Google’s answer to Apple Pay is here: Android pay, a mobile payment platform now live at more than one million restaurants, stores, and other locations in the United States. The tap-to-pay system works to encourage shoppers to use mobile devices, rather than plastic cards, to pay for purchases.

Similarly to Apple Pay, Android Pay relies on near-field communication (NFC) to enable payments at compatible point-of-sale terminals. Several major retailers and restaurant chains, such as Jamba Juice, Macy’s, Chevron, McDonald’s, and Coca-Cola, have already signed up, according to Google.

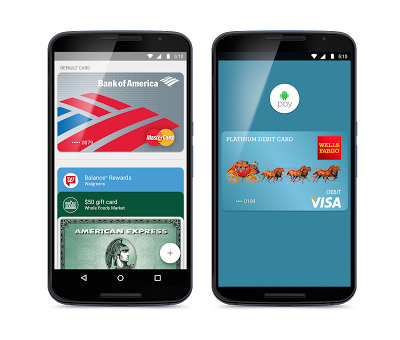

The payment system supports major credit cards, including American Express, Bank of America, Discover, Navy Federal Credit Union, PNC, Regions Bank, USAA, and U.S. Bank, with Citi Bank, Wells Fargo, and Capital One coming soon.

Android Pay also supports loyalty cards, gift cards, and payments within other apps (developers are soon adding a “buy with Android Pay” option).

With Android Pay going live, Google’s other NFC payment platform, Google Wallet, will be replaced. The company plans to relaunch a new wallet app focused on peer-to-peer payments, similar to Venmo.

Existing Google Wallet users will be able to access Android Pay by simply updating their pre-existing app, while new users can download Android Pay via Google Play. The company negotiated with Verizon, AT&T and T-Mobile to pre-install Android Pay on Android 4.4 “KitKat” smartphones, or later, with NFC built in, and will also ship on devices running the new Android “Marshmallow” operating system, where users can authorize their payments via fingerprint.

Consumers using Android Pay will not have to open an app to make a payment as it can be done by simply unlocking their smartphones. As with its competitors, Android Pay does not send your credit or debit card number to a merchant, but rather uses a virtual account number as a security caution.

Google’s take on the technology differs from Apple Pay, which generates tokens in a chip called the Secure Element, while Android Pay produces them in the cloud. This means Android Pay is more dependent on Internet connection, but does offer to store a limited number of tokens on the device for when you may not have Internet access.

“We’re starting to roll out Android Pay, bringing our next generation mobile payments platform to Android users across the U.S. Mobile payments is an important area for Google, and this is just the beginning for Android Pay,” said Pali Bhat, Director, Product Management, Google. “We have a great set of partners that have contributed to the launch of Android Pay, and we’ll continue to work closely with the entire ecosystem to make paying with your Android phone simple, secure, and available everywhere.”

Via TechCrunch

Advertisement

Learn more about Electronic Products Magazine