By Roger H. Grace,

President,

Roger Grace Associates,

www.rgrace.com

This article provides the results of the recently completed 2012 MEMS Industry Commercialization Report Card Study (Report Card). The Report Card has been published annually since 1998. For the establishment of the specific topics of the report card, market research was conducted on the general topic of technology commercialization and resulted in the selection of a number of critical success factors (a.k.a. topics) that were considered necessary for successful commercialization specific to MEMS and to the MEMS industry. The report started with nine topics in 1998 and by 2003 it had expanded to 14 based on continuous reassessment of the ever changing dynamics of the MEMS industry. The purpose of the report card is to provide MEMS industry participants with an objective assessment of these critical success factors over time and to act as a tool to help them better understand, respond to and exploit the ever changing dynamics of the MEMS industry. The MEMS Industry Commercialization Report Card has been developed not only to help assess the progress of the commercialization of this technology but more importantly to serve as a vehicle to help guide industry participants overcome the barriers to the successful commercialization of MEMS.

The Report Card is unique in the technology commercialization strategy sector and also to the MEMS industry. It has been widely published and presented worldwide since its introduction in 1998 and is widely accepted as a valuable tool for MEMS industry participants to create winning business strategies for their organizations.

The problem

It is interesting to note that MEMS technology established vis-à-vis the discovery of the piezoresistive effect at Bell Laboratories in 1955 by Charles Smith is approximately the same “age” as Integrated Circuit (IC) technology established vis-à-vis the semiconductor effect that was discovered at the same laboratory by Bardeen et al. only a few years earlier. More importantly however, the total sales of MEMS as reported by numerous groups at the time was approximately 1/25th of the sales of ICs in 1998 at the time of the first Report Card. The MEMS market has been reported by several organizations to be approximately $10 Billion (US) in 2012 whereas Gartner Research has reported that that total IC market was $299.9 Billion(US) in 2012 (approximately a 30:1 ratio). Some positive news here is that the MEMS market has been reported to be growing over the past several years at a compounded annual growth rate (CAGR) in the 15-20% range where the IC market has remained relatively stagnant over the similar period. However, the question remains why there is still such a disparity in the market sizes.

Barriers to commercialization / situational analysis

The following are considered to have been or currently are some of the more significant barriers to the successful commercialization of MEMS:

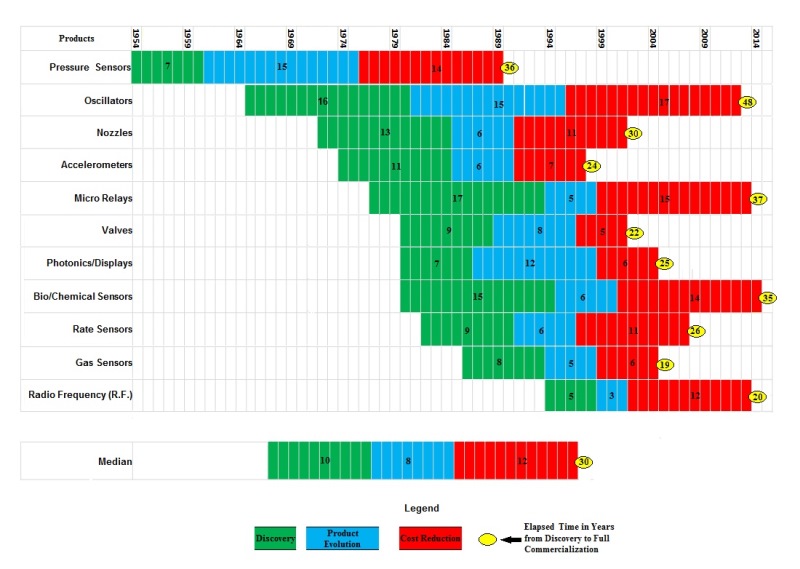

- The extremely long period of time to commercialize a MEMS product is approximately 30 years (Fig. 1 ). [1]

- Until recently, MEMS has been plagued by the lack of high-volume applications.

- There is a lack of well defined direction, in the form of roadmaps, industry standards, and industry associations.

- Multidisciplinary technology knowledge is required.

- Packaging and testing costs typically are at 70% of total value. Yet focus has been — and continues to be — on devices not systems solutions. [2]

- There has been a significant lack of focus on customer needs.

- MEMS device suppliers are technology-centric and exhibit a technology push versus market / applications pull strategy.

- Marketing programs are either non-existent or are under- funded and/or ill-planned.

- A lack of capital formation opportunities exists. Investors are risk adverse and there is low IPO opportunity because of small sales volume levels of companies (with the exception of those addressing the mobile phone and other high-volume consumer markets).

- Successive “bubble busts” have occurred (e.g. biomems, optical telecom) that have resulted in creating wary investors.

- Markets are highly fragmented and diverse: many small companies, few large players.

- Limited “success stories” of MEMS companies. Only a couple of MEMS companies have had IPOs.

Fig. 1: Research has determined that MEMS device commercialization efforts have been hampered by many barriers as evidenced by the average of 30 years of time necessary from discovery to full commercialization of various technologies. Source: Roger Grace Associates/S. Walsh University of New Mexico

However to offset these difficulties, new market opportunities for large volume applications have recently emerged in automotive (e.g., gyros and pressure sensors) and consumer (e.g., oscillators, magnetometers, microphones, gyros, accelerometers, and displays) applications, as well as in Point-of-Care diagnostics; analytical instruments; and infrastructure monitoring. The challenge is how to overcome successfully the existing barriers to successful commercialization of MEMS and to exploit these application opportunities.

Research methodology

The research approach is based on having experts in their respective fields as the research universe, a technique known as Delphi and developed by Project RAND during the 1950s and ‘60s by Olaf Helmer, Norman Dalkey, and Nicholas Rescher,. It provides the best possible insight into a research topic where a statistically significant/projectable approach is not feasible.

Questionnaires were emailed to selected individuals in the Roger Grace Associates data base who have played, and continue to play, major roles in the MEMS commercialization process. The participants represented a worldwide universe with the majority of the respondents coming from the US and Europe. The members of this universe were asked to rate the 14 critical success factors/topics using grades “A+” through “D-”. Additionally, they were asked to provide specific comments on the rationale for the grades they assigned.

The participants represented a broad range of MEMS manufacturers and employers, as well as individuals representing companies engaged in MEMS infrastructure (e.g. foundries, design software, and equipment providers). Academics were not included in the research universe. The 67 respondents had a collective experience of over 1,300 years, averaging approximately 20 years per respondent. Certainly this was an exceptionally well-experienced and well qualified group of participants, well deserving of the designation “experts”.

Results

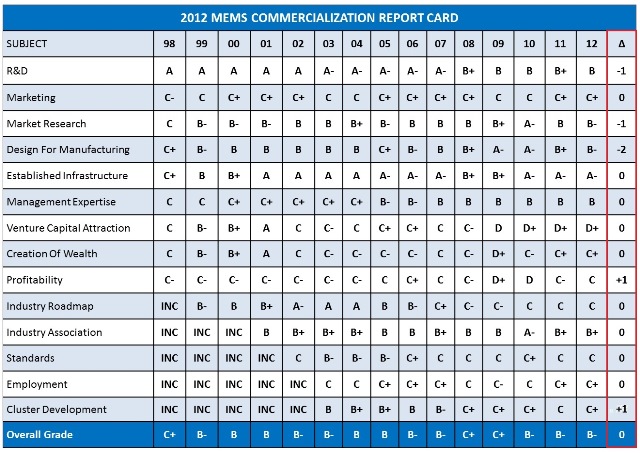

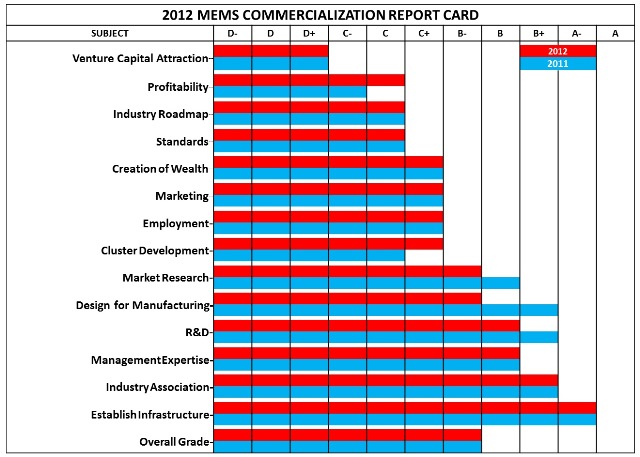

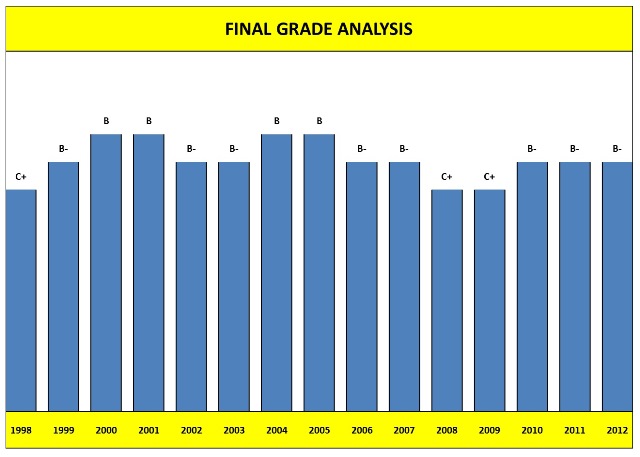

The results of the 2012 MEMS Commercialization Report Card is given in Fig. 2 , with a comparison between the 2011 and 2012 grades shown in Fig. 3 . The 2012 MEMS Commercialization Report Card provided an overall grade of B- based on all 14 critical success factors for MEMS commercialization. The overall grade has not changed from those of 2011 and 2010 (Fig. 4).

Fig. 2: The MEMS Industry Commercialization Report Card was created in 1998 and annually provides an objective measurement using a market research approach of the MEMS industry’s performance against 14 critical success factors. Source: Roger Grace Associates

Fig. 3: The 2012 Report Card established the continued under-performance of Venture Capital Attraction, Creation of Wealth and Marketing. Nine of the 14 critical success factors remained at their 2011 level. Source: Roger Grace Associates

Fig. 4: Final grades of the Report Card have gone from a low of C+ in 1998 and in 2008/2009 to highs of B+ achieved in 2000/2001 and 2004/2005. The level has remained at B- for 2010 to 2012. Thus it has followed the trend of the health of the general economy. Source: Roger Grace Associates

Nine grades remained constant from their 2011 levels, which was a rather new outcome from previous years where results demonstrated a larger number of letter grade changes. Increasing one grade level from 2011 were Cluster Development (C+) and Profitability (C). Reduced grades of one level were R&D (B) and Market Research (B-). A two letter grade decrease was given to Design for Manufacturing and Test (B-).The only subject to receive an “A” was Established Infrastructure. VC Funding was the only subject to receive a “D”.

These grades established that marketing and capital formation continue to need major improvement and may be critical items in restraining the industry from realizing its true potential. Capital formation for MEMS continued to be a major problem and has been significantly exacerbated by the slow emergence of the economy from the worldwide financial crisis of 2008. Additionally, most “angel” and VC investors continue to be “infatuated” with Social Media funding opportunities at this time, rather than those which are hardware-based.

I believe that the objective of the 2012 annual MEMS Industry Commercialization Report Card — providing a valuable tool for MEMS industry participants to objectively monitor the “health” of the MEMS industry — has been realized once again.

I strongly recommend that MEMS industry participants heed George Santayana’s oft-misquoted opprobrium: “Those who cannot remember the past are condemned to repeat it.”[3] The results of the 2012 Report Card should prove a valuable aide memoire for industry participants, helping them effectively craft their business strategies moving forward.

For a more comprehensive look at the 2012 MEMS Industry Report Card, visit www.rgrace.com to see much more information including the extensive verbatim responses of the participants on each of the 14 topics.

References

[1] R. Grace and S. Walsh, MEMS Industry Roadmap; Micro and Nanotechnology Commercialization Education Foundation Roadmap , Chapter 2, 1990, www.mancef.org

[2] R. Grace, MEMS Commercialization: From the Lab…to the Fab…to the Market , Commercial Micro Manufacturing, January/February 2012, www.rgrace.com

[3] George Santayana, Reason in Common Sense , volume 1 of The Life of Reason , 1905

Advertisement

Learn more about Roger Grace Associates