Special Project Editor’s Note: The most ubiquitous components in any electronics design — interconnect, passives, and electromechanical (IP&E) devices — are in the midst of an unprecedented supply shortage. What distinguishes this scarcity from others is the broad base of markets that are desperate for IP&E.

OEMs are facing idle production lines while they wait for devices that cost less than a nickel. Engineers are trying to find workarounds for components that are facing 40-week lead times. AspenCore Media’s Special Projects team is taking a deep dive into everything IP&E: What end markets are gobbling up components? Why isn’t capacity being added? Where are prices going? And how did we get here?

Finally, we’ve interviewed IP&E market leaders to find out how they’re meeting customers’ needs and what the supply chain can expect from interconnect, passive, and EM technologies in the future.

By Gina Roos, editor-in-chief

The first rumblings of a components shortage were heard in late 2016. Scarcity became a sobering reality in 2017 as rising demand spread across industry sectors. But many component manufacturers questioned whether the uptick in demand was real, leading to their reluctance to ramp up production capacity. Component manufacturers weren’t ready to invest in factories, fearing a repeat of the 2000 industry downturn marked by ballooning inventories and rock-bottom pricing. This contributed to further supply constraints.

What’s made the situation worse is that many suppliers have decided to obsolete many of their parts at the same time, widening the supply gap. Distributors report that many Japanese passive component manufacturers are dropping their legacy commodity lines and shifting production over to newer products, creating further sourcing challenges.

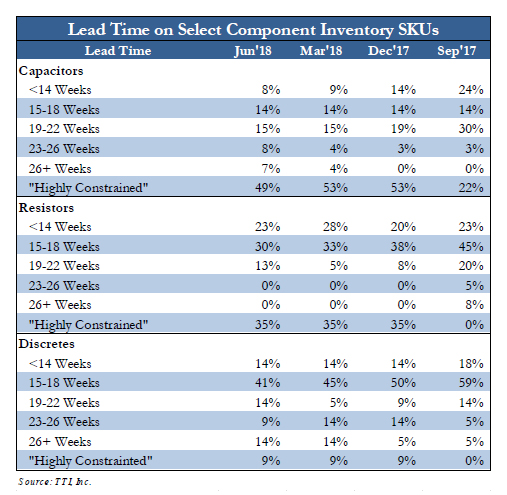

Currently, many MLCCs and resistors are on allocation or are quoting lead times well into 2019. But the supply shortages are spread across capacitor technologies including aluminum electrolytics, film, and tantalum, as well as inductors and all types of resistors.

Industry players don’t expect to see much relief until mid-2019, and some think that shortages will last well into 2020. As part of AspenCore’s look at the current state of IP&E component shortages, EPSNews has polled leading passives suppliers AVX , KEMET , Murata, and Vishay to find how they are meeting supply challenges and helping their customers stay up-and-running.

Ceramic capacitor manufacturers including AVX, KEMET, Taiyo Yuden, and TDK are all quoting extended lead times and managing product allocation. Murata Manufacturing, a leader in ceramic capacitors, is no exception. Murata is reporting constrained supply for smaller 0201 and 0402 case sizes as well as some larger sizes for both low- and high-capacitance/voltage (CV) values.

Electronics distributors, which work with many suppliers, are quoting lead times between 20 weeks and 50 weeks depending on the manufacturer and characteristics of the ceramic parts, said Sean Sisson, vice president, North America, for Rutronik Electronics. “Larger case sizes are more difficult to get and are at the higher lead-time range. But they are all difficult to get.”

Murata and AVX lead times are running at 52 weeks or longer, said Sisson. “Make no mistake about it, we’re in allocation.”

Some manufacturers are investing in new plants, but the challenge is that it takes time to get those plants up and running, said Sisson.

Like suppliers, distributors are trying to help end customers. Sisson recommends that customers expand their approved vendors list (AVL). OEMs can survive these shortages by having the flexibility to move from one manufacturer to another on their AVL, he said.

Even stringent medical and automotive OEMs “are changing without blinking because they know it will shut down their production lines,” he added. “There is a lot more flexibility with those verticals than I’ve ever seen.”

“As long as our customers are giving us the ability to move from one supplier to another, we’ve been pretty successful in fulfilling our customer requirements. It’s all about inventory, and our inventory is very strong, so we have the ability to help as long as they provide us with some flexibility with their AVL.”

Three Tips to Ensure Supply

- Expand your AVL

- Consider a part with a different CV value such as a lower/higher capacitance or voltage

- Evaluate different technologies such as tantalum or aluminum electrolytics

Source: Data compilation & analysis by Stifel.

All major manufacturers of multilayer ceramic chip capacitors (MLCCs) are increasing production capacity. In addition to alleviating the current shortage, manufacturers see tremendous demand projected for MLCCs. The number of these devices per application — ranging from smartphones to vehicles — are increasing, and there’s a rise of new applications related to 5G, the internet of things (IoT), and the electrification of vehicles.

Fearing a sudden oversupply, capacitor manufacturers are “cautiously” adding production capacity. But many industry players don’t believe that it’s enough. Shortages will likely play out until 2020.

More parts move to EOL or NRND

Adding to an already squeezed supply chain, Murata reportedly is placing many products on end of life (EOL) or not recommended for new designs (NRND). Murata declined to comment on the matter. However, distribution lead-time trends indicate that Murata is quoting long lead times for MLCCs and has issued EOL notifications for many parts.

Future Electronics, in its Q2 market conditions report, said that lead times for Murata’s surface-mount ceramic capacitors range between 20 to 38+ weeks and continue to increase. Murata has issued EOL notifications for many of these parts, added the company.

Future also reported lead times of 18 to 20 weeks for Murata’s leaded ceramic capacitors, although many of the company’s leaded parts are EOL. It also noted a “controlled order entry on a long list of parts, mostly for large parts.”

TTI Inc. also lists several of Murata’s parts as constrained. These include Murata’s GR and ZR series of ceramic capacitors for select values in 0402, 0603, 0805, and 1206 and larger case sizes across dielectrics, including R, X5R, X7R, X7S, and X6S. Capacitance values are typically ≥1 µF with voltages less than 100 V. In addition, several of Murata’s commercial and automotive ceramic capacitors are in constrained supply including the GC, GRM, and ZR series for select values in case sizes from 0201 to 1825. Low and high CV values in all dielectrics are affected.

Constrained Murata Parts

GR* and ZR* Series Monolithic Ceramic Capacitors:

- Select values in 0402, 0603, 0805, and 1206 and up case sizes

- R, X5R, X7R, X7S, and X6S dielectrics

- Capacitance values ≥1 uF and voltage less than 100 V

Commercial and Automotive Ceramic Capacitors

- GC*, GRM, and ZR series

- Select values in 0201−1825 case sizes

- Low CV and high CV all dielectrics

Source: TTI Inc., July 2018.

Fusion Worldwide reported in August that “Murata is at the forefront of the manufacturers impacted” by the dramatic increase in global demand for MLCCs, particularly in the telecommunications and automotive markets. Fusion reported lead times of 12 to 36 weeks for Murata’s standard MLCCs and 24 to 52 weeks for Murata’s automotive series capacitors, including GCM31/GCM21/GCM188/GCJ31/GCJ32.

“Bigger case sizes, such as 1210/1206/1812 for 105/106/107/226 capacitance values are facing critical shortages,” said Fusion. “On top of that, Murata officially announced a number of part numbers updated with status ‘Not Recommended for New Design’ as well as cost increases in line with market demand. The NRND parts are mainly case sizes above 0603, capacitance below 104 (0.1 µF), and voltage within 100 V.”

Murata is expected to stop producing consumer MLCCs in 2020 to focus on automotive products, according to Fusion. The supplier plans to expand production capacity at plants in Japan, the Philippines, and Wuxi, China. But it could take two to three years before it reaches full capability, said Fusion, so no short-term relief is expected.

In June 2018, Fukui Murata Manufacturing Co., Ltd., a manufacturing subsidiary of Murata Manufacturing Co., Ltd. acquired a new site in Japan to expand MLCC production capacity. Construction is expected to start in September 2018 and be completed by the end of December 2019.

Sisson expects that component shortages will continue into 2020 and beyond due to new technologies using more MLCCs. “It’s not going to get better any time soon. The end of 2020 is a conservative estimate,” he concluded.

Check out all of the stories inside this IP&E Component Shortage Special Project:

Engineering a Solution to the IP&E Shortage

Supply challenges are not something that designers typically concern themselves with, but this is one time when they should.

How the Supply Chain Developed an IP&E Shortage

The ghosts of shortages past — specifically, the inventory glut of 2001 — are haunting manufacturers of interconnect, passive, and electromechanical (IP&E) components.

Passive component shortages drive new supply strategies at Kemet

After nearly two years of passive component shortages , component manufacturers are having difficult conversations with their customers about forecasting and supply strategies to ensure that their product lines don’t go down.

AVX: Component shortages require better communications, more transparency

Like most major ceramic capacitor makers, AVX Corp. is dealing with constrained supply for almost all of its ceramic products.

Vishay Intertechnology Diversifies as End-Markets Expand

The company is likely to exceed growth expectations in 2018 given a severe component shortage across the electronics industry.

IP&E Users Get Creative as Component Shortages Linger

This year, the interconnect, passives, and electromechanical (IP&E) industry hit an inflection point. New and growing markets, including automotive, smartphones, telecommunications equipment, and industrial applications, are pushing demand for many types of resistors and capacitors well beyond what vendors can comfortably supply.

Substituting Solid Tantalum and Tantalum Polymer Capacitors for Surface-Mount MLCCs

Due to current bottlenecks in the procurement of surface-mount ceramic capacitors, however, designers are looking for substitutes to keep their production lines running smoothly and to find long-term replacements for hard-to-find ratings.

Advertisement

Learn more about Electronic Products Magazine