El Segundo, Calif. Bosch of Germany was the No. 1 supplier in the world last year of automotive microelectromechanical system (MEMS) sensors, a market in which shipments continue to expand strongly but where revenue was being squeezed by marked price erosion, according to a new report from IHS Technology (NYSE: IHS).

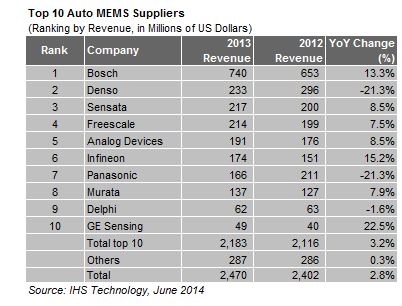

With revenue of $740 million, Bosch’s total amounted to more than three times the sales of its nearest competitor, Denso of Japan, which remained in second place, as in 2012. Together the Top 10 accounted for $2.18 billion worth of revenue, as shown in the attached figure, equivalent to 88 percent of the industry total of $2.47 billion. In 2012, the top 10 also had an 88 percent share in light of combined revenue of $2.12 billion, out of an industry aggregate of $2.40 billion.

“While Bosch was out front and even increasing its lead, other suppliers were much closer together last year in a tightly knit pack,” said Richard Dixon, Ph.D., principal analyst for MEMS and sensors at IHS. “The tighter competition among Bosch’s other rivals is due to Denso and Panasonic declining in dollar terms—while others like Sensata, Analog Devices and Infineon not facing this drawback took advantage of the situation to close the gap.”

Specifically, the decline suffered by Denso and fellow Japanese maker Panasonic was a result of an overall 22 percent drop in the value of the yen in 2013, which wiped out a large part of their revenue. Similarly affected were other Japanese-based auto MEMS suppliers not in the top 10, such as Epson Toyocom and Fuji Electric.

Overall for the industry, shipments continued to climb in 2013, growing 13 percent, up from 11 percent in 2012. Revenue growth, however, was much slower at 3 percent, pulled down by price erosion for components in safety applications like electronic stability control (ESC) and tire pressure monitoring systems (TPMS). Price erosion is particularly pronounced for multisensors—or so-called combo sensors—used in ESC and now for roll-detection systems, contributing to slower revenue growth.

These findings are available in the report, “MEMS Market Tracker – Automotive – H1 2014,” in the Semiconductors & Components service of IHS.

Bosch leads the way

Bosch’s revenue was up 13.3 percent from $653 million in 2012. The company benefited from its strong captive market via its internal Tier 1 customer. Outside its own base, the supplier is increasingly successful in promoting its inertial sensors through merchant channels, such as to a major Tier 1 and U.S. original equipment manufacturer.

Bosch has a well-balanced portfolio and a strong position in safety applications that exploit MEMS sensors, in addition to automotive powertrain applications. It is the top supplier of accelerometers, gyroscopes, pressure sensors and flow sensors for cars.

At No. 2 and No. 7, respectively, Denso and Panasonic saw revenues decline because of the shift in the exchange rate between the yen and the dollar. Shipment growth at both companies indicates, however, that the two suppliers actually experienced stable growth last year.

Denso is the top supplier of MEMS for heating, ventilation and air conditioning systems, and is also No. 1 in continuous variable transmission systems, at present mainly a Japanese market. Panasonic, meanwhile, derives most of its sales from the automotive gyroscope business, but the supplier is increasingly under pressure from rivals like Murata in ESC and Epson Toyocom for navigation.

Denso’s revenue fell 21.3 percent from $296 million to $233 million; Panasonic also fell 21.3 percent from $211 million to $166 million. Denso stayed in second place, but Panasonic fell four spots last year from No. 3 in 2012.

Achievers rise within ranks

Taking advantage of the travails of Denso and Panasonic to close in on rankings was a group of four suppliers that saw good growth for the year.

Rising two places to third place was global multinational supplier Sensata Technologies, with U.S. headquarters in Massachusetts. The company is in second place in pressure sensors after Bosch, and its other products include ceramic pressure and polymer-based humidity sensors. It is currently the world’s only commercial supplier of a MEMS cylinder pressure sensor, used by Volkswagen and Daimler diesels. Sensata grew 8.5 percent in revenue to $217 million, up from $200 million.

Up one place each were Texas-based Freescale Semiconductor, in fourth place; Analog Devices Inc. of Massachusetts, at No. 5; and Infineon Technologies of Germany, in the sixth spot.

For Freescale, success came through a solid performance in staples like accelerometers, along with shipments of side airbags to the North American market. The Freescale MEMS business now seems fully recovered from the damage to its Sendai fab after the Japanese tsunami in 2011, which cost the supplier some loss in market share. Freescale revenue in 2013 rose 7.5 percent to $214 million, up from $199 million.

A large part of Analog Devices auto MEMS activity comes from airbag accelerometers, and the supplier overall grew revenue 8.5 percent to $191 million, up from $176 million.

Infineon, the final member of the high-ranking, fast-moving quartet, is the leading player for TPMS, with a strong position at the major suppliers of these systems. And even though price erosion is to some extent affecting its revenue, Infineon’s takings climbed 15 percent to $174 million, up from $151 million.

The rest of the top 10

Murata from Japan, Delphi from Michigan and Massachusetts-based GE Sensing occupied the eighth, ninth, and 10th rung, respectively, in the automotive MEMS top 10.

Murata was strong in accelerometers for ESC. But increasingly, its combo accelerometer-and-gyroscope sensor is now growing in volume. Murata’s revenue rose 7.9 percent to $137 million, up from $127 million.

Meanwhile, Delphi’s sweet spot continued to be in airbags, even though revenue declined 1.6 percent to $62 million, down from $63 million.

GE Sensing, the final member in the elite top 10, had significant business in TPMS, growing its shipments there by 38 percent. Revenue last year was $49 million, up 22.5 percent from $40 million.

Advertisement

Learn more about IHS iSuppli