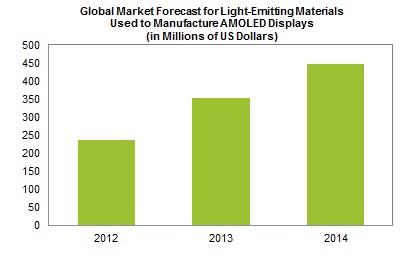

With a flood of new competitors set to initiate or increase the production of active-matrix organic light-emitting diode (AMOLED) panels next year, demand for materials used to make AMOLEDs is forecast to rise by nearly 27% in 2014, according to a new report “Display Materials and Components Report – AMOLED Light-Emitting Material – 2014” from IHS. The research company says the global market for AMOLED light-emitting materials will expand to $445 million in 2014, up from $350 million. While growth next year will moderate compared to the 49% rise in 2013, the market will swell by about $100 million in 2014 (see figure).

The report says that Samsung has successfully pioneered the AMOLED business with the introduction of 3 to 5-in. panels for smartphones. Their success has led to other panel manufacturers to design and make AMOLEDs for smartphones, TVs, and other products. This will increase the sales in the materials used to make the AMOLEDs.

The organic light-emitting materials utilized in AMOLED panels can be largely divided into two categories: common functional layer materials and color-emitting materials. The common layer materials include hole transport layer (HTL), hole injection layer (HIL), electron transport layer (ETL), electron injection layer (EIL), capping layer (CPL), charged generation layer (CGL), electron blocking layer (EBL), efficiency enhanced layer (EEL) and RGB prime layer materials. Of these, the EBL and EEL materials are hardly used at this time, while the CGL material is used only in white organic light-emitting diode (WOLED) panels. The color-emitting materials are red, green and blue host and dopant materials. Yellow-green materials are used in WOLED.

Samsung Display started the AMOLED market when it commenced large-scale mass production in 2008. Since then, it has led the AMOLED market’s expansion. In 2013, LG Display Co. Ltd. of South Korea launched a WOLED TV panel and a flexible AMOLED panel. Meanwhile, AU Optronics Corp. (AUO) of Taiwan introduced samples of small- to medium-sized AMOLED panels.

Next year, LG, AUO and Japan Display Inc. (JDI) are poised to commence or increase AMOLED panel production. As a result, light-emitting material makers are expected to compete in a more diverse market environment with increased demand and a broader base of customers. This will represent a marked change from the last five years, when they depended wholly on demand from Samsung Display. For more information http://tinyurl.com/loz2ddp

Advertisement