Lauded as the largest data leak in history, 2.6 terabytes of secret data on tax-refuges and offshore accounts were leaked from the Panama-based legal firm Mossack Fonseca, revealing the numerous ways used by the wealthy elite to stash their assets and avoid paying taxes. The 11.5 million files—collectively referred to as the Panama Papers —have turned up ties to 12 national leaders, dozens of politicians and their families, and many other high-profile people.

The documents were anonymously sent to the German newspaper Süddeutsche Zeitung, which then disseminated the content across the International Consortium of Investigative Journalists or ICIJ, a collective of 370 journalists from 100 other media outlets. More surprising than how the files were obtained, is how the collective managed to remain completely silent as they scoured through as many documents as possible in the last year.

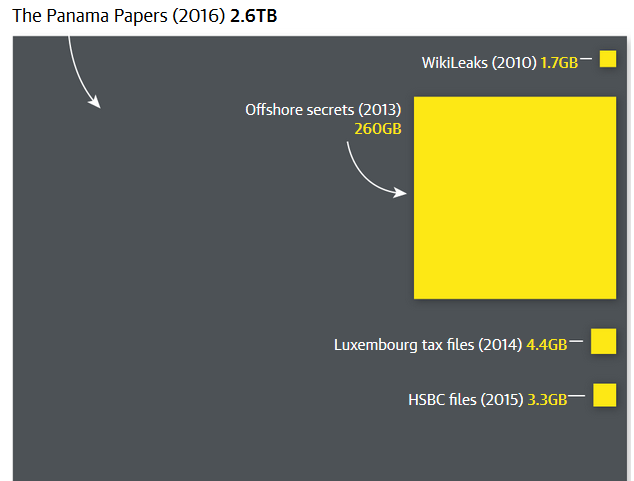

The quantity of data contained in the Panama Papers is unprecedented, surpassing the diplomatic cables released by WikiLeaks in 2010, and the NSA documents exposed by Edward Snowden in 2013. It primarily consists of e-mails, PDF files, photos, and excerpts from an internal Mossack Fonseca database. Its authenticity has been verified by the firm’s co-founder Ramon Fonseca in an interview with the BBC.

What’s contained in the leak?

Many more revelations will come to light in the coming weeks as news agencies continue to publish additional content related to the leak. In the interim, we’ve learned that some of the high-profile names who use offshore accounts include Vladimir Putin, President of Russia; Mauricio Marci, president of Argentina; Sigmundur Davíð Gunnlaugsson, the prime minister of Iceland; Nawaz Sharif, prime minister of Pakistan; Petro Poroshenko, President of Ukraine; Alaa Mubarak, son of Egypt’s former president; Ayad Allawi, ex-interim Prime Minister and former vice-president of Iraq; soccer superstar Lionel Messi; Ian Cameron, father of English Prime Minister David Cameron; and many more.

Image via The Guardian

Are offshore accounts illegal?

Holding money in an offshore account is not illegal in itself. However, it offers a degree of anonymity that makes it easy to conceal assets and commit tax evasion or money laundering. Parties deliberately seeking to do this can funnel money into shell companies using a complex string of proxies in the form offshore accounts, thereby allowing one hide capital gains and avoid taxation. The ICIJ believes that many of Mossack Fonseca’s clients have used their position to engage in “bribery, arms dealing, tax evasions, financial fraud, and drug trafficking.”

What do we know about Mossack Fonseca?

Mossack Fonseca is the law firm at the center of this story and is responsible for managing offshore firms, providing financial services, and is the fourth largest offshore service provider in the world. In total, 14,153 client and nearly 215,000 offshore shell companies are tied to Mossack Fonseca. The firm is based out of Panama but has offices worldwide in 42 countries including Switzerland, Cyprus, and the British Virgin Islands.

How is the ICIJ conducting its research?

Given the wide breadth of the assignment, the ICIJ used the Nuix data-sorting software to index the vast amount of information and make it searchable. PDFs and scanned image files of passports, IDs, and signed contracts were converted into machine-readable data using an optical character recognition (OCR) technique and added to the index. By applying this level of digital processing, it became very easy to sort data by names based on a list of politicians, athletes, international criminals, and other well-known people. The challenge comes in combing through the data.

Source: Sueddeutsche.de , Guardian , and Deadspin

Advertisement

Learn more about Electronic Products Magazine