The list of potential applications for continuous glucose monitors (CGMs) is rapidly diversifying. This electronic skin patch is evolving from a diabetes management essential to an energy and lifestyle management gadget for professional athletes and biohackers.

This trend is sparking interest for many stakeholders in the CGM supply chain who sense that the wellness market could explode. But is the CGM really on course to become the Swiss Army knife of wearables—versatile, personalized and adaptable to the specific needs of diverse end-user demographics? Or is the mass-market potential over-hyped?

Diabetes management: the pocket knife

Before speculating as to the long-term disruptive potential of CGM, let’s remind ourselves why it has so much value within diabetes management. For people with Type 1 diabetes, periodic measurements of blood glucose levels are crucial to managing insulin delivery and sugar intake. Historically, patients had no choice but to take an inconvenient finger-prick test regularly.

However, the commercialization of the CGM, a disposable microneedle and glucose oxidase sensor housed within a skin patch, has made this process easier and crucially enables continuous measurements. This wearable technology can now take readings every minute for days at a time, significantly reducing the chance of missing a potentially fatal spike or trough in glucose level. This has been life-changing for millions of people with Type 1 diabetes and undeniably incredibly useful—the pocket knife of the multi-tool analogy.

Some players remain focused on expanding the long-term opportunity presented by CGMs within diabetes management. For example, it is now possible to use a catheter tube-free “patch pump” instead of a pen for insulin delivery. As such, the success of the CGM is driving interest in a sensor plus patch-pump solution to “close the loop” for diabetes management. Overall, however, the short-term trend will be toward the integration of diabetes management tools, including CGMs, within a wider digital health economy.

Athletic performance: the corkscrew

People with diabetes are not the only demographic with a stake in what and when they eat— the same is true of professional athletes. Performance edge can be obtained from well-timed refueling and hydration in a variety of sports, particularly those that are endurance-related, like multi-stage cycling or long-distance running. As a result, elite athletes offer a compelling market opportunity for wearable technology like CGMs—especially considering this demographic is already well-versed in undertaking extensive laboratory tests.

The opportunity for CGM within athletic performance management has already been identified by players like Abbott, which has partnered with Supersapiens to repackage its hardware into a product best suited to this market. These efforts have included allowing readout from a dedicated Apple Watch app, fitness-focused insights extracted from the data and a focus on the interplay between blood glucose and exercise.

Going forward, however, Supersapiens seems most interested in growing the adoption of CGMs for athletic performance and energy management within the diabetic community. The insights offered by the CGM are in part about informing eating but more crucially on the impact of insulin dosage and timing in and around exercise. This will, in part, likely be within a strategy to demonstrate to non-diabetic athletes how powerful CGM could be in preventing them from hitting a wall at that next crucial event.

But perhaps the reality is that CGM for professional sports is not the blue-ocean opportunity it first appears, with the highest value to be found in meeting the specific needs of a highly active subset of the diabetes market. Useful, but not quite as versatile—a corkscrew, perhaps.

Lifestyle management: the nail file

Diabetes management and energy management applications of CGMs are largely focused on answering the specific questions of what and when I should eat or administer insulin. However, there is also a trend toward its incorporation within the more loosely defined wellness, biohacking and lifestyle management market.

Lifestyle management today encompasses not only weight loss, nutrition and sleep but also stress and recovery tracking, metabolic hacking and even gut-microbiome analysis. Of course, all of these needs cannot be met solely by blood glucose readings and require a combination of smart scales, blood testing, stool analysis, breath testing and more.

However, the pitch of new players in this space, such as ZOE Ltd., is that understanding the interplay of all the data these tests provide is necessary for effective lifestyle management. This opens the door for the development of proprietary software to interpret data from CGMs and use it within in-house metrics designed to help users improve their health. Almost all consumer wearables utilize Abbott’s CGM hardware, with the data repackaged by third parties to create benchmarks like the ZOE scores or Abbott’s own Lingo count.

Ultimately, energy management is a subset of lifestyle management in which CGMs can play a role. As such, if the end user is using the lifestyle management score to inform diet choices, the CGM is competing with an enormous range of alternative data sources for this advice. This includes doctors, calorie-tracking apps, weight-loss coaching apps, cookbooks, social media influencers and much more. The CGM is akin to the nail file here—nice to have but applicable to a wide audience.

In reality, many savvy consumers may know the improvements to our lifestyle that we should be making but struggle with motivation as opposed to a lack of knowledge. Accountability has been a major driver for fitness tracker adoption that could prove essential in the success of consumer CGM. But in 10 years, it is unlikely that everyone will worry as much about meeting their glucose targets as they are about their 10,000 steps, except perhaps if a non-invasive method integrated within a smartwatch finally prevails.

Market outlook

So will history really show CGMs to be a mass-market technology as popular as the iconic Swiss Army knife? On closer inspection, there is plenty of room for cynicism. The value proposition of a CGM arguably decreases as the target market grows—life-saving for a diabetic but a relative novelty to the mass market.

Moreover, as it stands, the larger the addressable market, the higher the cost barrier. Upfront device costs can be multiple hundreds of dollars, plus an ongoing subscription. While in some instances healthcare can offer reimbursement and professional sports sponsorship, today, personal use remains limited to wealthy biohackers and CEOs.

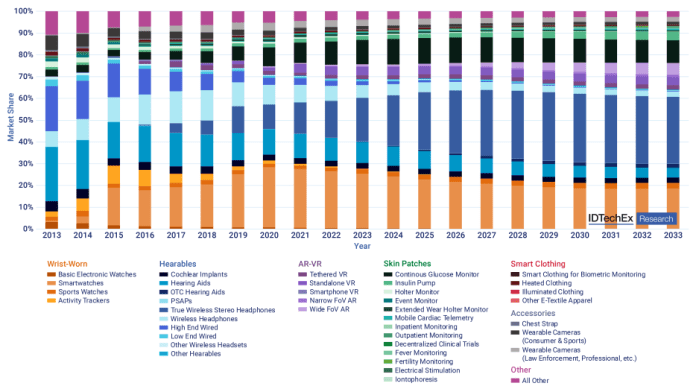

Wearable applications range from wrist-worn, AR/VR and hearables to skin patches and smart clothing. (Source: IDTechEx)

However, the smartwatch and fitness tracker industry has paved the way for business model innovations to grow the market share of expensive tech. Economies of scale could, of course, see costs fall, plus health insurers could offer subsidized access, and hardware-as-a-service could enable further growth.

Yet meta-drivers for mass-market adoption do arguably remain—namely, the continued struggle of healthcare services to grapple with population growth and aging alongside huge staff shortages. Consumers are hungry to improve their quality of life and are often so frustrated by the ineffectiveness of existing care pathways that they are willing to take matters into their own hands.

The use of CGMs sits within a wider emerging ecosystem of at-home swabs and blood tests, breath diagnostics and even DNA testing. Evidence may be lacking as to the efficacy of these solutions, but at least users feel less helpless.

The CGM is indeed impressive, versatile and practical but also expensive and facing stiff competition in the consumer market. Its value will always remain highest for people with diabetes, for whom the tech has and will continue to be transformative to their quality of life. Yet despite this, CGM technology may truly prove to be the Swiss Army knife of consumer wearables because it can offer a satisfactory solution when superior alternatives are out of reach.

Advertisement