El Segundo, Calif. (Feb. 6, 2014)—The worldwide market for industrial electronics semiconductors ended 2013 on a strong upbeat note, with overall revenue up convincingly from the previous year and reversing the disappointing decline of 2012, according to a new report from IHS Technology (NYSE: IHS).

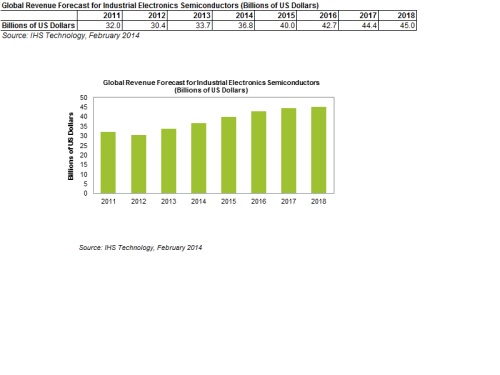

Global industrial electronics chip revenue for 2013 amounted to $33.7 billion, a solid 11 percent rise from $30.4 billion in 2012. After final figures are confirmed for the fourth quarter, the double-digit increase expected in 2013 will show that the market recovered from the 5 percent loss of 2012. Growth will continue in the next few years, and industrial-related semiconductor revenue will reach some $45.0 billion by 2018, as shown in the figure below.

“The market’s persuasive bounce-back is due to a strengthening global economy, coupled with higher purchasing confidence across all geographical regions,” said Robbie Galoso, principal analyst for industrial electronics at IHS. “While the field may not sound as sexy or attention-grabbing as some of the more popular markets around, like wireless or consumer, there is no underestimating the power or sheer breadth of its applications, ranging from home automation to the medical field, to energy, to aeronautics and military purposes, and much more.”

In the Americas, led by the U.S., an upturn in the housing market fueled the expansion of industrial electronics usage in the building and home control segment. China was another locus of growth, with broad-based revenue increases occurring in various segments, including medical electronics and factory automation.

Even a beleaguered Europe, still disentangling itself from the recent financial turmoil, was a happy contributor, with 13 of its countries figuring among the top 20 global industrial electronics markets. Those nations included the likes of Germany, France, Switzerland, Sweden, Italy and Finland.

The industry on the whole continued to pick up steam during the third quarter after demand started improving in the second. Overall, the turnaround for the year sets the stage for a robust 2014, Galoso said, with annual revenue forecast to grow 9 percent to $36.8 billion.

These findings are contained in the report, “Solid Q3 Industrial Growth Improves 2013 Forecast,” from the Industrial & Medical Technology research area of IHS.

Powerhouse segments pull up weaker performers

The largest segment in all of industrial electronics during 2013 was building and home control, spurred by a newly resurgent U.S. residential market. Revenue in 2013 is estimated at $10.1 billion, or nearly a third of the industry’s entire takings. Lighting was a prominent performer, especially in the light-emitting diode (LED) sector, as were security systems used in applications like video surveillance and fire alarms.

Also obtaining high marks last year were the military and civil aerospace segment, as well as medical electronics. In the former, a robust commercial avionics sector drove expansion that compensated for headwinds encountered in the military sphere because of the U.S. federal budget sequestration. In the latter, the diagnostic-therapy-patient monitor market continued to perform well.

One other important segment last year was energy generation and distribution, even though third-quarter results were mixed. Here weakness in wind turbines dragged down the stable growth seen in other renewable-energy sectors such as nuclear, thermal, hydro, and oil and gas.

Other segments contributing to industrial electronics included test and measurement, still soft in the third quarter; and manufacturing-process automation, which enjoyed enhanced results due to a significant increase in demand from China and the U.S.

The top five countries last year in terms of semiconductor design and influence for industrial electronics were the United States, China, Japan, Germany and France. Together the five nations controlled more than 70 percent of the industrial electronics sphere in 2013.

Advertisement

Learn more about IHS iSuppli