Editor’s Note: After perhaps a decade in research labs and drawing boards, 5G is on the verge of deployment. Indeed, early deployments of the technology are coming online now. You can tell because the marketers have sunk their teeth in and started promoting it. With 5G moving out of the lab, the team at AspenCore looks at what it will take to reach full deployment — from technical, supply chain, carrier, and policy perspectives .

By Larry Desjardin, contributing writer

The first 5G mmWave systems are being rolled out by Verizon in major cities in the United States. AT&T and T-Mobile promise to follow soon. While 5G, or fifth-generation wireless communication technology, promises faster speeds and lower latencies, another thorny issue has arisen: local attachment fees.

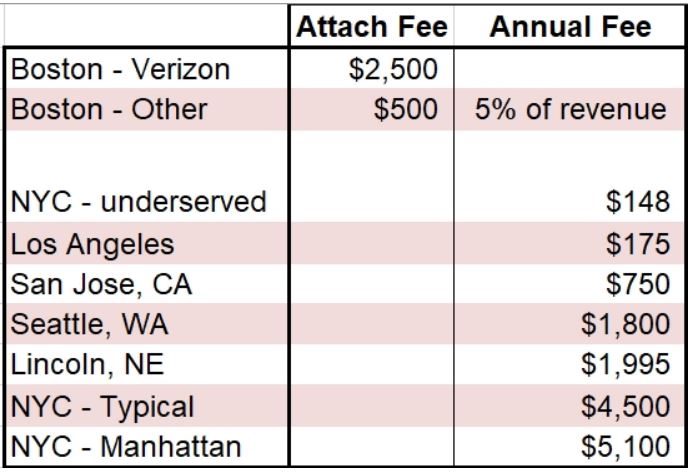

Attachment fees have always been part of the financial calculations of cellular deployment. If a 4G LTE cell needed to be mounted on a city light pole or other structure, the city would charge the service provider a one-time installation fee, followed by annual fees plus electricity costs. The fees can be significant. Boston charges Verizon $2,500 per pole for a 4G small-cell base station installation. New York charges $4,500 per pole annually. The prices vary dramatically, with cities tuning their fees to promote specific geographical rollouts in underserved areas or to add public Wi-Fi. Of course, it’s also an attractive revenue stream for the local governments. Table 1 shows the current pricing structure for 4G LTE small-cell installations for several U.S. cities. Not all fees being charged are publicly disclosed. The value is left blank if undisclosed.

Table 1: Small-cell attachment fee structure for several cities.

5G being deployed at mmWave frequencies will, however, require considerably more cells. The same frequencies that make spectrum available in unprecedented quantities also have a limitation: cellular range. 4G LTE signals can easily traverse kilometers, but 5G mmWave range is limited to hundreds of meters. The square of the range determines the area covered, so a range decrease of a factor of 10 leads to a coverage decrease of 100 and, proportionally, more small cells required.

A recent paper from equipment maker Ericsson proposes small cells to be deployed in a grid pattern for fixed wireless access (FWA), with each cell located approximately 350 m from the adjacent cells. FWA is not a service targeted at mobile phones. Instead, it is an alternative method of deploying residential internet, competing with cable networks, DSL, and other FWA providers. It’s a good first application for 5G, as detailed in “ The first killer app for 5G wireless may not even be mobile.” The fixed locations of the customers ease some of the more difficult challenges of 5G. Even then, residences on the boundary between cells may require a custom-mounted antenna to receive internet service promised by 5G.

The fee issue has pitted local governments against cellular service providers. 5G deployments simply require many more small-cell base stations for the same number of customers. Local governments look at the issue as a potential revenue windfall, while service providers perceive the fees as onerous. The FCC, concerned that the fees would impede 5G deployments, capped the fees at $500 per installation and $270 per year after that, plus electrical costs. The fees can be raised only if the local government documents that there is a higher cost to the local government than the capped limits. Several cities, such as Seattle, have sued the FCC to overturn the limits.

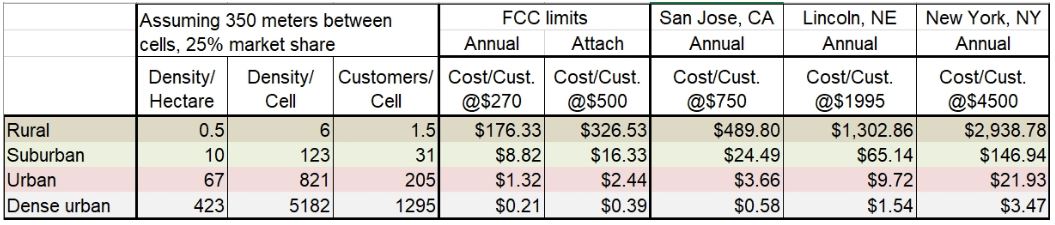

I won’t dive into all of the policy issues involved with this issue. They are complex and multi-faceted. We can, however, use a bit of engineering and math to estimate what these fees mean per customer and use our own judgment as to their significance. After all, the customers eventually pay these fees through their monthly subscriptions. To do the analysis, we use the FWA business model with small-cell spacing of 350 m, as articulated in the Ericsson paper. The coverage area per cell is 0.1225 km2 , or 12.25 hectares. This is approximately 30 acres. We will then look at four housing density scenarios: suburban, dense urban, urban, and rural. FWA requires one device per residence. Assuming a 25% market share, we can estimate the number of customers served per cell. The fee is simply divided by the number of customers to derive the per-customer impact.

For the housing densities, we will use the following averages:

- Rural: 0.5 residences/hectare

- Suburban: 10 residences/hectare

- Urban: 67 residences/hectare

- Dense urban: 423 residences/hectare

The densities were taken from a U.K. study of various housing densities, with the rural matching one residence per 5 acres, a typical density limit in unincorporated areas in the U.S.

This leads to Table 2 , showing the cost per customer depending on housing density and the fee charged. First, the new FCC limits are shown, followed by current annual fees in three metropolitan areas: San Jose, Lincoln, and New York.

Table 2: Calculations for the per-customer cost of local 5G attachment fees depend on housing density and the fee amount.

A few takeaways can be gleaned from Table 2 . First of all, housing density makes an enormous difference in the impact of fees. Annual rural costs of $176, even under the FCC price limits, are very high. This is a microcosm of the issues related to many rural broadband deployments, as costs must be allocated among fewer customers. Rural customers are clearly impacted by these fees. However, rural broadband isn’t one of the first deployments of 5G.

Suburban costs are also significant. New York annual costs of $4,500 per cell lead to $146 per customer, nearly as much as rural customers under the FCC limit. Lincoln’s fees of $1,995 come to over $5 per month. This is a significant fraction of a $30 (15 Mbps) or $40 (60 Mbps) monthly fee from Comcast, one of 5G FWA’s potential competitors. For suburban customers, one of the early targeted areas for 5G FWA, the fees have a significant impact on the competitiveness of a 5G FWA offering, perhaps enough to prevent some deployments.

Urban densities lower the per-customer impact of fees proportionally. Instead of spreading the per-cell costs over 31 suburban customers, they are spread over 205 urban customers, nearly seven times as many. These densities are typical of areas with moderately sized apartment complexes. The same Lincoln fees that added $5 of monthly costs to each user now add under a dollar. Under the FCC limits, they add 11 cents. One could argue that the impact of fees in an urban environment are not particularly onerous.

Dense urban environments, exemplified by high-rise apartment buildings, should reduce the impact of fees even further. Even the $5,100 annual fees in Manhattan sum to only 33 cents per month per user. 5G systems, however, run into another barrier: the number of users supported. The calculations for dense urban environments assume 1,295 customers/cell. It’s true that the cellular range can cover that many potential customers, but the 5G cell will simply run out of aggregate bandwidth before that. A good loading for a 5G cell in a FWA application may be 100 to 200 users. This equates to 100 Mbps to 50 Mbps per user for a cell with 10-Gbps total capacity. This is the same number of users per cell as in the urban environment scenario. Due to this limitation, even for dense urban environments, the per-user impact of fees should be calculated using the standard urban environment model.

My conclusion from this is that current 4G LTE access fees may be an impediment for 5G deployments in rural and suburban environments but probably have minimal impact in urban and dense urban areas.

There are several caveats to this analysis. This is for FWA only, which is one potential customer per household. 5G mobile should increase the number of users within a geographical area, reducing the per-user impact. Also, a 25% market penetration was assumed for any one service provider. The number of users in the rural or suburban environment is proportionally dependent on this market share value. It is conceivable to have nearly 100% market share in some rural environments if this is the only internet option.

As with many items related to 5G, when it comes to local fees, the devil is in the details.

Check out the articles showing how 5G is coming along and the issues it still faces:

5G test gears up

As products emerge and networks assemble, the test-equipment industry must keep up with standards, production, and deployment.

5G: Where is it and where is it going?

Despite the oncoming hype, 5G has a considerable way to go given that deployment is just beginning. We still need much of systems to get into full production. Then businesses and consumers will have to buy the products.

Optical interfaces to address 5G test

ODI is now positioned to address difficult challenges in 5G communications, mil/aero systems, and high-speed data acquisition.

5G Networks Under Construction

Engineering managers from AT&T and Verizon share their experiences designing and deploying their first 5G cellular networks.

Building the Early Supply Chain Path to 5G

Although it may be months or even years before 5G takes its place in the market, it’s not too early to start to get the supply chain prepared. Building the right supplier relationships and talent pool is critical.

5G buildout will be more involved than we’ve been led to believe

The spectrum that each cellular network operator has license to will have ramifications for the 5G networks they will have to build. Among the most significant of those ramifications is cell spacing.

Related articles:

Advertisement

Learn more about Electronic Products Magazine