MicroLED is a display technology in which each red, green and blue sub-pixel is an independently controllable light source: a tiny LED chip, typically less than 50 µm. Just like OLEDs, microLED displays are self-emissive. This means they retain all the benefits of OLEDs, such as high contrast, high speed and wide viewing angles. But their unique characteristics should allow an improvement in most performance metrics, including color depth and purity, contrast, brightness, power consumption, lifetime, environmental stability and ruggedness.

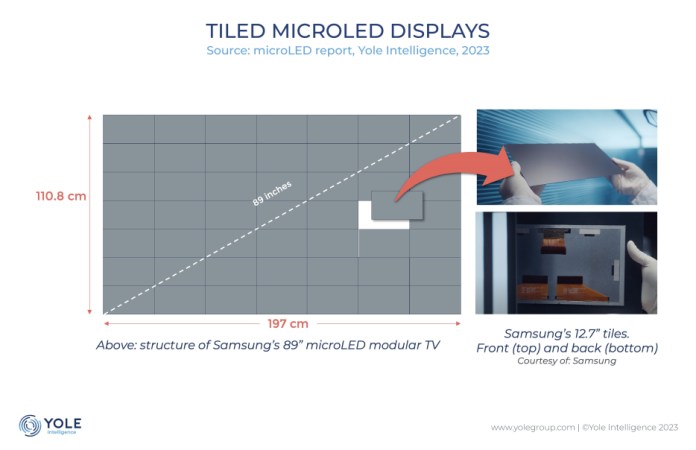

Unlike OLEDs, which require some encapsulation to protect fragile organic materials from oxygen and moisture, microLEDs are built from very stable materials and do not require any protection. This confers the ability to build bezel-free modules, or “tiles,” which can then be seamlessly assembled into a continuous display of virtually any size and shape.

No other display technology enables these bezel-free modules. LCDs require edge seals to contain the liquid crystals and OLED encapsulation, and to be effective, they must cover the full organic stack and extend by at least a few hundred microns beyond the edge of the pixels. This characteristic is already leveraged by Samsung in its 89-inch TV, using a 7 × 7 array of 12.7-inch tiles. The company has shown many other sizes, including a 76-inch TV, 6 × 6 array; a 101-inch TV, 8 × 8 array; and a 114-inch TV, 9 × 9 array.

Samsung leverages the microLEDs’ capability to build bezel-free modules or tiles in its 89-inch TV. (Source: Yole Group)

Because microLEDs are so bright compared with OLEDs, the emitting area required for a given display brightness is much smaller. This enables very high aperture ratios (the ratio of the pixel to emitter area). This favors contrast for all displays but is especially beneficial for transparent displays. To deliver a clear, high-contrast image, transparent displays must also be extremely bright, another characteristic that favors microLEDs over OLEDs. Transparency is desirable in a variety of applications, such as retail, public information displays and automotive.

The combination of small emitter and encapsulation-free architecture enables another unique category: stretchable displays. Stretchability is hard to achieve with displays.

One promising avenue is to combine small, rigid islands containing the emitter and driving circuit with stretchable conductor lines. Because the ratio of the rigid versus stretchable area dictates how stretchable the whole display is, microLEDs offer an advantage. Stretchability enables freeform displays, which are flexible along any axis and conformable to any complex shape. Those could be integrated into fabrics. For automotive, as an example, they could enable complex-shaped designs and, when combined with actuators, replace physical buttons.

Finally, microLED technology could allow the integration of sensors and circuits, enabling thin displays with embedded sensing capabilities, such as fingerprint, in-display camera, touch function, gesture control and more.

A strong momentum but not fully ready yet

Spearheaded by efforts from Apple, among others, microLEDs have generated a lot of excitement over the past decade. According to Yole Intelligence’s MicroLED 2023 report, the industry has spent about $12 billion on microLED development and industrialization efforts. Another $2.4 billion has been spent on mergers and acquisitions. This still pales compared with the more than $100 billion spent building OLED fabs since the mid-2000s, but still, it shows a strong momentum.

All display makers now have sizable microLED efforts. The first commercial products, various augmented-reality (AR) headsets and an 89-inch TV from Samsung, are available. A luxury watch from Tag Heuer is expected in the spring. The supply chain is shaping up, and various companies are investing to set up manufacturing.

Samsung’s 89-inch TV, however, retails for more than $100,000, and Tag Heuer’s watch will be positioned as a luxury product. The first real consumer application is expected to be Apple’s smartwatch. Initially expected as soon as 2024, it will likely not hit the shelves until 2026.

Apple has spent close to $3 billion to develop the technology. Its partner, ams Osram, is building a $1 billion microLED chip fab in Malaysia.

The consumer electronics giant also selected LG Display to supply the thin-film transistor backplanes onto which the more than 1 million microLEDs required for these displays will be transferred and electrically connected. Those microLEDs are 6–9 µm in size. Picking up every single one and precisely assembling them with a positioning accuracy of ±1 µm is a work of art. This will be performed by LG Display but under close supervision of Apple, using a proprietary technology developed by the company.

The task of assembling close to 1 million microLEDs seems daunting. For a 4K TV, this number goes up to 24.9 million (3,840 × 2,160 × RGB). An 8K TV would require 4× more.

Only three years ago, a company developing microLED displays had to invent its own mass-transfer process and build the equipment. Both Samsung and Apple did so. Today, more than a dozen off-the-shelf tools are available from equipment makers.

Similarly, critical inspection, testing and repair tools are becoming available from a variety of reputable vendors. Those first-generation tools might not yet be ready for high-volume manufacturing of consumer products, but they are suitable for development, for pilot lines and, in some cases, for a first product. In any case, they considerably lower the entrance barrier for newcomers and significantly accelerate development cycles.

MicroLED displays: market pull and market push

When and where can we expect microLED consumer displays?

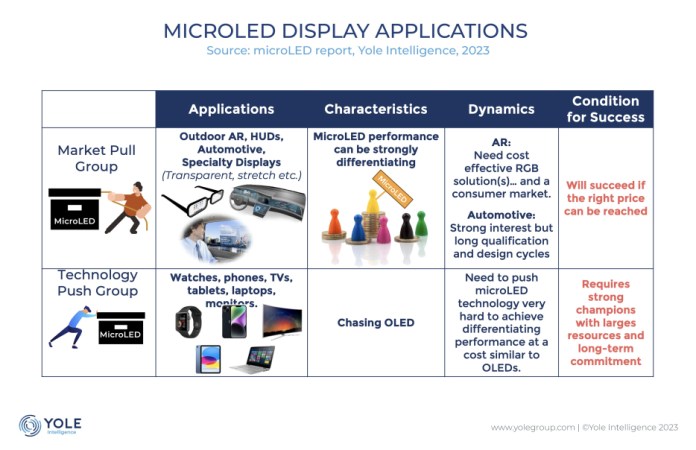

There are two categories of applications for microLEDs. In the first group, microLED characteristics are intrinsically differentiating and superior to any other display technology. For those, microLEDs are in a “market pull” situation in which OEMs are eager to adopt the technology as soon as it matures enough and reaches a cost compatible with their application.

This group includes micro displays for AR headsets. Here, microLED is potentially the only technology capable of delivering the right combination of size, brightness, cost and power consumption for the application. Jade Bird Display is already shipping microdisplays out of its new Shanghai fab, and dozens of startups and large companies like Samsung, Apple and Meta are developing their own.

Automotive is another use case: Automakers are anticipating microLEDs’ potential to deliver a combination of very bright, high-contrast, rugged, durable, transparent, conformable or rollable displays. PlayNitride and AUO in Taiwan and Tianma in China are leading the charge and have shown a variety of rollable, transparent and even stretchable prototypes.

AUO is currently ramping up small-volume production of smartwatch microLED displays and will use it as an incubator for automotive. The company also recently acquired BHTC, a German Tier 1 automotive supplier, which will give the display maker direct access to automakers and accelerate design and qualification cycles. Tianma is also building a pilot line for automotive microLEDs.

For most other consumer applications, such as smartphones, smartwatches, TVs and laptops, OLED is already doing an excellent job and keeps improving regularly in terms of both cost and performance.

MicroLEDs are in a “market push” situation. To compete, it must deliver strong differentiation and do so at a cost similar to that of OLEDs. Achieving this requires strong champions—companies willing to commit vast resources to lead microLEDs through a long and challenging development path. Examples include Apple with its watches and phones, Samsung with its TVs and AUO for wearables and automotive. More could emerge: Innolux, BOE and Tianma are all accelerating their efforts.

MicroLEDs need to deliver strong differentiation at a cost comparable to OLEDs to compete in the display market. (Source: Yole Group)

A microLED display is a new and complex puzzle. Many of the pieces already exist, but some have yet to be perfected. Bringing them all together and ironing out the last few kinks will take more time.

Only after yields and costs get close to the target will the first consumer products appear. The next two to three years will be critical. Apple’s smartwatch and Samsung’s TV projects are incubators for the entire industry. The watch is now expected in 2026, but failure would be a massive and potentially fatal blow.

Nevertheless, there is very strong momentum toward microLEDs, although as OLEDs keep improving, there is a sense of urgency to accelerate commercialization and secure some success before OLEDs get too entrenched in all major target applications.

Advertisement

Learn more about Yole Group