Despite Covid-19’s impact on the automotive industry, the demand for connected vehicles remains strong in all regions, and connectivity is meant to become ubiquitous in key markets within this decade. According to ABI Research’s report “Connected Car Market Data,” over 73% of new vehicles shipped globally in 2027 will feature embedded connectivity.

Europe has the highest adoption of connectivity in new vehicles due to the eCall mandate. Although not mandatory in the region, North America has the second-highest adoption because car OEMs perceive it as value-added to customers. In fact, North America is expected to exhibit the fastest growth in embedded connectivity as new cloud-based services become a core proposition for OEMs.

Europe has the highest adoption of connectivity in new vehicles due to the eCall mandate. Although not mandatory in the region, North America has the second-highest adoption because car OEMs perceive it as value-added to customers. In fact, North America is expected to exhibit the fastest growth in embedded connectivity as new cloud-based services become a core proposition for OEMs.

Asia-Pacific has the third-highest adoption of embedded connectivity, led mainly by China. Telematics has grown dramatically in the country, boosted by quick adoption of electric vehicles (EVs), fast 5G implementation, and leadership in vehicle-to-everything (V2X). Moreover, China is at the forefront of connected vehicle technologies due to decisive government action in developing a solid local internet-of-vehicles industry and distinctive consumer behavior, with a desire for high-tech vehicles with superior infotainment experience. At the end of 2021, nearly 50% of all new vehicles in China will have connectivity, which will increase to almost 80% by 2025.

In Latin America, embedded connectivity has been fostered by the adoption of eUICC (or embedded SIM) in the past four years. While currently available in premium vehicles only (e.g., BMW), several carmakers (e.g., Ford, FCA, Renault) have already updated their production line to expand connectivity to their entire fleet within the next few years.

The Middle East and Africa still have a shallow penetration of connectivity in new vehicles due to the complexity of the market. As carmakers have little control over which countries in Africa their cars will be sold, it is difficult to determine which local mobile network operator will be responsible for the connectivity and consequently set up profiles.

In summary, connectivity will become an essential car component due to regulations, cloud-based services, and software-defined vehicle architectures that rely on over-the-air (OTA) updates. Also, it provides convenience to EV ownership and a long-lasting customer relationship between carmakers and drivers. Nevertheless, it incurs costs to automakers who have not yet developed a sustainable business case for it.

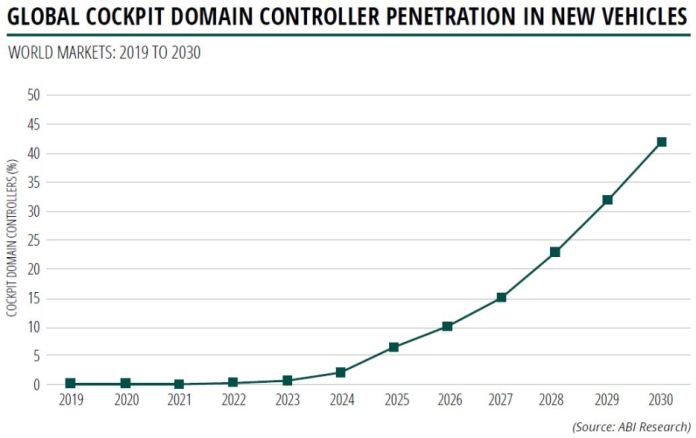

Click for larger image. (Source: ABI Research

Connected service subscriptions

Connected infotainment systems, considered a key selling point, will be featured in 83% of connected vehicles shipped in 2021. However, only a few car owners renew their subscriptions after the free trial period, with churn ranging from 70% in premium brands to 90% in mass-market brands. Consumers see little value in embedded infotainment subscriptions because of the widespread use of smartphone mirroring (e.g., CarPlay, Android Auto) with access to apps with free updates (e.g., Waze). Moreover, mirroring sometimes offers a more streamlined user experience than embedded systems.

While tethered-only systems are a cheaper alternative where embedded connectivity is not mandatory, OEMs are compelled to implement embedded connectivity to provide a differentiated branded experience and enable the software-defined vehicle architecture and OTA updates.

As the infotainment subscription revenue model fails to yield financial results for carmakers, they are looking to bundle the connectivity costs in the vehicle price and offer free-for-life connectivity. The existing revenue model will be replaced with monetizing apps, on-demand vehicle features, or innovative new capabilities such as advertising and in-vehicle payments.

Nevertheless, the success of these proposed monetization strategies relies on consumer adoption of the embedded systems. To do so, many OEMs are transitioning to app-centric systems based on Android Automotive OS, seen by some as a panacea for all user-adoption–related issues.

However, the deployment has yet to be perfected. Reportedly, the companies involved in a recent commercial deployment of an Android Automotive OS–based infotainment system paired with Google Automotive Services (GAS) are seeing lower-than-expected consumer uptake of GAS services due to a complex customer onboarding and authentication process, despite three years of free subscription.

Monetization opportunities: In-vehicle commerce platforms

OEMs can monetize their connected vehicle installed base via in-vehicle payments enabled on the vehicle’s human-machine interface (HMI) by repurposing components and technologies already available in-car without significant upfront investments.

Commerce platforms combine payment capabilities with a passive promotion strategy — nearly unnoticeable to the consumer — activated by navigation entries. After entering information into the navigation search engine, the driver is presented with purchase suggestions related to their input from enabled merchants in the form of icons or points of interest. The entire payment process happens in the background without disturbing the driving experience. The technology learns from the driver’s search history and, with time, provides smart personalization.

Car owners benefit from the convenience of in-vehicle payments, and OEMs profit from each payment transaction performed using a vehicle’s HMI. According to ABI Research’s report “Automotive In-Vehicle Advertising and Commerce,” commerce platforms could lead to $3.94 billion in revenue to OEMs by 2026. GM and FCA already offer basic forms of these platforms today. More advanced deployments are expected in production vehicles from 2022 to 2024.

The key benefits of commerce platforms are the low initial investments and the potential for high returns, even in low-user–adoption scenarios. In high-user–adoption scenarios, the profits can offset connectivity costs, but that demands a compelling digital experience to drive revenue-generating touchpoints, including:

- Frictionless, safe signup

- Safe and seamless payments

- Fully voice-enabled functionalities

- Personalization via artificial intelligence and machine-learning algorithms

- Large number of merchants on board

- Achieving better user experience

With the upsurge in smartphones and tablets and the fast time-to-market cycle of their technologies, customers have become more demanding concerning their infotainment expectations. Drivers now expect their vehicles to deliver the same UI experiences as their smartphones, smart TVs, smart speakers, and other IoT devices. Consequently, most trends in the infotainment segment derive from efforts to implement consumer device technologies in vehicles. However, the implementation of these functionalities increases hardware complexity, posing challenges to the legacy architecture of vehicles.

Traditionally, each new vehicle functionality or application would be added into an individual electronic control unit (ECU) that would become a new component of the vehicle architecture. The duplications of subsystems inside each ECU are not only costly but power-inefficient.

Moreover, due to the various interconnections, upgrading individual ECUs is time-consuming and challenging, as a change in an ECU can affect another ECU. Thus, the industry is moving from discrete ECUs to an architecture that integrates the in-vehicle infotainment (IVI) system, instrument cluster, heads-up display (HUD), rear-seat entertainment, and even advanced driver-assistance system (ADAS) ECUs, such as driver-monitoring systems, into a single digital cockpit domain.

This simplifies development and reduces bill-of-materials costs by combining parameters in a single chip and paves the way to streamline the communication channel between driver and passenger features. However, cross-domain cockpit solutions require all displays and operating components to be merged in a holistic UI in a single piece of hardware that can be updated on an ongoing basis, demanding powerful computing.

The focal point of innovation in vehicles has shifted toward the enhancement of the drivers’ experience via the use of multiple interconnected high-resolution displays, digital dashboards, and HUDs with turn-by-turn navigation, voice assistants, and AI-enabled personalization, among other functionalities. The substantial amount of information to process and reproduce in useful ways requires robust and flexible hardware solutions with high-performance graphics capabilities and a broad range of interfaces.

A cost-optimized manner of running this range of functionalities is by using system-on-chips (SoCs) that can efficiently support various computational elements in a heterogeneous architecture that combines multiple microprocessors, accelerators, and cores to process computational elements efficiently.

The consolidation of increasingly complex and heterogeneous hardware subsystems onto a single SoC with mixed-criticality (safety-critical and non-critical) requirements threatens the operability of the entire system. Additionally, open-architecture approaches pose challenges to safety, such as a hacked Android application communicating to safety-critical subsystems. This creates a need to isolate different applications, so safety-related functionalities always have priority in accessing the CPU. Therefore, virtualization has become a requirement to guarantee the digital cockpit domain’s safety.

Click for larger image. (Source: ABI Research)

Ecosystem implications

OEMs are still cost-driven and often tend to select low-cost hardware and lower-range processors. This behavior must change if they are to deploy an integrated cockpit with applications that can be upgraded OTA.

In addition, OEMs and Tier 1s have traditionally engineered IVI and instrument cluster applications separately, so the consolidation of both ECUs demands the merge of different departments with distinct engineering and safety requirements.

The merge of domains has been challenging for OEM suppliers, as they suddenly became responsible for offering a consolidated cockpit system with different criticality and software requirements. Therefore, Tier 1s and Tier 2s must partner with one another to achieve synergies to keep up with the electronic needs (e.g., Continental and Pioneer). These unprecedented collaborations will become more common. However, companies will continue commercializing their offerings separately, allowing OEMs to select a Tier 1 as lead developer.

Silicon vendors must provide high-performance, heterogeneous SoCs to power all in-vehicle displays and the subsystems of consolidated ECUs while meeting temperature-resistance requirements, safety criteria, and regulatory mandates.

About the author

Maite Bezerra is a research analyst on the Smart Mobility & Automotive team at ABI Research, providing research, analysis, insights, and forecasts into connectivity, service adoption, and emerging and disruptive business models within the transport sector. Maite’s research focuses on connected vehicle platforms and cooperative mobility.

Cover image: Shutterstock

Advertisement

Learn more about ABI Research