By Aalyia Shaukat, contributing writer

In December 2017, China’s Ministry of Industry and Information Technology released a three-year action plan to mass-produce neural-network processing chips by 2020. The plan fits into the overarching goal of becoming a global artificial intelligence (AI) innovation center by 2030. The Chinese government has already backed the statement with $150 billion in funding to boost the domestic chip industry from 2015 to 2025.

Despite lagging behind the $340 billion in U.S. annual semiconductor sales, China has been aggressively chasing outbound mergers and acquisitions — Rhodium Group estimates that Chinese firms have made $34 billion in bids for U.S. semiconductor companies since 2015; this includes the attempt to buy out the U.S.-based chip manufacturer Lattice Semiconductor that was eventually blocked by an executive order from the U.S. President. Of all the buyout attempts, only about $4.4 billion in Chinese semiconductor acquisitions were completed.

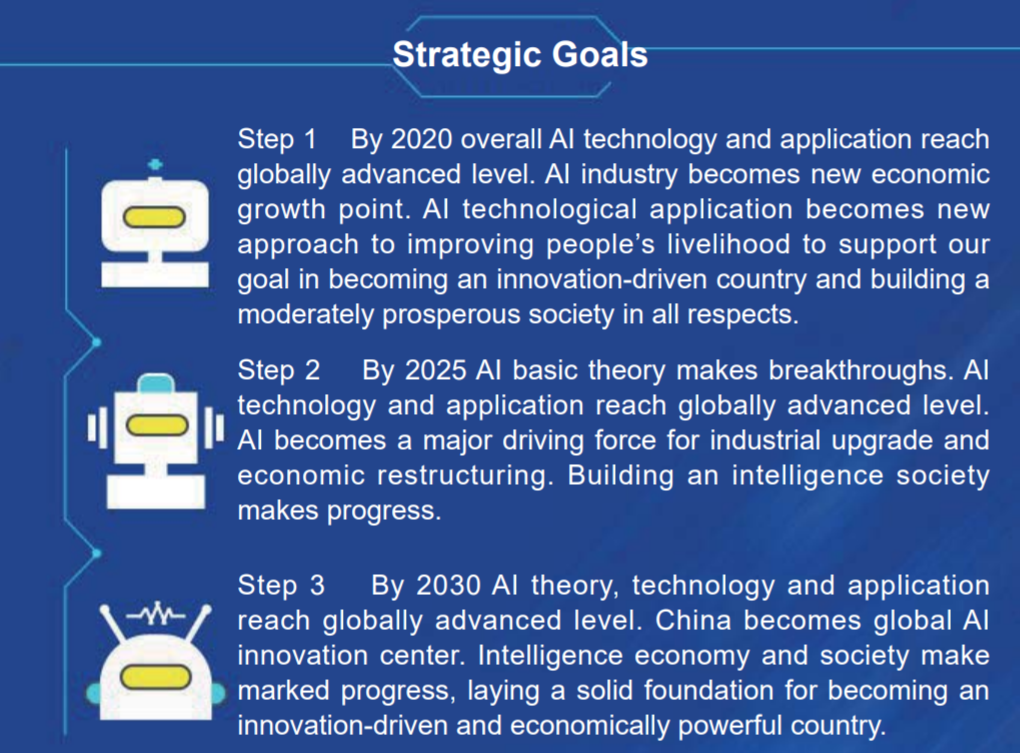

China Science and Technology Newsletter (Sept. 2017 ) drawing out government plans to mass-produce AI chips by 2020 with the long-term goal of becoming a world leader in innovation based on a foundation of their AI industry. Source: China International Science and Technology Cooperation.

“We cannot be reliant on foreign chips,” said China’s vice premier, Ma Kai, at a meeting last year of the National People’s Congress, China’s legislature. China is currently the world’s biggest chip market, consuming nearly 60% of global semiconductor sales by their fabless design firms. Only 10% of those $190 billion of chips are produced in domestic fabrication facilities.

China has since been working on upping its chip game on the domestic front, investing $22 billion into Tsinghua Unigroup Ltd., a Beijing-based chip manufacturer, back in March 2017. A second substantial investment followed this past Nov. 2017, when China raised $30 billion for phase two of the “Big Fund” — a national chip financing fund. First created in 2014, the Big Fund is focused on supporting the design and manufacturing of memory chips — compound semiconductors such as Silicon Carbide (SiC) and Gallium Nitride (GaN), as well as ICs for IoT, 5G, AI, and smart vehicles. Shanghai also released a municipal plan in Nov. 2017 to expand AI-related sectors with more than $15 billion by 2020.

China’s push toward neural-network innovation starts with $2.1 billion in funding for a technology park in Beijing dedicated to AI research and development (R&D). This park is expected to produce $7.7 billion a year from the 400 enterprises housed in the park with some big players like Cambricon Technologies, Huawei, DeePhi Tech, Horizon Robotics, and Bitmain. Some firms, such as Tsinghua, have already released multi-purpose AI chips. Tsinghua’s chip, called the “Thinker ,” is a multi-purpose AI that can handle multiple neural networking applications from voice commands to image recognition. The Chinese Academy of Sciences’ Institute of Computing Technology (ICT) released an AI chip for robots called “Dadu.” A third firm, Horizon Robotics, revealed two chips : The first is an AI processor called “Journey” that’s designed to help cars recognize and monitor traffic obstacles, and the second, “Sunrise,” is another image-recognition-based processor to help gauge how much customers like a product. With the current trends of AI chip releases and heavy domestic investment in the burgeoning Chinese AI economy, China can very well compete with the United States in AI chip manufacturing.

Advertisement

Learn more about Electronic Products Magazine