BY PATRICK MANNION,

Contributing Editor

It might be just a coincidence, but at the time of this writing, members of the 3GPP are packing for Lisbon to vote on the first phase of what will be the new 5G standard. At the same time, legislators in Washington are getting set to vote to dismantle net neutrality regulations. The shared thread is that the fundamental premise of 5G is that not every service is equal: Instead, it pulls every technological trick in the book to optimize the use of spectrum and core network capacity to provide the right service to the right user for the right application.

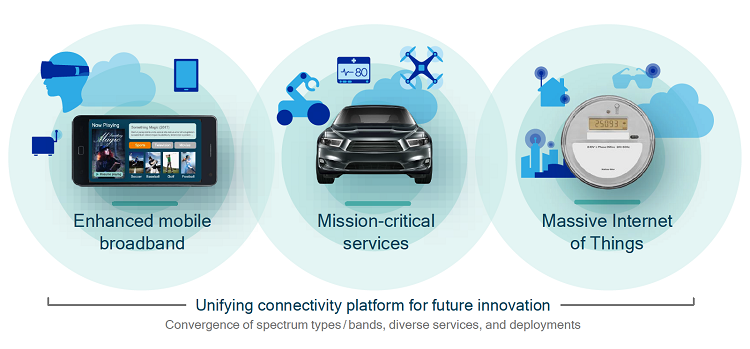

The optimization is combined with network flexibility to achieve the necessary enhanced mobile broadband (eMBB) for mobile and fixed wireless; ultra-reliable, low-latency communications (URLLC) for mission-critical services; and massive machine-type communications (mMTC) for the Internet of Things (IoT) (Fig. 1 ). Fig. 1: eMBB, URLLC, and mMTC are the use cases for what will be 5G. Image Source: Qualcomm.

Fig. 1: eMBB, URLLC, and mMTC are the use cases for what will be 5G. Image Source: Qualcomm.

These are the three main use cases that have been defined for the 5G requirements set forth by the ITU-R in IMT-2020 that the 3GPP is starting to finalize between December and March. Those requirements include a peak downlink rate of 20 Gbits/s, a user-experienced data rate of 100 Mbits/s, a spectral efficiency that is three times that of 4G networks, a peak spectral efficiency of 30 bits/s in the downlink, a latency of 1 ms, a connection density increase to 1 million devices versus 4G’s 100,000, and a network energy efficiency that is 100 times that of current networks.

Its finalization will trigger the design and implementation of a wave of technological advances and network deployments. These have been researched and exercised to varying degrees in pre-5G deployments from all of the major wireless operators and their equipment, chip, and software providers. All are looking to get their share of a 5G global market that will have 1 billion subscribers by 2023 (Ericsson Mobility Report, November 2017) and be worth $2.86 billion in 2020, reaching $33.72 billion by 2026 (MarketandMarkets, 5G Infrastructure Market, November 2017).

The expectations of the reports reflect the breadth and depth of the changes to wireless and core access and processing infrastructure that will be required to support 5G and its applications. The changes will push the limits of electronic components, software, subsystems, and designers’ capabilities, from antennas and RF chips to baseband processing, network servers, security, and, last but not least, system test and verification.

2018: “the big year” for 5G

However, before all of that can begin in earnest, the 3GPP must fulfill its part by meeting the schedules for both the non-standalone (NSA) and standalone (SA) versions of 5G New Radio (5G NR), the official term for the iteration of 5G that the 3GPP group is finalizing. There are other incompatible “5G” iterations, such as Verizon’s 5G TF.

The decision to split the 5G NR proposal into two parts was made early in 2017 to allow operators to leverage their current front-end 4G LTE networks. It allows operators to deploy 5G services more quickly while making maximum use of their currently installed infrastructure, said James Kimery, director of marketing at National Instruments.

The 3GPP Radio Access Network (RAN) Working Group is expected to have determined Stage 2 (signaling and architectural elements) of Phase 1 5G NR NSA during the week of December 18, 2017. This keeps it on track to meet the March 2018 deadline for the software to be finalized (ASN.1 freeze).

Stage 2 of Phase 1 5G NR SA is focused on the back-end networks and is scheduled to be completed in June 2018, with an ASN.1 freeze for software set for September 2018. Though the final Phase 2 5G NR is scheduled for finalization between December 2019 and March 2020, the completion of Phase 1 allows equipment vendors and operators to start global deployments.

The first big test of what will be 5G is still set for the 2018 Winter Olympic Games in PyeongChang, South Korea (February 9–25). KT has already started deploying services along highways and tunnels to give attendees a sample of what is to come.

3GPP resets 5G expectations

Even as the 3GPP RAN Working Group meets to decide how to meet IMT-2020 requirements, it has already reset some expectations. Early in 2017, in order to meet the December deadline, it decided to postpone some elements around millimeter-wave (mmWave) operation. There were too many bands for the group to simulate before the December meeting. Those simulations are necessary for test-equipment vendors to design test equipment. For now, some bands of operation will be put on the back-burner.

The scaling-up of features and capabilities happened with 3G and 4G and is expected to continue with 5G. The many front-end optimization tricks used to achieve IMT-2020 requirements include making maximum use of available spectrum from sub-1 GHz to 100 GHz, application of massive multi-user, multiple input, multiple output (MU-MIMO) and beamforming MIMO techniques, and the use of advanced coding and modulation schemes.

According to Dr. Nishith Tripathi, principal consultant at Award Solutions Inc., 5G NR will also be characterized by flexible channel bandwidths, flexible subcarrier spacing, dynamic duplex switching (from TDD to FDD, where frequencies support it), the use of advanced and new coding schemes such as low-density parity check (LDPC) and polar coding, and, of course, higher modulation levels up to 256 QAM.

However, while all of these techniques will eventually be used together, to start, Kimery expects early-stage 5G to comprise more modest, baseline approaches, including the use of single input, single output (SISO) instead of MIMO and an initial baseline modulation scheme of 64 QAM per carrier instead of enabling 256 QAM at the outset. Using a 100-MHz carrier, Kimery expects to be able to start with a data throughput of 2.4 Gbits/s. “That’s three times what’s currently doable on LTE, which is a big improvement,” he said. The data throughput will increase as higher-order modulation and MU-MIMO are added.

Core network flexibility matches service to application

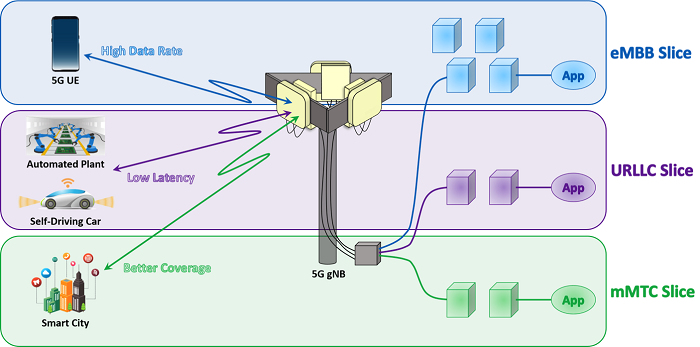

Moving in from the radio, the heart of what will eventually be full 5G NR is the core network, in which the focus is on abstracting the services and software from the underlying hardware as much as possible. The techniques to achieve this are already either well-researched and characterized or already in the field. They include network function virtualization (NFV), software-defined networking (SDN), mobile edge computing (MEC), and the newer concept of network slicing (Fig. 2 ).

Fig. 2: 5G moves from physical to more virtual networks, with features like network slicing that allow an operator to provide the optimum quality of service for each use case (eMBB, mMTC, or URLLC). Nishith D. Tripathi and Jeffrey H. Reed, “5G Cellular Communications: Journey and Destination,” Fall 2018. Image Source: Award Solutions Inc.

Fig. 2: 5G moves from physical to more virtual networks, with features like network slicing that allow an operator to provide the optimum quality of service for each use case (eMBB, mMTC, or URLLC). Nishith D. Tripathi and Jeffrey H. Reed, “5G Cellular Communications: Journey and Destination,” Fall 2018. Image Source: Award Solutions Inc.

Features like SDN and NFV lower the cost of equipment and provide the flexibility to update networks as new features roll out. However, network slicing is particularly interesting because it ensures that each use case (eMBB, URLLC, and mMTC) gets its required data rate, latency, coverage, and other requirements.

This flexibility in QoS on a per-user and per-application basis is timely given the FCC’s plan to roll back net neutrality regulations. In doing so, it effectively gives broadband providers free reign to make the best use of their networks as they see fit. This has given rise to concerns over what they will do with that freedom. However, from a 5G point of view, it means that wireless operators are in a position to deploy flexible and scalable broadband network access and services in rural locations, using either 5G at mmWave over short distances or at sub-6 GHz or sub-1 GHz for longer distances — or a combination of both.

The second implication has to do with the cost of deploying broadband based on 5G wireless: Without the need to lay cable or fiber, smaller, independent operators are able to provide broadband services at a lower cost as needed.

In his recent report, “Broadband Disruption: How 5G Will Reshape the Competitive Landscape,” Peter Rysavy describes how mmWave 5G can be used to leapfrog current hybrid fiber/coax (HFC) installations in underserved areas.

5G pushing limits of components and test

As interesting as leapfrogging operators may be, Virginia Tech’s Dr. Jeffrey Reed points out that much has to be done with respect to component performance, cost, power consumption, and testing to make 5G viable, especially at mmWave bands, such as 28, 37, and 39 GHz. At those frequencies, path losses increase dramatically over sub-6-GHz operation. Weather can also play a factor, and, “note that power amplifiers are not as efficient at higher frequencies: We need to do massive [antenna] arrays, so there are lots of channels,” he said. “We need new components, new testing methods to test smart antennas, and processes to make them behave as we expect.”

The difficulty of operating higher frequencies means that 3.5 GHz will be the “killer band” for 5G, according to Prayerna Raina, senior analyst at ABI Research. “Ultimately, 5G must make good business sense for operators who continue to battle stagnating ARPUs, rising network traffic, and the need to cost-effectively optimize network management and operations,” says Raina. “C-band, with the support of new technologies, including uplink decoupling, will likely be the dominant 5G spectrum band [because] it allows operators to deploy 5G on an existing network grid rather than spend significantly on new cell sites.”

Regardless of which way it goes, most good test vendors have been supplying mmWave equipment for mil/aero applications already, and testing 5G is forefront for Kimery and his team at National Instruments. “We’ve been researching and developing technology for 5G since 2010,” he said. “We’re ready.”

All of the test vendors are prepped with various software-defined test solutions, standard or proprietary, to address the wide-ranging needs of 5G tests. How those perform will soon be determined.

Meanwhile, Qualcomm, ZTE, and China Mobile recently demonstrated the first 5G NR end-to-end data Interoperability Data Testing (IoDT) system (Fig. 3 ).

Fig. 3: The first IoDT system for 5G was recently demonstrated by Qualcomm, ZTE, and China Mobile. It operates in the 3.5-GHz band. Image Source: Qualcomm.

Fig. 3: The first IoDT system for 5G was recently demonstrated by Qualcomm, ZTE, and China Mobile. It operates in the 3.5-GHz band. Image Source: Qualcomm.

Operating in the 3.5-GHz band, the system uses Qualcomm’s sub-6-GHz user equipment (UE) prototype and complies with the 3GPP Release-15 5G NR layer 1 framework, with latencies down to 1 ms.

While 4G networks have many years of usage ahead, the rise of mobile and broadband video, vehicle-to-vehicle communications, and the IoT will usher in 5G networks by 2019 as planned.

Advertisement

Learn more about Electronic Products Magazine