From a hardware perspective, the Fire Phone carries a bill of materials (BOM) low enough to allow Amazon to cut a profit for each smartphone sold. But with Amazon likely having sunk large amounts of money into developing the Fire Phone’s unique features, the company must sell large volumes to recoup its investment.

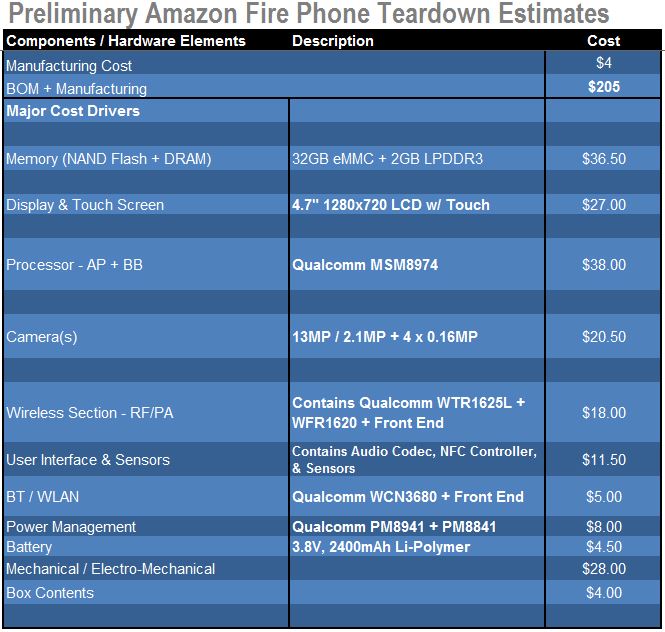

The BOM of the Amazon Fire Phone equipped with 32 gigabytes of NAND flash memory amounts to $201, according to a preliminary estimate by the Teardown Mobile Handsets Intelligence Service at IHS Technology (NYSE: IHS). The cost of production rises to $205 when the $4 manufacturing expense is added.

Given an unsubsidized retail pricing of $650, this means the Fire Phone has hit the appropriate price point to compete profitably on a per-unit basis with other manufacturers selling smartphones for similar prices. However, the BOM as well as manufacturing cost do not account for the research and development (R&D) expenses, which will have a major impact on the profitability equation for Amazon.

“The features that differentiate the Amazon Fire Phone—particularly its unique Dynamic Perspective interface—required the development of specialized hardware and software,” said Andrew Rassweiler, senior director, cost benchmarking services for IHS. “This kind of R&D effort is expensive and can only be paid off through major sales success. In a highly competitive smartphone space dominated by Samsung and Apple, Amazon will face the considerable challenge of selling enough Fire Phones to make its R&D effort worthwhile.”

The launch price also sets the Fire Phone in direct competition with the established flagship smartphones of Apple and Samsung, which are the market leaders, noted Ian Fogg, senior director for mobile media at IHS. “This is a high-risk launch-price strategy which is unsustainable for a smartphone market entrant like Amazon,” said Fogg. “Simply having a well-known brand on the box is not enough to sell smartphones, as Nokia and Motorola know well.”

The table attached presents the preliminary BOM and manufacturing cost estimate of the Amazon Fire Phone. Note that this teardown assessment is preliminary in nature, accounts only for hardware and manufacturing costs, and does not include other expenses such as software, licensing, royalties or additional expenditures—like R&D.

These findings are available in the “Teardown – Amazon Fire Phone” report, from the Materials & Cost Benchmarking service of IHS.

Friendly Fire

Amazon is marketing the Fire Phone’s user-friendly Dynamic Perspective interface as the smartphone’s main feature. Dynamic Perspective allows one-handed access to menus and shortcuts simply by tilting or swiveling the phone, or peeking at the display.

To make the Dynamic Perspective technology work, the Fire uses hardware not found in any other smartphone: four camera-like sensors that coordinate their activities with the applications processor. The sensors are placed in each of the Fire’s corners, detecting the user’s perspective relative to the display. The IHS Teardown Service revealed these devices to be monochrome sensors with a resolution of 400 by 400 pixels.

There are also four infrared (IR) light emitters, one in each corner of the front bezel. “These emitters may project more than just a blanket of infrared light,” said Rassweiler. “These IR emitters may broadcast an array of light ‘points,’ which are then ‘seen’ by the cameras, providing the camera with a ‘map’ of its surroundings. Though we are not sure at the moment, it is assumed that the Amazon Fire phone sensors work in a similar manner to the technology used in Microsoft’s Xbox Kinect.”

For their part, the sensor cameras feature specialized image sensors from OmniVision Technology Inc. While IHS is still in the process of confirming the exact part name, it’s likely OmniVision’s OV6211, a shutter sensor used for computer vision applications.

Qualcomm keeps the Fire burning

Chips from Qualcomm Inc. account for the majority of the Fire Phone’s functionality, with the semiconductor supplier contributing the core processor, along with the radio frequency (RF) and power amplifier (PA) sections of the design.

At the core of the device is the MSM8974 applications processor and wireless baseband chip from Qualcomm. The Teardown Analysis service has seen several variants of the MSM8974 in more than 10 teardowns of other phones and tablets examined in 2014, including the Samsung Galaxy S5, the Nokia Lumia 1520 and the ZTE Grand S II.

The Amazon Fire Phone also features Qualcomm’s full RF 360 suite of integrated circuits (IC). While IHS previously has analyzed wireless products that contain a few chips from the suite, it never before has seen the full Qualcomm solution in a single smartphone or tablet. The suite consists of the QFE1100 envelope tracker, the QFE1520 and QFE1550 antenna-matching tuners and the QFE23xx series of transmit modules.

The RF360 suite of ICs is designed for wide global LTE deployments, reducing handset design SKUs and time to market.

Qualcomm also contributes the WCN3680 chip, which delivers support for the 802.11ac advanced Wi-Fi specification. The technology is expected to support data speeds of at least 1 gigabit per second.

Just the right touch

The display/touch-screen subsystem of the Amazon Fire Phone is conventional for midlevel smartphones. The 4.7-inch, 1,280 by 720p-resolution display falls short of the 1,080p full high-definition screens used in high-end models. Japan Display is the supplier of the subsystem.

The use of a less-than-cutting-edge display allows Amazon to keep the Fire Phone’s BOM costs down—and to keep its hardware margins up.

Advertisement

Learn more about IHS iSuppli