Lyon, France – February 19, 2013 – Though MEMS standardization will never happen, companies are optimizing their own technology platforms. Such process innovations will drive MEMS equipment and materials to a 7% CAGR over 2012-2018.

In its new report MEMS Front-End Manufacturing Trends, Yole Développement goes further in the equipment & materials market forecasts and in the manufacturing trends for MEMS. The report gives detailed analyses about MEMS device technology process flow, manufacturing trends and manufacturing cost breakdown (accelerometers/gyroscopes, microphones, pressure sensors, optical MEMS…).

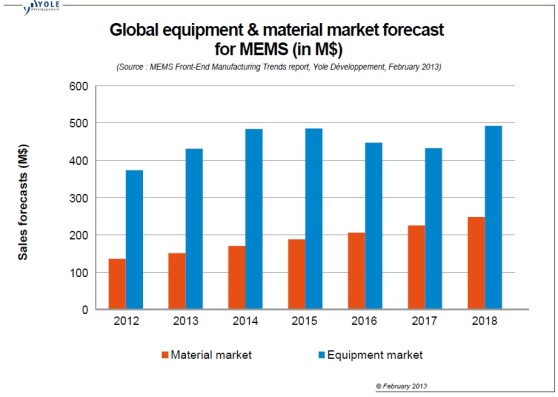

Changes in MEMS manufacturing will drive the equipment & materials market from $378M to $512M for equipment and $136M to $248M for materials between 2012-2018

Innovative processes are fueling the MEMS equipment & materials market. Yole Développement forecasts that demand for MEMS-related equipment will grow from ~ $378M in 2012 to > $510M by 2018, at a CAGR of 5.2% over the next five years. It's interesting to note that our MEMS market forecast will follow a cyclical up/downturn similar to what the mainstream IC equipment market underwent.

The demand for materials and related MEMS consumables will grow from ~$136M in 2012 to > $248M by 2018 at a CAGR of 10.5% over the next five years.

As MEMS become commodity products, manufacturing will change and mature

Today, MEMS fabrication is still very diversified and lacking in standardization; Yole Développement's rule « One product, one process » still applies. Indeed, MEMS has a different story than IC and doesn't follow the same roadmap as the semiconductor industry. Thus, it's still common to see many players with radically different manufacturing approaches for the same MEMS device, sometimes within the same company (i.e. both the CMOS MEMS and hybrid approaches can be used for inertial devices or microphones).

However, as MEMS becomes a commodity product with a quicker time-to-market compared to previous generations, anything that speeds up the commercialization process is welcome. MEMS packaging is evolving in a different direction than front-end processing, and Yole Développement has already identified that packaging standardization will become increasingly critical in order to support the massive volume growth in unit shipments, and decrease overall costs associated with MEMS & sensor content. For example, microphone packaging is very similar between one manufacturer and another. Additionally, this report shows that at the front-end level, companies are developing in-house technological platforms targeted for different MEMS devices.

In this report, Yole Développement shows that as MEMS moves from competing on process technology to competing on functions and systems, a move towards more standard solutions is necessary to drive down package size and cost.

Currently, MEMS foundries still compete at the process level and have to propose a wide range of processes in order to cope with new MEMS designs and structures. This approach differs from fabless companies, which usually focus on one type of MEMS design. Their main objective is to find the most experienced and reliable foundry partner in order to convince customers of their expertise. IDMs, meanwhile, generally rely on robust and established MEMS processes to manufacture their products. Foundries, which must always remain at the forefront of changes in the MEMS manufacturing landscape, have the biggest challenge.

TSV & unique wafer stacking solutions are key enablers for reducing die size and cost

This report highlights the major front-end manufacturing changes. For example, TSV for CSP is gradually seeping into the MEMS industry.

However, since miniaturization will be limited, new detection principles are currently being developed at various R&D Institutes (i.e. Tronic's M&NEMS concept) in order to lower MEMS size at the silicon level. This technology is based on piezoresistive nanowires rather than pure capacitive detection, and is poised to be a leap forward in terms of device performance and chip size. This will set the stage for a new generation of combo sensors for Motion Sensing applications, achieving both significant surface reduction and performance improvement for multi-DOF sensors.

Amongst the large array of MEMS technologies, we've identified several that will have the widest diffusion in the years to come.

The list includes:

• Through Si Vias

• Room Temperature Bonding

• Thin Films PZT

• Temporary Bonding

• Cavity SOI

• CMOS MEMS

Other MEMS technologies, i.e. gold bonding, could be widely used to reduce die size while maintaining great hermeticity for wafer level packaging.

About the report “MEMS Front-End Manufacturing Trends”

Authors:

Dr Eric Mounier has a PhD in microelectronics from the INPg in grenoble. He previously worked at CEA LETI R&D lab in grenoble, France in marketing dept. Since 1998 he is a co-founder of Yole Developpement, a market research company based in France. At Yole Developpement, Dr. Eric Mounier is in charge of market analysis for MEMS, equipment & material. He is Chief Editor of Micronews, and MEMS'Trends magazines (Magazine on MEMS Technologies & Markets). He has contributed to more than 150 marketing & technological analysis and 50 reports.

Amandine Pizzagalli recently joined Yole Développement Advanced Packaging and MEMS manufacturing teams after graduating as an engineer in Electronics, with a specialization in Semiconductors and Nano Electronics Technologies. She worked in the past for Air Liquide with an emphasis on CVD and ALD processes for semiconductor applications.

Catalogue price: Euros 5,990.00 (multi user license) – Publication date: February 2013

For special offers and the price in dollars, please contact David Jourdan (jourdan@yole.fr).

Companies cited in the report:

AAC, Adeka Corp., Advanced Chemical Company, Aichi, Air Liquide, Air Products, AKM, Akustica, 3M, Alces, Altatech Semiconductor, AMAT, AMEC, AML, Analog Devices, Atotech, Avago, baolab, Bosch, bTendo, Brewer Science, Canon, Canon Anelva, Cavendish Kinetics, Colibrys, Cookson Electronics, Daetec, DelfMEMS, Discera, Dupont Electronic Technologies, Dynatex International, Ebara technologies Corp., EEJA, Epcos, Epson, Epson Toyocom, Everspin, EVGroup, FLIR, Freescale, Fujifilm, GE Sensing, Hermes Systems, Honeywell, hp, IBM, IceMOS, IMT, Infineon, Ion Torrent, Invensense, Irisys, Kionix, KiyoKawa Plating Industry, Knowles, Lemoptix, Lexmark, Leybold Optics, Maradin, MEMJET, MEMSCAP, MEMSIC, Memsmeriz, MEMTRONICS, Micralyne, Microvision, Miradia, Mitsubishi, Mitsubishi Gas Chemical, Mitsumi Electric, MSI, Murata, Nanofab Korea, Nexx Systems, Nikko Metal, Nikon, Nippon Signal, Novellus, NovioMEMS, nScrypt Inc., Océ, OEM group Oerlikon,, Okmetic, Olympus, Omron, OnSemi, Opus, Philips, Plansee Metal GmbH, polight, Pyreos, Radant MEMS, Reactive Nanotechnology Inc, Rena GmbH, Sand9, Sandia National Lab, Sensata, Sensirion, SensoNor, SensorDynamics, Sentech Instruments, Shinko Seiki, Silex, SiTime, Sony, SPP, SPTS, SSS, ST Micro, SUSS Microtec, Tamarack

Scientific, Tango Systems, TDK-Epcos, Tegal, TEL, Teledyne Dalsa, Texas Instrument, Thin materials AG, tMt, TOK, Toshiba, Triquint, Tronics, TSMC,Ulis, Ulvac Inc, Uyemura Co. Ltd, Veeco, VTI, Wavelens, WiSpry, Xaar, X-Fab, Yamaha…

About Yole Développement – www.yole.fr

Beginning in 1998 with Yole Développement, we have grown to become a group of companies providing market research, technology analysis, strategy consulting, media in addition to finance services. With a solid focus on emerging applications using silicon and/or micro manufacturing, Yole Développement group has expanded to include more than 50 associates worldwide covering MEMS, Microfluidics & Medical, Advanced Packaging, Compound Semiconductors, Power Electronics, LED, and Photovoltaics. The group supports companies, investors and R&D organizations worldwide to help them understand markets and follow technology trends to develop their business.

CUSTOM STUDIES

• Market data, market research and marketing analysis

• Technology analysis

• Reverse engineering and reverse costing

• Strategy consulting

• Corporate Finance Advisory (M&A and fund raising)

TECHNOLOGY & MARKET REPORTS

• Collection of reports

• Players & market databases

• Manufacturing cost simulation tools

• Component reverse engineering & costing analysis

More information on www.yole.fr

MEDIA

• Critical news, Bi-weekly: Micronews, the magazine

• In-depth analysis & Quarterly Technology Magazines: MEMS Trends- 3D Packaging – iLED – Power Dev'

• Online disruptive technologies website: www.i-micronews.com

• Exclusive Webcasts

• Live event with Market Briefings

CONTACTS

For more information about :

• Services : Jean-Christophe Eloy (eloy@yole.fr)

• Reports: David Jourdan ()

• Media : Sandrine Leroy ( )

Advertisement

Learn more about Yole Développement