It is no secret that the automotive industry is going through a revolution: Electric vehicles have never been so popular, and autonomous vehicles are getting tantalizingly close to an everyday transportation option. For both autonomous and electric vehicles, the underlying, enabling technologies are continuing to evolve.

Now that electric cars have become more commonplace, further progress aims to commoditize, bringing prices down to further drive adoption. But for AVs, development and refinement are still underway, and higher-performance computing combined with new AI technologies is needed before humans can hand over the reins.

Innovative semiconductor and AI technologies in AVs

It has been said for many years that modern cars are computers on wheels. The automotive industry is adopting new semiconductor technologies so quickly that a car from a couple of years ago will look like an abacus compared with the supercomputer-powered machines on the way. IDTechEx sees two major drivers for this new interest in cutting-edge technologies from the foundries and chip designers: autonomous driving and software-defined vehicles.

Autonomous driving has come a long way over the past decade, with commercial services now available, albeit in a limited sense, in multiple U.S. states and across China. IDTechEx’s research tracks all progress related to AV development. IDTechEx predicts more commercial autonomous services will come online each year, spreading city by city, leading to the widespread availability of autonomous-car-powered mobility-as-a-service in the next decade.

These cars have incredibly comprehensive sensor suites, with leaders such as Waymo using a mix of cameras, radar and LiDAR, numbering 40 sensors in total. This is where the latest semiconductor technology is needed.

The data from all those sensors needs processing and fusing, after which the on-board computer needs to perform object detection, classification and tracking, generating a complete understanding of its environment many times per second. This takes some real computational horsepower, which is why the leading chipmakers for autonomous driving keep launching new chips with smaller and smaller node technologies.

Another innovation seen in recent years is the adoption of AI technologies within the chip in the form of neural network accelerators. These little blocks on the semiconductor die have been optimized for functions specific to sensor data processing and fusion. They provide a magnitude boost in processing power for a fraction of the electrical energy usage—something critically important in autonomous and electric vehicles, where even 100 W of parasitic load will be felt.

AI technologies won’t just be buried in the car’s autonomous-driving stack, though. Over the last couple of years, the world has been shown what generative AI (GenAI) can do, and now, carmakers are scrambling to get GenAI-powered assistants into their infotainment systems.

At CES 2024, many companies were demonstrating their in-cabin AI assistants. Most had been trained on the vehicle’s user manual, allowing the driver to ask, “How do I use this feature?” and get a natural-language answer. Voice control has been in vehicles for years, but it has been clunky and prescriptive, requiring the user to remember specific commands and sequences. AI shows promise for transforming this into a much more natural experience.

However, some of the most exciting uses of this technology are unlocked with the vehicle’s connectivity. For example, when the car’s internal timer dictates it is due for service, the car could let you know audibly, and with access to the local dealership’s calendar, it could negotiate a timeslot and get the service booked. Or in a new city, a driver could ask, “Where is the nearest good coffee shop?” With the AI able to see customer reviews and coffee shop locations, it can make a suggestion and add it as a stop to the satellite navigation system.

Over the next decade, the way people use and interact with the latest cars will become unrecognizable compared with operating a car from just one decade ago. Of course, another key part of this transition will be to a more electrified driving future.

Innovations in EV battery and motor technologies

EVs have seen tremendous growth historically, but growth has slowed somewhat in 2024. Part of this slowdown is likely due to the lack of models in the more affordable price range (less than $25,000). The goal of automakers is to reduce the cost of making EVs, both to improve their profit margins on existing vehicles and make lower-cost models more feasible. A greater variety of low-cost EVs will open another portion of the market and lead to reinvigorated growth.

IDTechEx’s research covers key drivetrain technologies within EVs, including the battery, motor, power electronics and thermal management. IDTechEx predicts the 2024 slowdown will be temporary, and strong growth will resume in the coming years as a greater variety of models becomes available and further emissions regulations are implemented.

Lower-cost battery systems

As the most expensive component of an EV, the battery presents the largest opportunity for cost reduction. To this end, we see trends in battery chemistry to improve energy density (increasing range) and reduce costs.

The majority of the European and U.S. markets use battery chemistries based on nickel and cobalt (e.g., nickel manganese cobalt [NMC], nickel cobalt aluminum [NCA]). These chemistries present excellent energy density but contain expensive materials. Despite its lower energy density, its lower cost of materials has led to a resurgence in lithium iron phosphate (LFP), especially in the Chinese market. Tesla introduced LFP cells in its base version of the Model 3 in markets outside China, and other automakers look to follow suit.

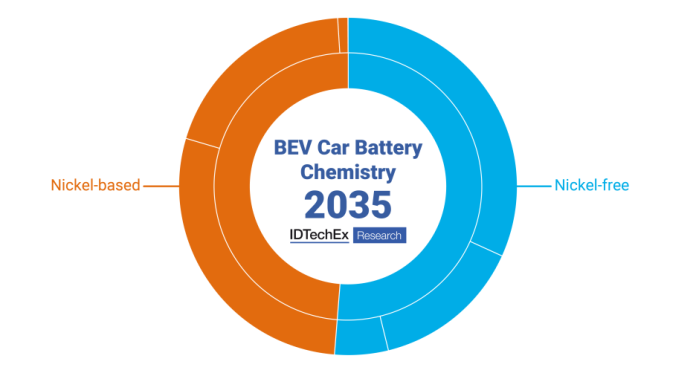

By 2035, IDTechEx predicts that about 50% of the BEV market will use nickel-free chemistries. (Source: IDTechEx)

Before the end of this decade, there will be significant deployment of other cell chemistries. As a key example, lithium manganese iron phosphate (LMFP) fills the gap in price and energy density between LFP and NMC, providing another option for automakers. Not to say that NMC is sitting still: There is increasing adoption of higher nickel variants, such as NMC 811 and NMC 9, to reduce the reliance on cobalt and increase energy density even further.

IDTechEx predicts that approximately 50% of the battery-electric-vehicle (BEV) market will use nickel-free chemistries by 2035.

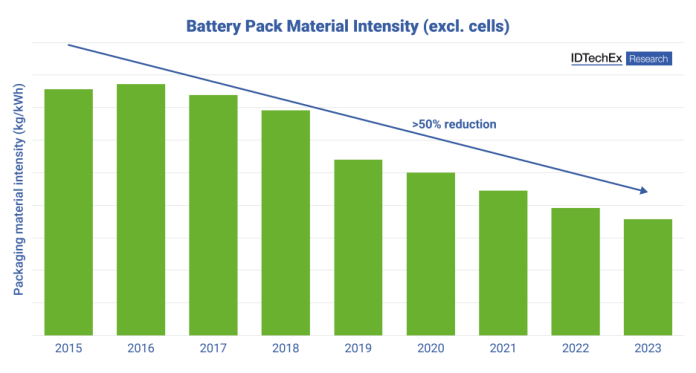

On average, the intensity of materials used to package battery cells has been decreasing. (Source: IDTechEx)

Outside the battery cells, the battery pack itself presents opportunities for cost reduction. Chinese OEMs have pioneered cell-to-pack (CTP) battery systems, wherein the normal modular structure is eliminated and cells are directly stacked together. This reduces materials, manufacturing complexity and, ultimately, cost. This has been a major driver for BYD’s adoption of LFP (wherein the cells have a lower energy density, but the improved energy density of the pack can offset this somewhat).

The next stage of battery-to-vehicle integration is cell-to-body (CTB) and cell-to-chassis (CTC), wherein the cells and their packaging become a structurally integral part of the vehicle. This has made it to market with BYD and Tesla’s 4680 pack, as well as some other players.

IDTechEx’s research found that approximately 22% of EVs sold in 2023 were using either a CTP or CTB design, with the majority in China. Many OEMs in Europe have also announced CTP designs. Market penetration will continue for these designs in the coming years.

Reducing material costs for electric motors

The electric motor is another key area of innovation. A more efficient motor means less of the battery’s energy is wasted and the EV’s range can be increased, or a smaller battery can be used for the same range (reducing battery costs). There are also considerations around the materials used.

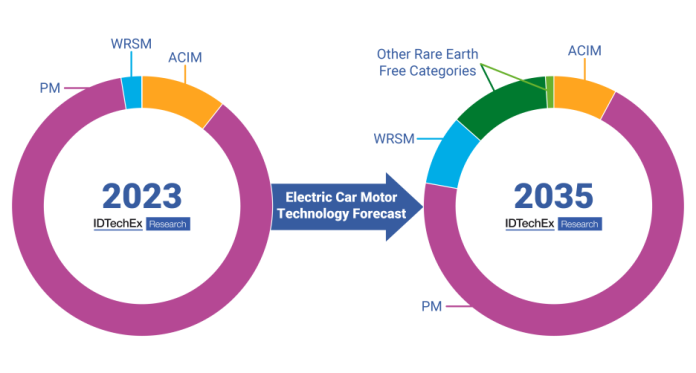

The permanent-magnet (PM) motor is the staple of the EV market due to its exceptional power density, efficiency and ease of manufacture. However, the magnets contain rare Earth metals, which, despite their name, are relatively abundant but have a very constrained supply chain, leading them to be expensive and subject to significant historical price volatility.

There has been increased interest in rare-Earth-free motors. In Europe, the key approach from automakers such as Renault and BMW has been the wound rotor motor, whereby the PM materials are replaced with copper windings as electromagnets. While this reduces the bill of materials, these motors require more manufacturing steps and a method of exciting the rotor windings, and they are typically larger and heavier than their PM counterparts. However, significant developments have been made by both automakers and Tier 1 suppliers to make these motors more compact and competitive with PM motors.

Another alternative is to change the PM materials. There are various alternatives, such as aluminum nickel cobalt (AlNiCo), samarium cobalt (SmCo) and ferrite magnets. However, none of these can provide the combined magnetic performance (maximum energy product, coercivity and remanence) of rare Earth magnets.

Companies such as Niron Magnetics are pushing the performance of materials to close the performance gap. Additionally, in a lower-cost EV model, ultimate performance might not be needed; instead, a lower-power-density motor utilizing rare-Earth-free magnets could be used, which would be suitable for this target market.

Permanent-magnet motors dominate the EV market and are predicted to remain the technology of choice. However, IDTechEx predicts increased adoption of rare-Earth-free technologies. (Source: IDTechEx)

The prices of rare Earth materials have settled again after a recent high in 2021/2022. While this is the case, OEMs are more likely to remain with PM motors. However, with the uncertainty around future supply and the potential for higher material costs, IDTechEx predicts that up to 30% of the electric-car market will use rare-Earth-free motor technologies by 2035.

Advertisement