Sapphire is the key material for LED manufacturing. But in 2015, 20% of sapphire will be used in Apple’s iPhone, for the camera lens, fingerprint readers and heart rate monitors covers, and the Apple watch’s window. The new Yole Développement (Yole) report on Sapphire Applications & Market 2015: from LED to Consumer Electronic provides a complete update of all sapphire uses, from LED substrates to consumer applications.

Today, the sapphire industry looks very different depending on your perspective. The market for sapphire wafers for LED manufacturing is depressed. Wafer prices often fall below manufacturing cost. There is excess capacity that will be able to supply the needs of the industry through to at least the end of the decade. Consequently, companies are shutting down one after the other.

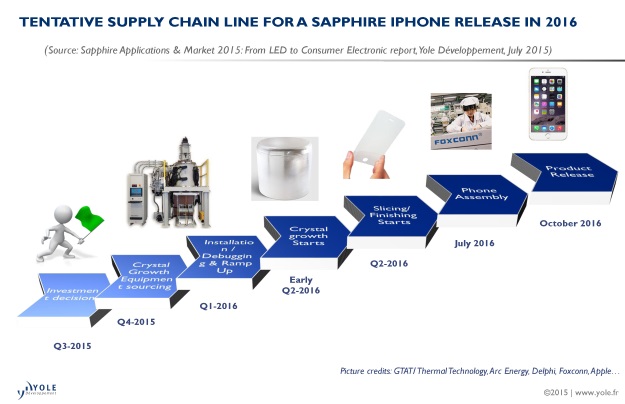

By contrast, the use of sapphire is booming for non-LED applications, driven by Apple’s choice of this material to protect various sensors, and this may be just the beginning. The company decided not to use sapphire for the iPhone 6 family’s display covers, a decision that led to the bankruptcy of GTAT. But now there are signs in the industry that the mobile phone maker is again looking at sapphire as the solution for display covers. Multiple companies are apparently attempting to position themselves in the potential future supply chain. The moves include Lens Technology investing US$532 million investment in a new Chinese sapphire facility, a US$98 million injection in GTAT, the plans of Biel’s joint venture with Roshow for a huge expansion in Inner Mongolia, and several other initiatives.

There were many reasons for Apple’s 2014 decision not to use sapphire in display covers, but they can be summarized as “too fast, too much, too soon”. The project was ambitious in its timeframe and targeted outputs, but many of the necessary processes and technologies in crystal growth and finishing were still at an early stage of development. Yet the venture still set the stage for the future. The partners have developed unrivalled expertise in working with sapphire in a high-volume, cost-controlled environment. A lot was also learned in manufacturing of the complex 3D-shaped Apple Watch cover.But the question remains: why use sapphire?

At more than five times the cost of glass, benefits in term of breakages are still far from obvious and its high reflectivity washes out displays. Sapphire won’t sell for a premium and increase Apple’s market share just on glamour and cachet. If the company eventually adopts sapphire, it means that it would have either demonstrated that it can improve breakage resistance compared to glass and/or developed entirely new functionalities enabled by some unique properties of sapphire.

To exist and thrive, the display cover market needs Apple to take the lead and to succeed. Otherwise, only Huawei seems in a position to propel this market, but not at the same level. And alternative technologies are emerging. Various phone manufacturers recently adopted alumina-coated glass display covers to provide superior scratch resistance. Sapphire Applications & Market 2015: from LED to Consumer Electronic report from Yole presents and analyzes the recent trends in this market, including cost structures, investments and alternative technologies.

In 2015, LEDs still consume 76% of the sapphire supply, but oversupply is affecting revenue and profitability. Capacity has increased non-stop since 2009, despite prices being at or below cost for most suppliers since late 2011. The market is oversupplied two or threefold, depending on product category. But the situation is complex. Tier one vendors often operate at high utilization rates and keep increasing capacity. Tier two companies operate at low utilization rates or not at all.

Companies such as BIEMT or Sumitomo Metal Mining recently disappeared or exited the business. The big winners in 2014 were Monocrystal, Aurora, Namiki, Rigidtech and Crystalwise, which all managed to increase volumes and revenue. Global revenue from sapphire cores, bricks and wafers reached US$1.1 billion. Adding finished components produced by Biel, Lens Technology, Crystal Optech and others, revenue reached US$1.8 billion, including the notable performance of Saifei, which supplied the Kyocera Brigadier’s sapphire display cover.

Under strong price pressure, the sapphire industry successfully reduced its costs – but prices are falling even faster. An 18% average selling price decrease in 2015 wiped out potential gains from a 16% volume increase in LED wafer shipments. “We expect prices to keep decreasing, resulting in an LED wafer market remaining essentially flat in revenue despite a 5.2% CAGR growth in volume expected through to 2020”, says Eric Virey, Senior, Technology & Market Analyst at Yole . Optical wafers may also struggle if Yole’s scenario of Apple phasing out its current sapphire fingerprint reader technology for an “In Display” fingerprint sensor materializes in 2018.

In addition to the publication of Yole’s new sapphire report, the “More than Moore” market research and strategy consulting company has teamed up with CIOE to organize a large sapphire conference, the 1st International Forum on Sapphire Market & Technologies, so that all stakeholders can interact and discuss the evolution of the industry. Yole & CIOE conference will take place in Shenzhen from August 31 to September 1. If you would like to take advantage of the early bird deal, register now.

Advertisement