In an effort to curb huge financial losses, Blackberry has agreed in principle to be bought by a consortium led by majority stakeholder, Fairfax Financial.

While exact figures have not been disclosed, the buyout is expected to be for $4.7bn — or $9 a share.

At present, Fairfax holds approximately 10% of Blackberry stock.

Blackberry, meanwhile, has said that it will continue to explore other options while negotiations continue.

News of the sale comes on the heels of the once mighty smartphone manufacturer’s second quarter report for fiscal year 2014, which showed an operating loss of $950 million to $995 million. The company is also expected to see a pre-tax inventory charge of $930 million to $960 million, which largely can be attributed to its unmoved Z10 devices.

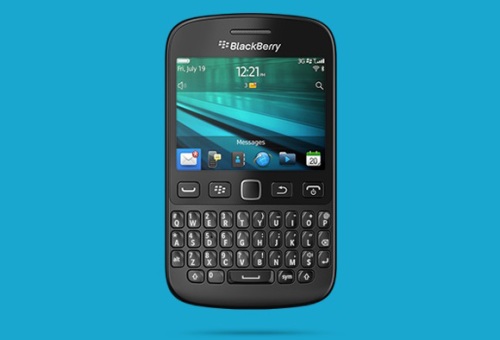

Blackberry pulled in $1.6 billion during the quarter, half of which was service revenue. The company also expects to see revenue come in on 3.7 million smartphones (primarily the BB7 model).

Losses for this quarter alone are expected to be in the range of $250 million (about $0.50 per share).

In a statement announcing the buyout, Barbara Stymiest, Chair of BlackBerry’s Board of Directors, said, “The Special Committee is seeking the best available outcome for the Company's constituents, including for shareholders. Importantly, the go-shop process provides an opportunity to determine if there are alternatives superior to the present proposal from the Fairfax consortium.”

Prem Watsa, Chairman and CEO of Fairfax, said: “We believe this transaction will open an exciting new private chapter for BlackBerry, its customers, carriers and employees.

We can deliver immediate value to shareholders, while we continue the execution of a long-term strategy in a private company with a focus on delivering superior and secure enterprise solutions to BlackBerry customers around the world.”

What do you think? Is this a good move for Blackberry or is it too little, too late? Let us know in the comments section below.

Story via: press.blackberry.com

Advertisement

Learn more about Electronic Products Magazine