Here’s a frightening statistic: in 2012, credit and debit card fraud amounted to a staggering $11.33 billion in lost funds.

Unfortunately, there are no signs that this trend will slow down any time soon. And while the banks and credit card companies are busy trying to figure out how to stop their databases from being hacked, we’re all responsible for our own well-being.

One approach that’s attracting security seekers is Final, a credit card that changes its digits every time it’s used. The CEO / CTO of the company behind the card said he suffered unexpected card cancellations during Target’s data breach, and it was this experience that led him to create Final.  When you order a Final credit card, you get everything you normally receive with any card request: a card (well, a pin and chip like those used in Europe), an app, and access to an online portal that serves as a smarter version of your monthly bill.

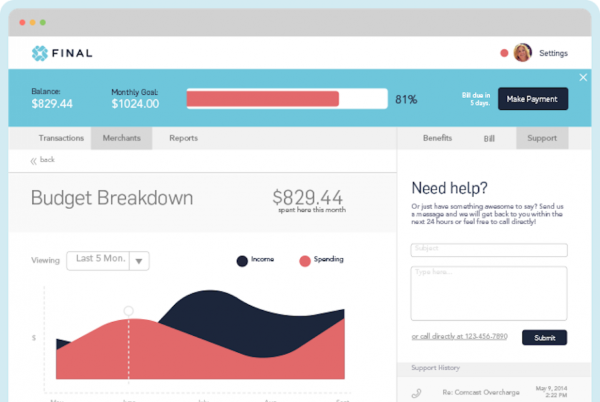

When you order a Final credit card, you get everything you normally receive with any card request: a card (well, a pin and chip like those used in Europe), an app, and access to an online portal that serves as a smarter version of your monthly bill.

When used, whether it’s a card or card-less transaction, Final will assign a unique credit card number to the merchant through which you’ve ordered your products / service. If this business begins charging amounts that the Final owner has not approved, that unique credit card number is cancelled immediately to disable any further charges.

A number can also be cancelled should a merchant be the victim of a security breach (e.g. the aforementioned Target incident).

And this can all be done without the owner ever having to forfeit his / her actual, physical card.

The mobile app serves as a means of quick-click convenience to show the user the card numbers assigned to each merchant; it can also be used to generate new ones if need be. The app also pushes notifications whenever the card is used so if there’s ever an unwarranted charge, the owner can cancel the merchant’s number immediately.

In terms of the online portal, there are tools to tally monthly expenses, chart what is spent, and compare the “charged” numbers against one’s income to ensure there’s never any overspending.

What’s particularly unique about the Final credit card is that it does not have any embossed numbers on it, at least for now. Deals are still being struck to have Final added to larger networks of acceptable forms of payment (think about how long it took PayPal to be accepted).

At present, the company is working out the finer details of getting into MasterCard and Visa networks.

For those curious, not everyone can get a Final credit card — they need to be applied for, require a credit review, and will come with pre-assigned limits.

If you are interested in learning more about Final, or would like to sign up for early access, visit the card’s website at GetFinal.com

Advertisement

Learn more about Electronic Products Magazine