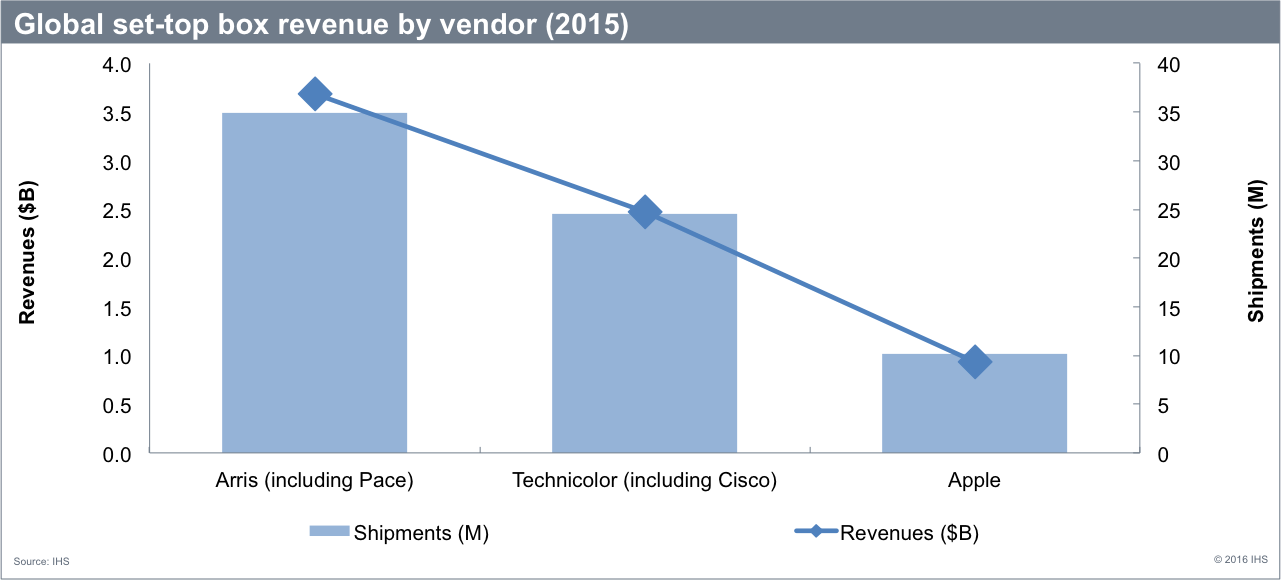

The popularity of Apple TV devices has sent Apple on a skyrocket toward the top of the global market in 2015, after being in ninth place in 2014 sales. Based on revenue in the overall global set-top box (STB) market, this higher ranking is due to a steady growth in consumer retail over-the-top television (OTT) boxes. Another helpful factor is Arris’s acquisition of Pace and Technicolor’s acquisition of Cisco’s STB division, as these are top companies in the global STB market. More than 10 million Apple TVs – the fifth largest volume in the world – were ultimately shipped in 2015, following the numbers of Arris, Technicolor, Skyworth, and ZTE.

“The STB market has certainly grown since 2007, when Steve Jobs originally described the Apple TV business line as a ‘hobby,’” said Daniel Simmons, director of connected home for IHS Technology. “Now we’re seeing sales of Apple’s consumer devices in the millions, which has catapulted the company ahead of leading STB manufacturers that ship to pay-TV providers.”

Simmons also accredits Apple TV’s success to including the Apple brand’s consumption habits on the TV screen. The transition proves to be monumental; 2015 saw a 4.8% increase in global STB shipments that eventually reached 353 million units. The global growth is thanks to Internet-protocol television (IPTV) in China, where telecommunications companies are encouraging IPTV services to generate returns on investments in fiber to the home (FTTH), enabling high-speed Internet access in buildings. However, revenue for 2015 fell 5.4%, reaching $22.2 billion because of a lesser demand for high-value STBs in North America. This decrease stemmed out of poor pay-TV performance in the region.

Apple’s new spot near the top of the market reflects several trends in the current market. “Pay-TV specific set-top boxes are becoming less important for consumers to access premium content,” said Simmons, “because Netflix, HBO Go, and other OTT video platforms now offer top-tier content to retail OTT STBs. As retail STBs have grown in the market, traditional pay-TV set-top vendors have been forced to reposition themselves.”

Causing noteworthy consolidation at the top of the market and low-end vendors moving toward broader volume, the growth of retail STBs has ultimately allowed for Apple to become a trendsetter in yet another field.

Source: IHS / FierceCable

Advertisement

Learn more about Electronic Products Magazine