By Jim Harrison

In a year of spectacular IC industry consolidation, two of my favorite companies have decided to wed. Analog Devices has acquired Linear Technology for $14.8 billion. Without a doubt, over the past 20 years, these two have led the industry in amplifier and data conversion analog IC technology advancements.

This union might make any engineer wonder whether competition, and therefore innovation, in the analog IC area may suffer. It certainly makes me wonder. Their many competitors, including Texas Instruments, Infineon, Maxim, Microchip, and NXP that are no slouches in the analog area for certain – but they also have other things on their mind.

If you’re looking for an acquisition without any product overlap, this isn't it. With the exception of DSP chips and a number of sensors, all the products overlap. And both companies work in the same applications areas. Nevertheless, I think they will continue all of their products. Two major questions come to mind: Will they combine product design teams? Will the two groups be able work well together?

Whoever is tasked with combining the two staffs, I don’t envy them.

Now some history.

Analog Devices

From its founding in 1965 to its milestone 50th anniversary in 2015, Analog Devices has a rich history of technology breakthroughs and achievements in linear integrated circuits. ADI’s story starts with humble beginnings in the 1960s in Cambridge, Mass.

Two MIT graduates, Ray Stata and Matthew Lorber, launched Analog Devices. Their focus was the manufacture of high-performance operational amplifiers, which was a newly developing market at the time. In 1965, ADI had three products, 46 employees, and $574,000 in annual revenue. The new company immediately made money; sales reached $5.7 million within three years and Analog Devices went public shortly thereafter.

Fig. 1: Ray Stata — Co-founder and Chairman of the Board, Analog Devices.

I could make a huge list of ADI’s accomplishments, but I will note just a few. 1974 saw the release of the first monolithic instrumentation amp, the AD520, and in 1978 ADI released the first monolithic A/D converter: the AD571. Released in 1980, the AD574 became the industry-standard 12-bit A/D converter with a microprocessor interface. In the late 1980s, ADI introduced a range of DSP ICs. By 1985, ADI had revenue of $322 million and employed 4,789; by 1995 ADI had 6,000 employees. Today ADI has more than 9,700 employees, and soon it will add 4,865 more very talented individuals.

Analog Devices is looking to get bigger to close the gap with industry leader Texas Instruments. TI is the biggest linear semiconductor manufacturer. By buying out National Semiconductor in September 2011 and updating production methods, Texas Instruments says it has cheaper manufacturing and more product offerings than anyone else. Its stock hit a record this year.

Linear Technology Corp.

Linear Technology, with 2015 revenue of $1.475 billion, was started in 1981 by engineer and semiconductor industry pioneer Robert Swanson. With three former coworkers, Swanson built the fledgling Linear into a $100 million company in the span of a decade, and established Linear as a technological leader. Swanson grew up near Boston and went to Wentworth Institute of Technology in Boston. He obtained a degree in industrial engineering when most colleges were still teaching vacuum-tube technology. He started hunting for a job in the semiconductor field. He turned down a $100-per-week offer from prestigious Polaroid to take a job with Transitron, then the nation's second-largest transistor/diode manufacturer. It was a great opportunity, and Transitron became a leader in military semiconductor applications.

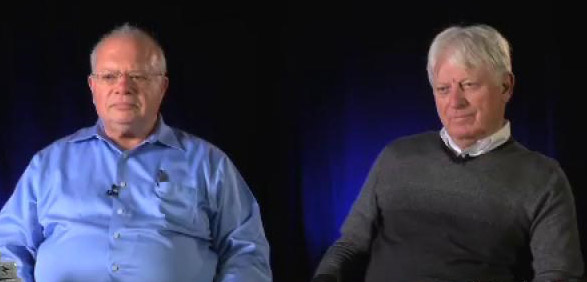

Fig. 2: Linear Technology’s Chief Technical Officer Bob Dobkin and Executive Chairman Bob Swanson.

After receiving a call from one of the soon-to-be famous founders of then-unknown Fairchild Semiconductor, Swanson moved west. He worked for Fairchild for five years and then joined National Semiconductor. During his 14 years there, National made the transition from a smaller, more entrepreneurial, company to a big corporation.

Swanson left National Semiconductor and, in 1981, formed Linear Technology together with Bob Dobkin. His goal was to develop analog chips and to eventually profit from the growth in new applications created by digital chip technology. Bob took three fellow executives from National with him and secured $5 million in venture capital funding. They subsequently hired away several of National's most talented EEs. Swanson's former boss at National, Charlie Sporck, was furious that his former coworkers were now going to compete with his company. He tried to squelch the venture with lawsuits, claiming that Linear had stolen technology developed at National. “We did choose to compete against them, and they accused us of misappropriating trade secrets, or stealing,” Swanson told the Business Journal-San Jose. “But I'll tell you, for every guy we hired away from National, ten applied.”

Linear first produced analog chips as a second-source supplier, providing chips to buyers whose main suppliers failed to fill an order. During the early 1980s, Linear used the cash flow from its successful, but fairly low-tech, line of analog chips to fund research and development of more advanced linear devices.

Linear invested heavily and posted net losses throughout the early 1980s. Annual sales rose past $20 million and Linear showed a net income of $1.17 million in the fiscal year ending June 30, 1986. It would continue to boost profits every year into the mid-1990s. Linear went public with a May 1986 stock offering.

After wowing investors with big gains during the mid- and late 1980s, Linear went on to achieve even greater growth and profitability during the early 1990s. It boosted sales to $265 million in 1995, with $84.7 million net income. Its performance earned it a reputation as one of the hottest prospects in Silicon Valley, and one of the best-managed companies in America.

What impact will the recent string of acquisitions or mergers (Intel/Altera, SoftBank/ARM, Avago/Broadcom, NXP/Freescale, Microchip/Atmel, Infineon/IR, and more) have on design engineering? We will keep a close eye on this over the next year or two. We would love to hear your comments.

Note: One source for the company histories was www.fundinguniverse.com.

Advertisement

Learn more about Analog DevicesLinear Technology