By Maximilian Teodorescu, AspenCore Content Manager

The integration of consumer electronics with cars made automotive semiconductors one of the fastest-growing chip segments between 2002 and 2012. The market averaged 8 percent annual growth, to $24 billion, before the rate tapered off as the number of MCUs per automobile plateaued at about 100, McKinsey & Co . reported. Now, responding to growing environmental concerns, major automakers are preparing to phase out fossil-fuel-based models and convert to electric lineups in the next few decades — some as soon as 2019. Automotive chipmakers are ramping up for a new wave of growth from the electrification of the drivetrain and the addition of further vehicle intelligence.

“The drivetrain is the next big opportunity” for semiconductors based on silicon as well as wide-bandgap alternatives such as gallium nitride and silicon carbide, said Jeff Casady, business development and program manager at Wolfspeed, a provider of GaN and SiC power and RF devices. “Electric vehicles, in general, are just emerging right now, so it’s all silicon, but it’s all low-volume. As the volume ramps up, it’s a pretty large market.

“In Europe, you especially see the OEMs really committed to EV, where four to five years ago it was kind of a novelty,” Casady added, alluding to the commitments made by nations such as Norway and the Netherlands to phase out fossil-fue l based vehicles completely by 2025.

Opportunities for nontraditional chipmakers

According to a 2016 McKinsey report, fully electric vehicles represented less than 1% of new-vehicle sales in 2016, but that figure could rise to as high as 5% to 10% by 2020. The rise in EV deployment could spur the largest growth in automotive chips over the next ten years, creating growth opportunities for semiconductor companies that are not traditionally automotive suppliers.

In 2013, drivetrains accounted for 30 percent of all the semiconductor content in the automobile, with EVs containing more than $1,000 of drivetrain electronics versus the $100 averaged by internal-combustion drivetrains. Market watchers expect further growth in drivetrain semiconductors — and a rise automotive chip content overall — as EVs become increasingly complex, adopting machine vision, GPUs, DRAM, and NAND flash in preparation for the arrival of the self-driving consumer vehicle.

Expanding use of hybrids and EVs creates an opportunity for nontraditional semiconductor suppliers to win market share in an otherwise conservative segment. Automakers rarely change suppliers for the electronics controlling their power and drivetrains, but the basic design of the electronic drivetrain is still evolving with each generation, as automakers look for ways to push the limits of power efficiency beyond that of silicon semiconductors.

“About five years ago, some chipmakers claimed that traditional silicon-based power MOSFETS had hit the wall, prompting the need for a new power transistor technology,” writes Mark Lapedus, executive editor for manufacturing at SemiconductorEngineering.com. As Moore’s Law scaling nears its end, electronic-component manufacturers are looking beyond the silicon MOSFET to insulated-gate bipolar transistors (IGBTs) and wide-bandgap semiconductors, such as high-voltage gallium nitride (GaN) and silicon carbide (SiC) MOSFETs.

Why wide-bandgap semiconductors?

Compound semiconductors like GaN and SiC are emerging as practical solutions for handling power switching in the electric drivetrain. Wide-bandgap materials possess a relatively larger bandgap than traditional semiconductors, meaning that the energy required for an electron to jump from the top of the valence band to the bottom band is larger than 1 or 2 electron-volts. Silicon, for example, has a bandgap of 1.1 eV, while GaN and SiC possess gaps larger than 2 eV. As a result, GaN and SiC power chips are more durable, operating at higher voltages, frequencies, and temperatures; switch much faster than conventional semiconductor devices; and eliminate up to 90% of power losses.

In market projections for discrete power devices through 2024, Lux Research forecasts that silicon will hold on to the lion’s share of the market, at 87 percent, but GaN and SiC will grow at a faster rate over the forecast period. The Lux study projects a total market of $23 billion for power discretes in 2024, with the transportation segment growing to nearly $1.2 billion, largely driven by demand for GaN and SiC devices. “Transportation uses will account for 65% of the total market for SiC and 41% of the total market for GaN,” according to the study.

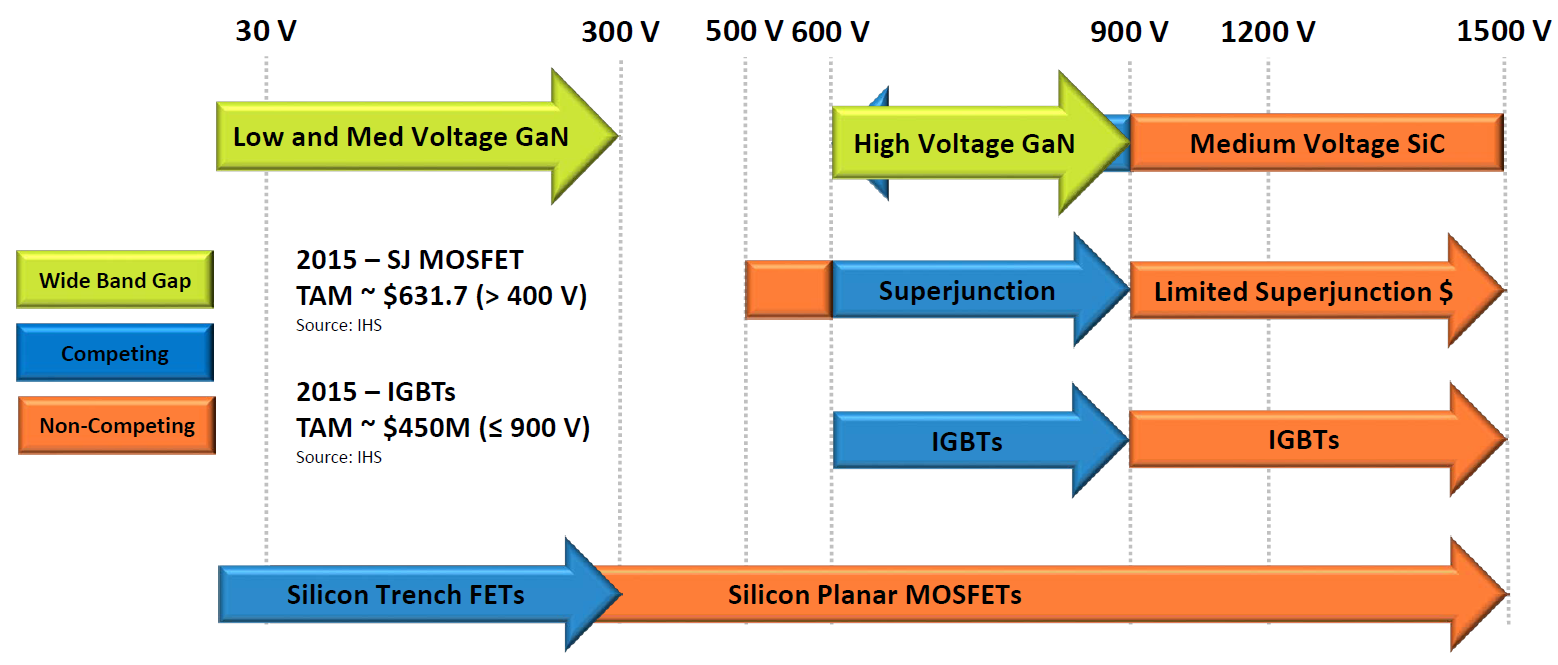

Wide-bandgap semiconductors primarily compete for power applications in the 600- to 1,200-V range, while traditional power MOSFETs remain dominant for designs at 10 to 500 V. For example, Transphorm Inc.’s 600-V GaN devices compete with IGBTs, superjunction MOSFETs, and even SiC devices, as SiC expands its range down to 650 V, said Philip Zuk, senior director of technical marketing for GaN at Transphorm.

Until recently, “1,200 to 1,700 [V] was considered medium voltage [for SiC], but now we’re starting to see suppliers like Wolfspeed come down to 900 V, and Rohm is already down to 650 V. So, for GaN, what we’re actually seeing is more competition with SiC today than with other GaN providers,” said Zuk. SiC has better thermal conductivity than GaN at around 900 V; GaN has the performance advantage at low voltage and high power, and a cost advantage at all voltages.

Several devices to choose from

Design engineers must consider multiple factors when evaluating power chips, including voltage, current, switching speed, load, temperature, and early-adoption cost. It bears considering that wide-bandgap semiconductors are more expensive than silicon, and revenue generated from the automotive market exhibits a slow ramp-up but a long life cycle. “Early adopters won’t see revenue for up to five years, but the automotive market is going to be the big market because everybody is working on electric cars,” Zuk said. “Meanwhile, SiC is just starting to penetrate the automotive market.”

He added, “If you look at automotive, GaN technology can operate in the onboard charger, AC/DC onboard charger, AC/DC auxiliary inverter, DC/DC auxiliary power module, and AC charging station. For GaN today, this is where we are focused. Traction is not an application for GaN today, but we are working on technology that might apply to drive inverters in the future.”

Image courtesy of Transphorm

There are other trade-offs among the competing semiconductor technologies. Compared with the standard power MOSFETs, which are most widely used at low voltages, superjunction MOSFETs function from 500 V to 900 V. IGBTs, on the other hand, are used in 400-V to 10-kV applications and can block high voltages. The downside is that silicon devices are limited by how quickly they can switch while delivering low on-state conduction losses, thus requiring costly thermal management methods and limiting power-conversion system efficiency. In some hard-switching applications, silicon-based IGBTs function close to GaN and SiC devices but bear a lower manufacturing cost.

According to a white paper by Steve Taranovich, EDN senior technical editor of analog and power, SiC MOSFETs possess a bandgap of 3.3 eV, resulting in very low switching losses, which increase efficiency and enable higher-frequency operation. Additionally, SiC MOSFETs’ positive temperature coefficient permits easy paralleling to obtain higher operating currents. SiC exhibits 10 times the breakdown field and three times the thermal conductivity of silicon MOSFETS, and better thermal conductivity than GaN at 900 V, whereas GaN has a performance advantage at low voltage and high power, along with a cost advantage across all voltages.

“What GaN offers is high efficiency because it switches so much faster than silicon,” said Transphorm’s Zuk. “When you switch faster, you can run at a higher frequency, and that shrinks all your magnetics, increasing power density. This results in a smaller application and a smaller product.” Transphorm’s TPH3205WSBQA , a 650-V 49-mΩ GaN FET, is the industry’s first GaN solution to earn the AEC-Q101 qualification required to supply the automotive industry, according to Zuk.

Image courtesy of Transphorm

Ultimately, wide bandgap market penetration remains contingent on EV and hybrid automotive market adoption rates. But as Bloomberg New Energy Finance forecasts, new-EV sales rates could reach as high as 54% of all new-car sales by 2040, with 33% of all automakers’ full lineups being electric. Wide-bandgap semis enable automobile designers to increase drivetrain efficiency and reduce weight, thereby alleviating range anxiety issues.

“Improving efficiency by 5% to 10% can be seen as taking out 5% to 10% of the battery cost, or extending the range by 5% to 10%,” said Wolfspeed’s Casady.

Read the complete EV Special Report here.

Advertisement

Learn more about Electronic Products Magazine