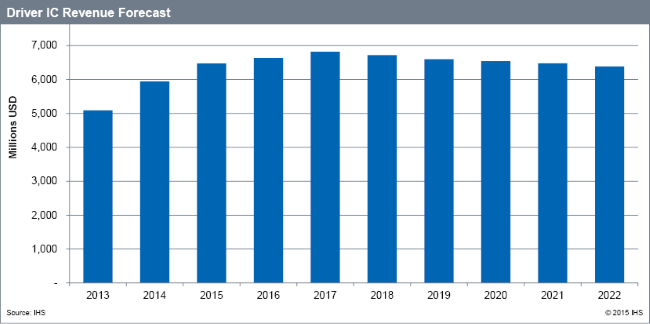

Annual revenue for driver integrated circuits (ICs) will peak at $6.8 billion in 2017, due mainly to the demand for higher resolution displays in smartphones and other applications. Smartphones boasting full high-definition (FHD) and 4K-resolution displays are on the rise, which is contributing significantly to the increase in driver IC revenue, according to IHS.

“To increase revenues panel makers are trying to reduce the number of driver ICs in their displays,” said Tadashi Uno, senior analyst and researcher for IHS Technology. “One way is to use driver ICs with more pins. While in the past the most popular source driver had 720 pins in the past, the latest driver ICs have more than 1000 pins, which drives down the number of driver ICs needed for each display.”

Among the many types of display materials and components, the driver IC supply chain is unique, according to the IHS Display Driver IC Market Tracker. Most driver IC makers are “fabless” companies — like TSMC and UMC — that contract out their production, rather than owning their own factories. Due to increased competition in the market, prices and profits for driver ICs dropped dramatically after 2007, which is why foundry makers have de-prioritized driver IC production.

“The lead time from order to delivery in the driver IC market is around three months,” Uno said. “This timeframe is quite long, compared to other materials and components; however, driver IC order delivery and pricing are not affected by the usual supply-and-demand forces.”

The IHS Display Driver IC Market Tracker is a quarterly report that covers the shipments, prices, revenue, value chain (supply chain) dynamics, wafer foundries, new technologies, interfaces, and display resolutions that influence driver ICs across all applications. For information about purchasing this report, contact the sales department at IHS in the Americas at +1 844 301 7334 or ; in Europe, Middle East and Africa (EMEA) at +44-1344-328-300 or ; or Asia-Pacific (APAC) at +604-291-3600 or .

Advertisement