By Majeed Ahmad, contributing editor

Cypress Semiconductor, a widely reported target for acquisition, has announced strong results for the second quarter of 2017. The San Jose, California-based chipmaker credits this strength to growth venues like automotive, IoT, and USB Type-C.

Is this a harbinger of the fact that the merger and acquisition wave that rocked the semiconductor industry during the past couple of years is finally losing steam? And that new growth markets such as automotive and IoT are taking pressure off of chipmakers? It’s at least partly true.

What we see now is an industry that is finally coming to terms with the slowdown of its key drivers: personal computers and smartphones. Just a few years ago, the smartphone market was growing by 20% to 25% annually. And then the mobile handset market started flattening.

Partly, it was the single-digit growth that brought a sense of paranoia to the semiconductor industry, and partly, it was a quest for a play in promising new markets like automotive and IoT. Nevertheless, the unprecedented era of semiconductor buyout is coming to an end.

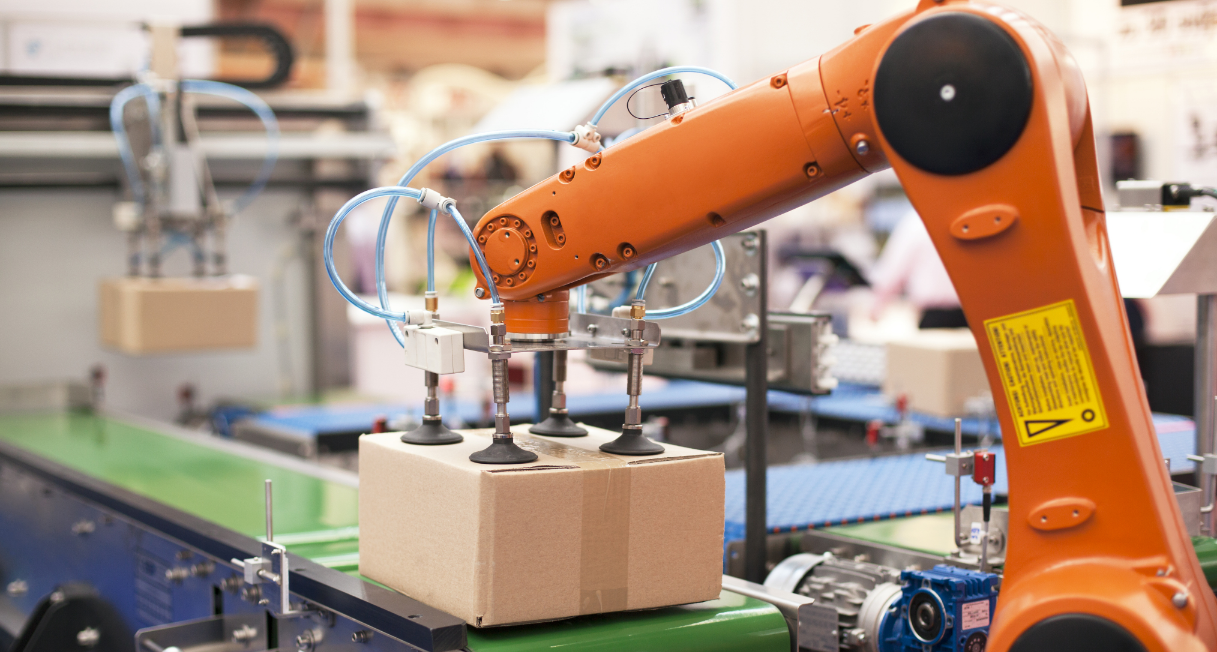

Meanwhile, it’s becoming apparent where the action is. Apart from Cypress results, another indication comes from Texas Instruments’ strong quarter performance riding on the automotive and industrial segments, which contributed to 70% of TI’s first-quarter growth. Industrial IoT is gaining traction in enterprise areas such as manufacturing, oil and gas, smart buildings, etc. Image: Cypress Semiconductor.

Industrial IoT is gaining traction in enterprise areas such as manufacturing, oil and gas, smart buildings, etc. Image: Cypress Semiconductor.

Here is a sneak peek at the segments that are now being seen as the emerging growth drivers. And they have triggered much of the action in the chip industry’s acquisition wave.

1. Data centers

Intel’s $16.7 billion purchase of FPGA kingpin Altera was one of the first major acquisitions, and it signaled the shifting sands in electronic design. Intel, a key supplier of high-end processors for data centers, saw the inevitable shift toward high-performance computing (HPC) and wanted to shore up its CPU offerings with FPGA solutions from Altera.

2. Automotive

Intel has also made a bid for automotive jackpot by acquiring the advanced driver assistance system (ADAS) specialist Mobileye. Before that, NXP had acquired Freescale to bolster its automotive offerings and make a strong bet on a wide array of IoT designs.

Moreover, Renesas’ decision to buy analog powerhouse Intersil was mostly about boosting its automotive offerings. The Japanese chipmaker has been aiming to complement its automotive MCUs with analog chips for car displays, batteries, etc.

3. Industrial IoT

Another buy from Intel, Movidius, specializes in vision processing for applications such as machine learning, and it applies to autonomous driving as well as industrial automation. The technologies like machine vision are going to play a vital role in IIoT applications such as asset management and predictive maintenance.

4. Hardware security

The IoT bonanza comes with serious security concerns, and that opens up a new window of opportunities for MCU suppliers. For instance, IoT design vulnerabilities are pushing hardware-based security to the fore.

Take MCU supplier Atmel, for instance. It had a long history in chip-based security technologies like secure boot and trusted computing platform. Atmel was snapped up by Microchip partly due to its security solutions like ATECC508A co-processors.

5. Internet of sensors

The IoT bandwagon is also reinvigorating the sensor industry. TDK’s takeover of MEMS specialist InvenSense for $1.3 billion just shows how sensors are quickly becoming a major building block in electronic design. The IoT-centric connectivity is allowing sensors to expand in automotive, industrial, and home automation segments. Image: InvenSense.

The IoT-centric connectivity is allowing sensors to expand in automotive, industrial, and home automation segments. Image: InvenSense.

There could be more deals in the coming months. For instance, Toshiba has announced to spin off its semiconductor business in a bid to recover from a series of missteps.

But one thing seems certain: The semiconductor industry is past its unprecedented consolidation era, and it has largely aligned itself to make a play in new growth frontiers like IoT.

Advertisement

Learn more about Electronic Products Magazine