By Barbara Jorgensen, managing editor of EPSNews, a sister publication of EE Times

President Trump’s tariffs were initially seen as a blunt instrument that would force other countries to drop their trade barriers. Nearly a year into the U.S.-China trade war, tech companies are accepting constant supply uncertainty as “the new normal.”

“Ten months ago, we were concerned about the first round of tariffs, but when we saw the actual impact, we could almost brush it off,” said George Whittier, president and COO of U.S. electronics design and manufacturing firm Morey Corp . “In the October time frame, it started to become more serious, and we were implementing plans to discharge tariffs to our customers.”

Morey, like many U.S. manufacturers, relies on imported resistors, capacitors, and printed circuit boards (PCBs). It is one of thousands of companies actively seeking alternatives for tariffed or scarce devices.

So far, tariffs have affected procurement costs, product design, and production timing. With 25% tariffs now levied on $250 billion worth of Chinese goods, OEMs may have to consider redesigning their products.

“I think this is the new normal,” Whittier said.

It’s possible, economists say, that the tariffs will never go away. That could have an upside for an industry that spent most of 2018 forging new supply networks. Institute for Supply Management CEO Tom Derry said that the supply chain will emerge more agile for its tariff travails. Manufacturers have a chance to differentiate themselves from China-reliant competitors.

The downside, however, may be irreversible. Procurement costs have increased; partnerships have been severed; and companies have been forced to relocate manufacturing. Global procurement operations are shifting away from China-reliant suppliers.

One U.S. component maker, faced with rising expenses, split with its Chinese factories and is now outsourcing in Japan. Another supplier is targeting competitors that build in China to give customers a “non-tariff option” for passive and electromechanical components.

“None of this is helping, and it’s a huge distraction,” Whittier said.

A tangled web

China’s role in the electronics supply chain can’t be understated. Component manufacturers have opened factories and/or outsourced production there. OEMs and EMS providers have done likewise and procured the bulk of their bills of material in China. Electronics distributors source, and then warehouse, large volumes of devices produced on the Mainland.

The most recent round of Chinese tariffs has heightened Morey Corp.’s concerns.

So far, Whittier said, there hasn’t been a cost that Morey couldn’t manage. But a 25% tax on many products could be a game-changer.

“Because we already have contracts with customers, they won’t be harmed [by the increase],” he said. “But I think they — or we — are going to spend a lot more time redesigning things. The major impact will be in PCBs, which is one of the biggest costs we have. More than 50% of PCBs are manufactured in China.”

Morey supports businesses in the automotive, aerospace/defense, commercial, and industrial markets. Customers must approve a departure from their approved vendor list. Noting that vetting new suppliers is time-consuming undersells the severity of the consequences — it could cause production delays.

“We are heavily engaged in alternative sources,” Whittier explained. “But if [many] manufacturers decide not to source from China, there could be a sudden shortage of PCBs.”

In some cases, he added, there are no alternative options. “The world’s biggest modem companies produce 100% of their products in China. If those are spec’d in, there’s little chance that [customers] will use someone else.”

Suppliers have been upfront about passing tariff costs onto customers. Expenses aside, the trade war has caused a lot of non-value-added work for electronics companies. Distributors must identify components subject to tariffs and pass that information along to their customers.

Electronics trade associations have pushed back against tariffs. “In [mid-May], the U.S. and China have followed through on threats to raise tariffs on more imports from one another’s countries,” stated the IPC, a PCB trade group. “These tariffs are affecting the global electronics supply chain, increasing costs and uncertainties for companies seeking to remain competitive in the global marketplace.”

New trade barriers will harm both countries, IPC added. “We urge U.S. and Chinese officials to accelerate negotiations and finalize an agreement that addresses long-standing disagreements, including intellectual property and market access.”

Managing through the uncertainty

For the past nine months, the channel has helped customers mitigate the impact of tariffs and realign their supply chains. Several distributors established “free trade zones” for purchasing transactions.

Still, customers’ bills of material typically call for hundreds of component SKUs.

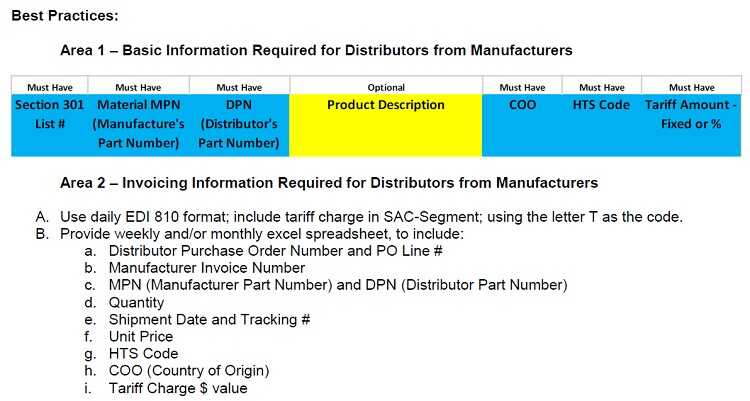

Since the implementation of the China Tariff List 301 in July 2018, authorized distributors are challenged with managing, processing, and sharing their suppliers’ tariff information, the Electronics Components Industry Association (ECIA) said. The trade group has developed a template for exchanging critical data.

The guideline represents what distributors consider the best practices for suppliers handling tariffs.

Image: ECIA.

The damage is done

Even if the U.S. and China reach a trade pact, the impact of the trade war won’t abate. Businesses have established new supply networks that are difficult to dislodge.

“The problem, the way I see it, is that both countries are so entwined with each other in this global market that we have that only the largest of the largest companies are able to diversify themselves out of a leveraged position,” said Reuben Townsend, director at Nano Components Pty Ltd in Australia.

As the U.S. and China duke it out, he said, the victors will be countries like India, Malaysia, and Japan.

“In electronics and production in electronics, both in components and manufacturing/assembly, we will find huge issues,” Townsend said. “We’re just coming out of a shortage crisis, and that’s put the industry on the back foot for the past two years.”

The latest round of tariffs, he said, “has the real potential to put pricing of electronics and goods with any kind of electronics in them into the stratosphere.”

Morey Corp. has decided to look for a silver lining.

“With news around the latest round of tariffs that will be assessed on almost everything, I look at this as a huge opportunity,” said Whittier. “Many of our competitors buy or build in China. If we do a redesign that can improve our cost position, I see that as a competitive advantage.

“We’ve come full circle,” he concluded. “This could be a net positive for our company.”

Check out all the stories inside this Special Project:

Tech Warfare Outbreak Hits China’s AI

Economist Dieter Ernst tells us, “The damage done by this outbreak of open technology warfare is likely to be much more serious and long-lasting than normally assumed in the media.”

U.S.-China Trade Damages Done

Despite trade negotiations that dragged on for months, the only discernible result was confirmation that “uncertainty” will indefinitely rule the future of the electronics industry and its markets.

China vs. U.S.: Cold War of 21st Century?

Tariffs and Trump’s executive order have replaced 40 years of economic integration. Vulnerable China could blink first in a trade war.

Advertisement

Learn more about Electronic Products Magazine