By Majeed Ahmad, contributing writer

Light detection and ranging (LiDAR) sensors are moving from niche scientific and space applications to mass-market adoption to deliver 3D data with depth resolution in advanced driver-assistance systems (ADAS) and autonomous cars.

Remember Google’s self-driving car with a mechanical spinning bucket on its rooftop? It was a 64-laser LiDAR from Velodyne LiDAR that offered a 3D view of the vehicle’s surroundings using reflected laser beams, and it cost $75,000. The LiDAR sensors have come a long way from that expensive and bulky setup as we begin to see early adopters in the commercial arena.

For example, Koito Manufacturing, a tier-one supplier in Japan, is integrating the miniaturized LiDAR sensors from Cepton Technologies into automotive lighting systems. Cepton’s LiDAR sensors, based on its Micro-Motion Technology (MMT), recognize and track objects from all four corners of the vehicle to provide a precise 3D image of the surrounding environment.

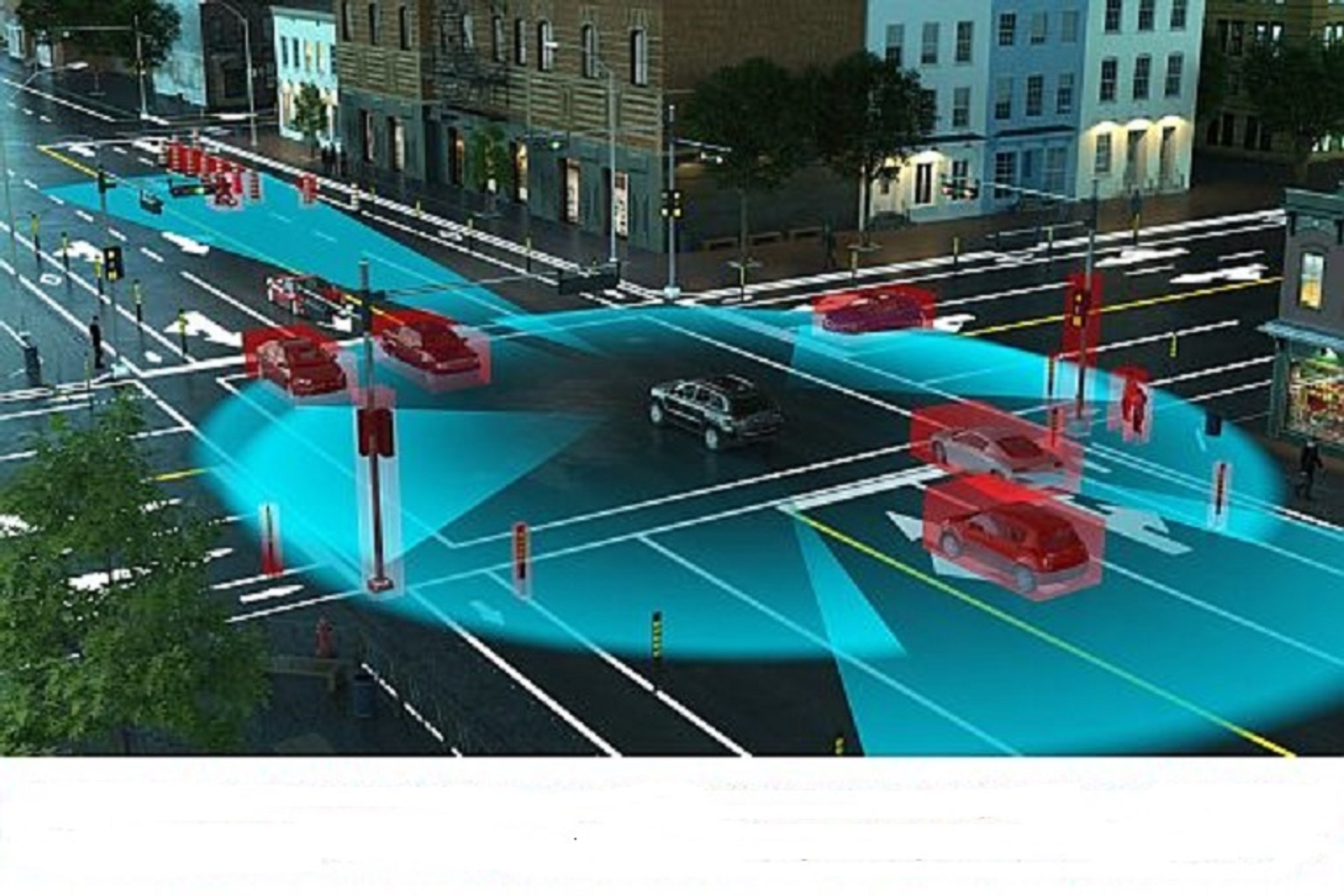

LiDARs detect objects and measure range and speed using infrared light. (Image: LeddarTech)

The LiDAR sensors, mostly unexplored in automotive designs, are now used alongside cameras, which identify road users, signs and traffic lights, and radars that facilitate an accurate distance range. LiDAR, short for light radar, provides mapping, object detection and identification, and navigation without relying on lighting and weather conditions. And it’s now widely used for high-performance sensing in robocar and ADAS applications.

However, autonomous cars clearly represent the biggest opportunity for LiDAR sensors, which offer greater depth resolution for highly automated vehicles. According to industry research firm Yole Développement, the market for automotive LiDAR is expected to increase from $325 million in 2017 to $5.2 billion in 2023.

LiDAR in autonomous vehicles

The fate of LiDAR sensors is intrinsically tied to the expectation that autonomous vehicles will enter mass-market production by 2020. LiDARs are crucial in road scanning to understand vehicle surroundings with precise and real-time 3D digitization, and that makes them an essential building block in ADAS and autonomous cars.

The LiDAR sensors create 3D point clouds that facilitate object detection and tracking, free space detection, road profile measurement, and localization capabilities. Moreover, with features such as lane marking and simultaneous localization and mapping (SLAM), LiDARs enable collision avoidance and trajectory determination in self-driving vehicles.

The early LiDAR designs are being deployed in highly-automated vehicles along with cameras and radars. For instance, BMW is integrating the MEMS-based LiDARs from Innoviz Technologies in its self-driving cars to be released in 2021. The InnovizOne LiDAR, which replaces an FPGA with an ASIC from an earlier design, boosts resolution to 0.1° × 0.1° and expands the range to up to 250 meters.

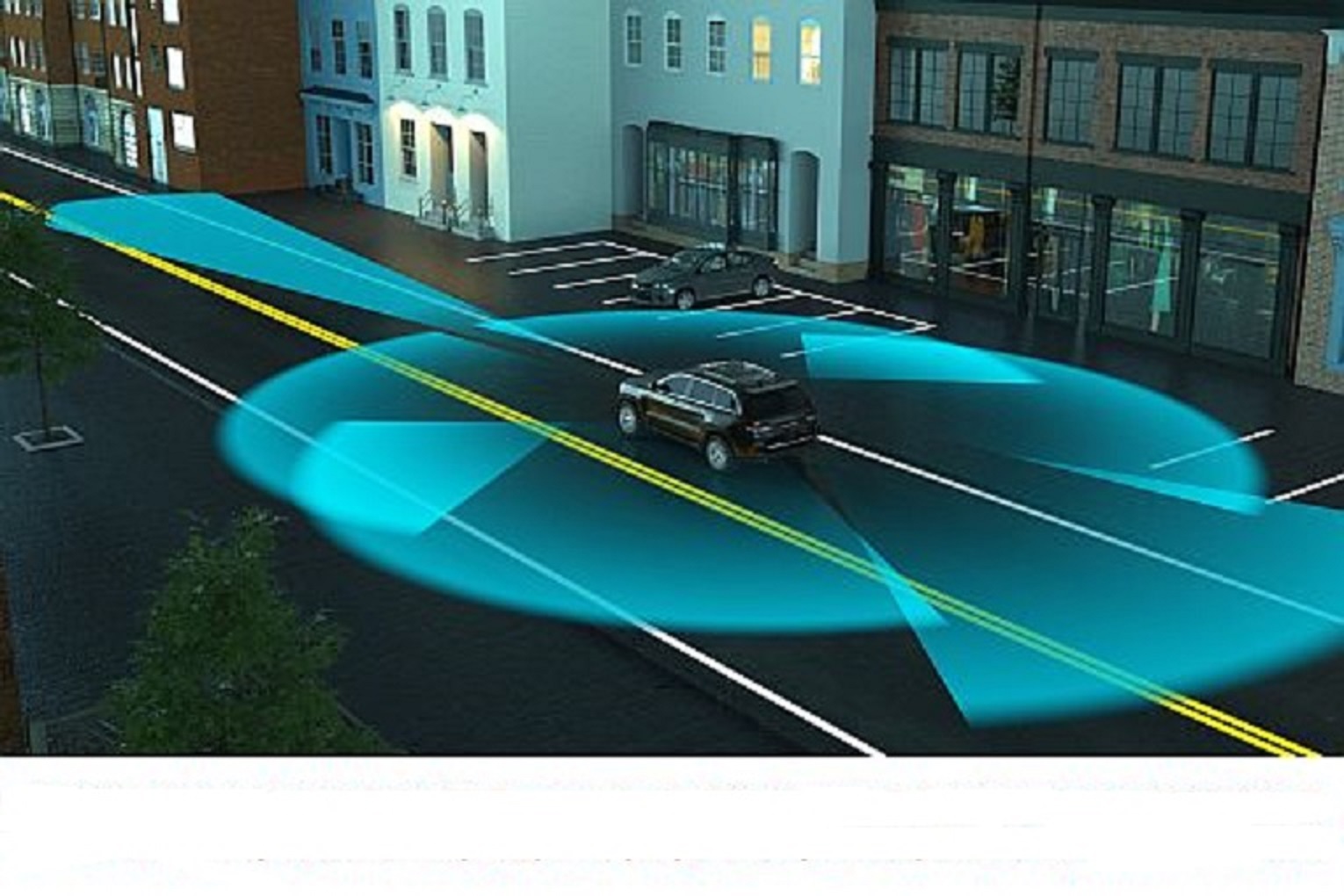

Automotive supplier Magna is integrating InnovizOne LiDARs to facilitate remote sensing in autonomous vehicles. (Image: Innoviz Technologies)

Here, it’s worth mentioning that LiDARs are not pushing radars and other sensors out of automotive designs; instead, they complement cameras, radars, and other sensors in ADAS and autonomous car designs. And their key value proposition is road scanning for active suspension control.

However, when it comes to the commercial realization of LiDAR sensors, there are serious technical limitations related to range and resolution as well as market barriers that mostly pertain to higher cost. In other words, the proliferation of LiDARs in automated vehicles is tied to cheaper, smaller, and more reliable sensors with fewer moving parts.

Switch to solid-state LiDARs

The LiDAR technology has quickly evolved over the past couple of years, and if there is a single defining trend in this design space, it’s the transition from mechanical spinning systems to solid-state LiDARs.

The traditional electromechanical LiDAR systems rely on moving parts to offer precise and accurate measurements. The photons from a laser reflect off of surfaces and concentrate into a collector to determine the distance from an object.

On the other hand, solid-state LiDARs are built on a semiconductor device and have no moving parts. So solid-state LiDARs without large rotating parts eliminate many problems associated with big mechanical hats on vehicle roofs and, thus, are more resilient to vibrations.

But it’s important to note that solid-state LiDAR is an umbrella term that encompasses several non-spinning LiDAR designs. Furthermore, the term “solid-state” doesn’t merely stand for non-mechanical designs; it entails the designs that are based on semiconductor devices.

First, the MEMS-based LiDARs use micro-mirrors to steer a laser beam into the surrounding environments from a solid-state laser. Take the example of the RS-LiDAR-M1Pre LiDAR from China’s RoboSense that incorporates a laser, a 2D MEMS scanning mirror, and a time-of-flight (ToF) sensor. It claims to cover a detectable range of 200 meters.

The LeddarCore LCA2 chip is at the heart of LeddarTech’s MEMS-based solid-state LiDAR for ADAS and autonomous cars. (Image: LeddarTech)

Second, some LiDAR designers have turned to optical phase arrays that transmit photons in specific patterns and phases to create directional beams. Unlike silicon MEMS, the phase-array LiDARs employ silicon photonics to facilitate depth resolution, and upstarts like Strobe, recently acquired by GM, are adopting this optical sensing design approach.

Finally, flash LiDARs illuminate the entire scene in a single flash without any beam steering, and it uses a 2D array of tiny sensors to detect light bouncing from different directions. What’s common in all three solid-state LiDAR categories is that they are a work in progress. And they are striving to bring down the price tag to below $200 while catering to application-specific design challenges.

A work in progress

These are still the early days, and LiDAR technology will continue to mature. Meanwhile, automotive system engineers are toying with LiDAR designs and how they relate to resolution, range, accuracy, and latency requirements. There is no one-size-fits-all solution in the LiDAR space, and that demands the right trade-off between different requirements relating to vehicle safety and reliability.

Automotive design engineers are also experimenting with the fusion of LiDAR sensors with cameras and radars in ADAS and self-driving applications. LiDAR is an expensive device, and it mandates new design considerations while LiDAR sensors add more compute power to boost intelligence.

The Velodyne-like mechanical spinning LiDARs are still around, but they have significantly trimmed down both size and cost of these light sensors. Ouster, a LiDAR startup founded by Quanergy co-founder Angus Pacala is still betting on the conventional spinning-laser approach as it offers a 360° field of view for complete coverage of a car’s surroundings.

But solid-state LiDARs are the mainstay, and a plethora of LiDAR startups are racing toward semiconductor-based solutions that enable advancements in sensor miniaturization and cost reduction.

The tipping point of mass-market adoption hasn’t arrived yet, but innovations around LiDAR designs are entering an interesting phase. What’s apparent is that highly automated vehicles will start using LiDARs sooner rather than later.

As mentioned earlier in this article, the fate of LiDAR technology and autonomous vehicles is intertwined, and if self-driving cars meet their production goal in 2020, LiDARs are most likely going to be part of this transport revolution.

Advertisement