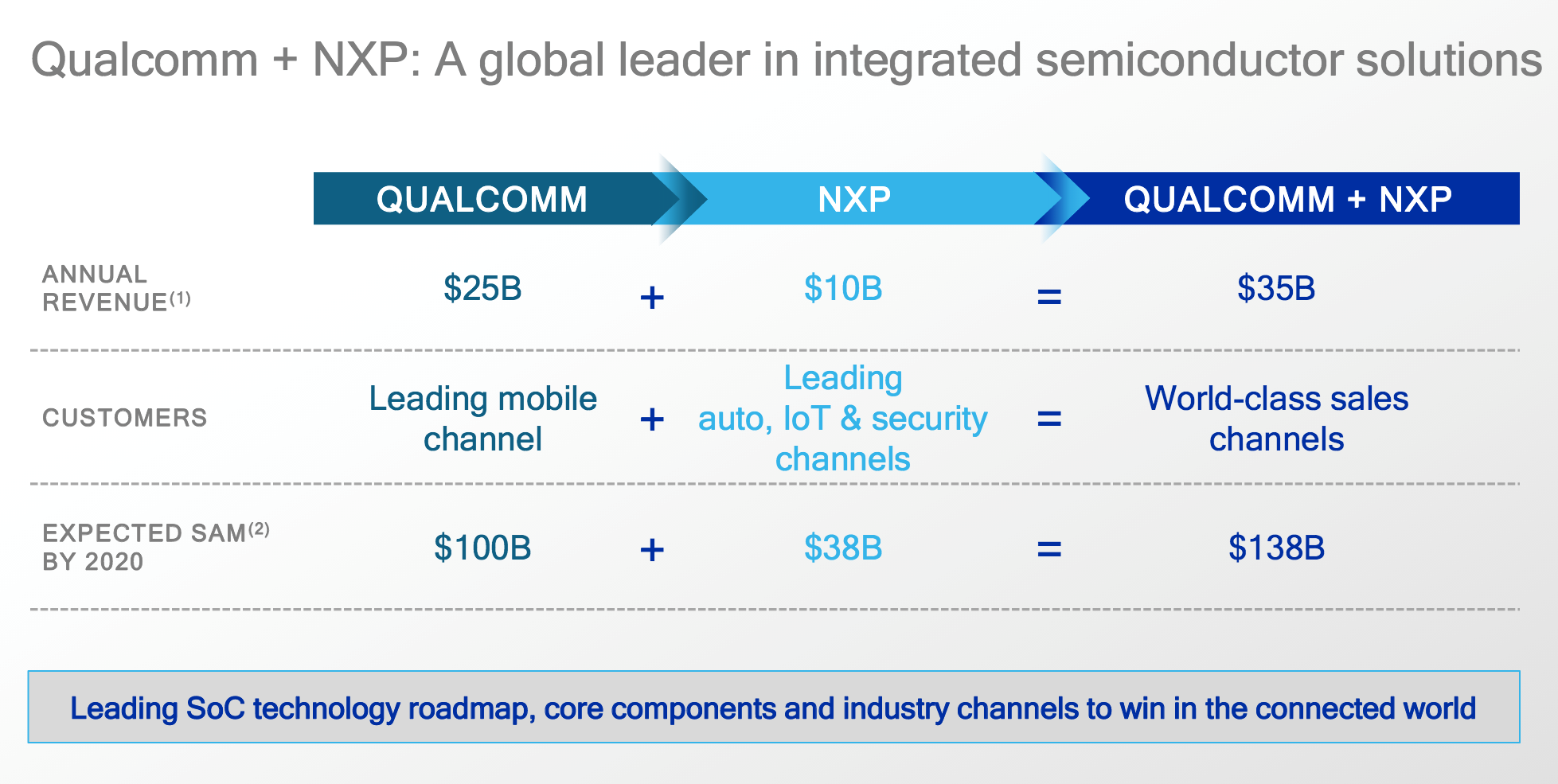

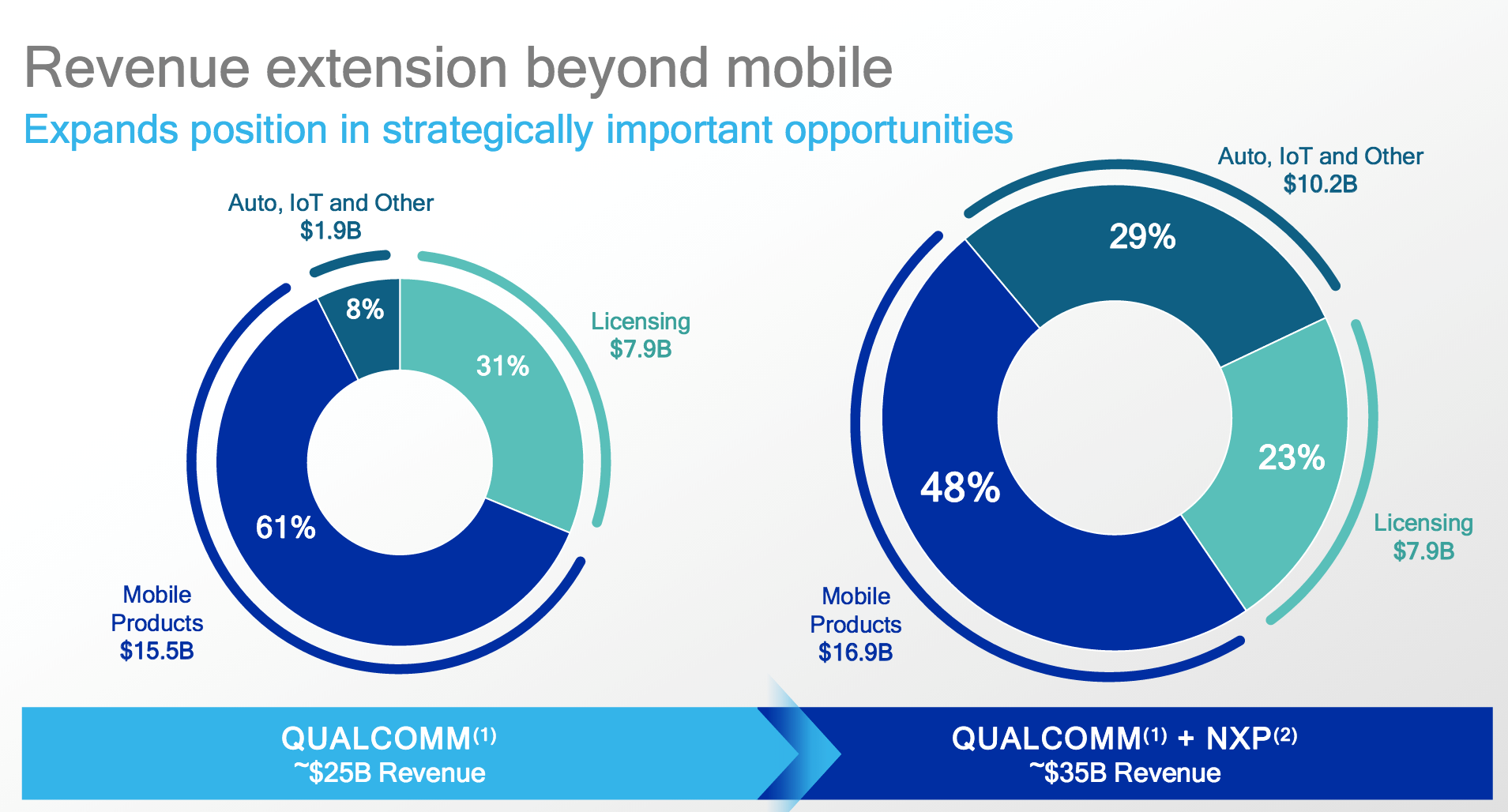

Qualcomm hopes to expand its footprint into key growth areas like automotive, Internet of Things, security, and networking, raising its total addressable market to $138 billion by 2020.

The deal is expected to increase Qualcomm’s adjusted earnings per share immediately after closing and will generate over $10 billion a year in earnings before taxes, interest, depreciation, and amortization. Debt taken to finance the purchase will be repaid within the two years. Qualcomm speculates that the deal would boost its earnings from the smart device segment fivefold to $10 billion.

By acquiring NXP, Qualcomm won’t simply diversify its product portfolio; the two companies complement each other’s strengths, penetrating market segments that were previously closed off to either.

“The NXP acquisition accelerates our strategy to extend our leading mobile technology into robust new opportunities, where we will be well positioned to lead by delivering integrated semiconductor solutions at scale,” said Qualcomm CEO Steve Mollenkopf. He sees the connected-car and IoT market comparable to “where handsets were back in 2000.”

NXP — especially after purchasing Freescale Semiconductor in 2015 — excels in areas where Qualcomm is lagging or not present, including chips for smart cars and self-driving cars and sensors for smart devices. Given the auto industry’s high barrier to entry and long product cycle of development, NXP’s well-established relationships with automotive OEMs enable Qualcomm to make immediate inroads and pick up an existing roadmap for the future. At the same time, NXP’s self-driving efforts lack the machine-learning capabilities on par with Qualcomm.

Despite NXP’s lead in the smart sector, the company is facing several challenges that Qualcomm’s telematics and connectivity may resolve. NXP’s smart-device chips are well suited for current applications, but they lack long-term technology needed to take advantage of faster networks like 5G networks. Qualcomm expects to have a phone-ready 5G modem chip available for testing in 2017.

The deal isn’t expected to close until the end of 2017, after facing a lengthy review by regulators in nine jurisdictions. The official announcement comes one month after rumors of the acquisition first leaked.

Advertisement

Learn more about Electronic Products Magazine