By Barbara Jorgensen, managing editor, EPSNews

The electronics industry has developed some of the most groundbreaking technologies in human history. Yet the best minds in high tech have been unable to overcome one of the industry’s most insidious challenges: counterfeit electronics.

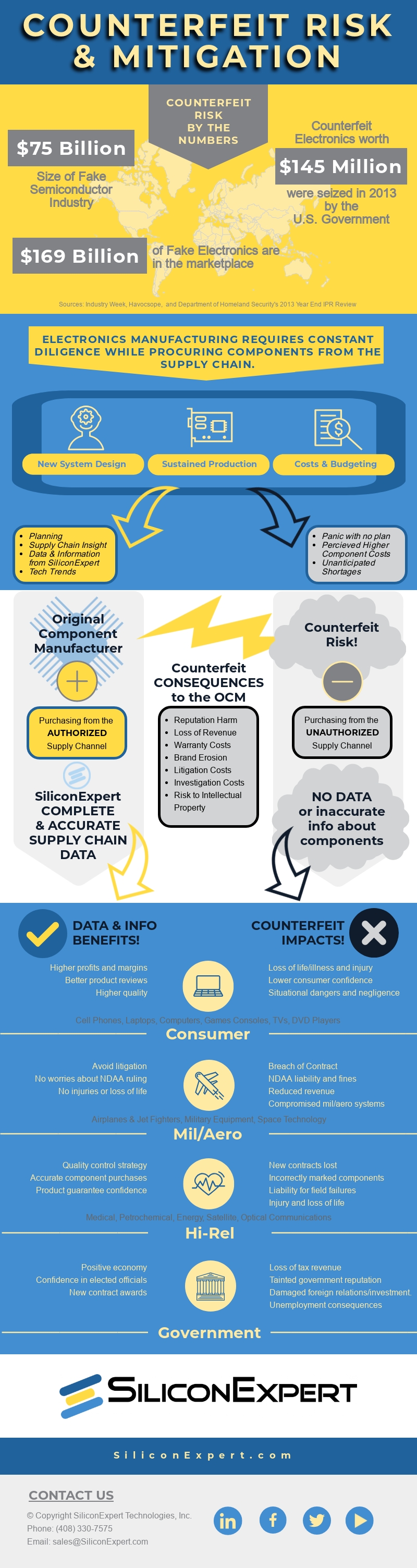

To some extent, technology advancements have only added to the problem: Electronic components can now be cloned so well that they cannot be distinguished from the genuine article. But counterfeiting is not just a technology issue — procurement and supply chain practices also contribute to the proliferation of fake devices.

Currently, there is no silver-bullet solution for counterfeit electronics.

Inauthentic components, most frequently, are recycled substandard devices or parts that have been modified to appear as something they are not. Counterfeiters most often target high-value components, many of which are destined for the defense, aerospace, automotive, and medical industries. Distributor PRB Logics Corp., for example, has been charged by the U.S. government for the sale of counterfeit ICs intended for use in military applications. This is the most profitable track for criminals.

However, supply chain practices contribute to the circulation of fake parts. Original component manufacturers (OCMs) try to restrict their distribution to authorized resellers that are audited for strict quality-control practices. Distributors buy directly from OCM factories; trace the devices via part numbers, date codes, or other identifiers; and pass through OCM warranties. Authorized channels are tantamount to buying directly from the OCM.

Industry associations and standards organizations have significantly contributed to sound procurement practices. Commercial distributors are using the SAE Aerospace 6496 standard for fraudulent and counterfeit components. Defense department sourcing rules, under the auspices of the National Defense Authorization Act (NDAA and DFARS ), are wide-ranging and comprehensive.

Nevertheless, because of imperfect forecasting, there are always unused electronic components in the supply chain. If customers are unable to return inventory, they can sell components on the open market. Many of these devices are bought by distributors that are not authorized by brand owners and are not required to adhere to established quality-control practices.

Although many non-authorized distributors strive to sell authentic products, less scrupulous brokers traffic in counterfeits or mix defective parts in with genuine devices.

There are inconsistent practices for identifying and eliminating suspect components within the electronics supply chain. NDAA and DFARS apply to all component sources but are largely self-policing. Within other agencies, such as NASA, there are no centralized systems for identifying and sharing information on suspect components or vendors.

Commercial manufacturers are encouraged to report counterfeits to organizations such as the Government Industry Data Exchange Program, (GIDEP ) . Because GIDEP requires complete transparency — reporting parties and brand owners must be identified — companies worry that their reputations will be tarnished. Therefore, some companies simply handle counterfeit notifications themselves .

ERAI , an organization that monitors, investigates, and reports issues affecting the electronics supply chain, maintains the confidentiality of organizations that report suspect devices. If the authenticity of the parts is disputed, ERAI arranges testing of the components. However, there are no formal information-sharing agreements between ERAI, GIDEP, and other outlets that combat counterfeiting.

Anti-counterfeiting solutions have lately focused on component traceability. The authorized supply chain promotes buying and selling only through franchised distributors that can provide the provenance of any component. But tracking a component from the factory throughout its lifecycle is problematic. RFID and devices such as microtags have been raised as possible solutions. Other efforts include:

- Applied DNA Sciences, Inc. has developed plant-based DNA that can be used for tracking purposes.

- Solutions developer Battelle offers a fast, non-destructive authentication of electronic components, enabling separation of cloned or counterfeit components from authentic components at a lower cost than alternative methods.

- Optimal+ provides software solutions for collecting, cleaning, and aggregating data from multiple chip-manufacturing locations. Company executives envision applying the data to create unique identifiers for components. That data can then be used for verification purposes.

It is unlikely that a single solution will ever be adopted across the electronics industry. End markets have different tolerances for risk. The consumer electronics industry has had its share of horror stories, but the automotive, medical, military, and aerospace markets have zero tolerance for defective parts. Industry segments seek solutions that best meet their needs.

At the same time, the breadth of anti-counterfeiting systems and tools is extensive. Information remains a powerful means of thwarting criminal efforts. SiliconExpert , which provides a variety of tools and services that enhance supply chain and component security, is hosting The SiliconExpert Market Insights: Counterfeit Risk & Mitigation Thought Leader Panel Discussion webinar on Thursday, Jan. 31, at 10 a.m. Mountain Standard Time. Free registration is available at https://event.on24.com/wcc/r/1911029/8E18D846C8BB16A20DC474BC63031D8B .

Advertisement

Learn more about Electronic Products Magazine