By: John O'Boyle, Senior Business Manager, Military and Aerospace Business Unit

The obsolescence of all types of electronic components, including integrated circuits (ICs), is a serious issue for many OEMs in the military and aerospace communities. The tutorial describes how the IC industry has offered several approaches to address the disruption for mil/aero OEMs. Nonetheless, when all those options are assessed, there is only one mitigation solution that really works—the Obsolescence Mitigation (OM) program from Maxim.

Obsolete part The obsolescence of all types of electronic components, including integrated circuits (ICs), is a serious issue for many OEMs in the military and aerospace communities. Many of the ICs that these OEMs have designed into systems are, unfortunately, becoming obsolete for reasons beyond the control of these companies.

This tutorial discusses some history of IC obsolescence, which will help shed light on the root cause of the problem impacting mil/aero OEMs. The history will also describe the unintended consequences for mil/aero customers when they shifted from traditional high-reliability mil parts to commercial-off-the-shelf (COTS) parts.

The article also describes how the IC industry has offered several approaches to address the disruption for mil/aero OEMs. Nonetheless, when all those options are assessed, there is only one mitigation solution that really works—the Obsolescence Mitigation (OM) program from Maxim. An unusual and inventive solution, OM is a collaborative effort between Maxim and an individual OEM.

Initially Mil/Aero Customers Drove the IC Business

If you reflect on the military and aerospace industry and its use of ICs, you discover that the military and aerospace communities were the predominant customers for semiconductors in the 1950s and 1960s (the early years of the industry). Then over the years IC demand shifted from mil/aero applications to computer and telecommunications where usage rose during the 1970s and 1980s. Later, the computer and telecom applications were supplanted by even higher demand from consumer electronics when ICs became truly commoditized at the end of the century.

The early ICs were prone to failure from a variety of causes including wafer defects (e.g., inclusions in the crystal lattice), mask imperfections, layout errors, process variations, and similar problems. Because military and aerospace applications required high reliability, the U.S. government, through the Department of Defense and others, developed detailed methods and techniques to assure reliability from the design of the IC itself, through the wafer fabrication processes, the piece part assembly steps, and ending with the physical testing (electrical, environmental, and structural) of the device.

These manufacturing and test procedures were detailed in military standards (STDs and PRFs, pronounced “perfs”). These highly detailed and thorough specifications and procedures covered IC layout and design, even to specifications for the thickness of the metal, the coverage of the metal in the vias between layers, and the metal coverage on the contacts to the active silicon region itself. Additional specifications defined fab process quality steps and various aspects of testing for a given end environment. The end result of all these specifications was a U.S. Department of Defense series of definitions of steps for producing and testing the most reliable devices possible. This was all outlined in familiar documents like the MIL-STD-883, MIL-PRF-38535, and many more. Most IC engineers and OEMs are familiar with these testing protocols and recognize that “mil spec parts” take longer to make since the testing is very involved and time consuming.

As with all things technical, by the late 1980s and early 1990s IC reliability had improved dramatically as manufacturing processes and quality controls evolved (Moore's Law at work). Meanwhile, as noted above, the market for ICs shifted from a focus on military to computers and telecommunications and then more recently to a focus on consumer electronics. With the IC industry emphasis now on personal communications and consumer-driven electronics, mil/aero OEM customers were able to obtain more complex devices. Meanwhile, the IC industry experienced far more rapid product evolution and shorter life cycles. The end result, of course, was the displacement of older ICs by newer devices. In short, while ICs were advancing, they were also being obsoleted in growing numbers and at a faster pace than perhaps anticipated by anyone.

Seeing only the rapid advancement in performance and the concomitant price decline of these new “commercial-oriented” devices, the military community longed for the improved performance (and lower cost) of these ICs. These commercial devices offered more function/performance per square micron of silicon than the traditional mil-spec parts. Moreover, the prices of the new ICs were dramatically lower. The enhanced reliability of the new generation of ICs, derived from the much improved manufacturing processes, lead many to postulate that the use of COTS devices should be seriously considered. More performance and at a lower cost—a true win-win!

Of course, this weighed against the staid (tried and true) view that a certified mil spec part would offer the desired long-term reliability.

Into this dynamic situation stepped the famous Admiral Perry who effectively argued for, and essentially mandated, that government-funded programs use COTS parts. The government's rationale was lower cost with higher performance from the latest technologies and much improved reliability. So Program Offices began to call for COTS parts as the means to achieve Adm. Perry's call for “cost containment” for the ever-more costly military applications.

The move to COTS parts proved successful in many applications. Performance improved, costs dropped, and the latest technologies became mainstream. COTS parts were holding sway across the majority of procurements and saving money for the majority of programs. And where COTS were not feasible, the more costly, full mil-spec parts could rationally still be used.

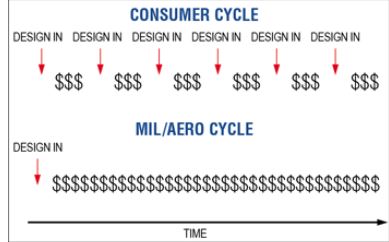

But time inexorably marched on. As new military and aerospace programs were initiated, many OEMs were anxious to utilize COTS parts. Further, some of the original COTS-based programs were extended beyond the originally planned lifetime horizon. An unintended and unanticipated problem emerged. Many of the new COTS-based systems had originally been designed with the former mil-spec parts which were expected to be available for the long term. In actuality, the COTS parts have finite lifetimes that are substantially shorter than the traditional mil-spec parts. Many OEMs discovered that a COTS part which they designed in had become obsolete long before the program into which the parts were deployed reached its end of life (Figure 1).

Figure 1. The life cycle for an IC in a consumer application is much shorter than for an IC in a mil/aero design. Over the same period of time the IC in a consumer application is expected to be revised frequently and generate revenue with each revision, while the mil/aero design generates revenue based on the long-term, original IC application.

An Unintended Consequence of Obsoleted COTS Parts

A declining supply and steady demand always creates problems. As low-priced COTS parts became obsolete, mil/aero OEMs and contract manufacturers (CMs) scrambled for any remaining parts. Sometimes they found the ICs on distributor shelves or with suppliers dedicated to obsolete parts like Rochester Electronics. Other OEMs turned to the “grey market” for parts. Actually, before COTS there was not much of an IC grey market. After the move to COTS parts, a widespread grey market developed to supply older obsolete parts to the unfortunate CMs and OEMs seeking the one critical part needed to complete a build.

Another unintended consequence of the obsolescence of COTS parts is the rise in counterfeit parts. From a recent article¹:

Over 50% of counterfeit parts are obsolete, which is a key reason for counterfeiting.

Of the counterfeit parts, 25% are analog ICs. The reasons for this are well understood: the high ASPs of the valid part; the long life of the original devices combined with their wide market appeal; and analog devices are much easier to copy than highly complex digital devices.

The IC Industry Responds

With IC obsolescence a fact of life in the modern COTS-driven world, how can IC manufacturers, their CMs, and mil/aero OEMs manage supply and demand today? There are several things that an IC supplier and mil/aero OEM can do. We will consider three possibilities.

Last-Time Buy (LTB )

When an IC manufacturer announces a LTB of designated parts, the mil/aero customer can make a final volume buy. Sometimes this is the OEM's only recourse, especially on the short term, to obtain the crucial remaining parts for an application.

There are “pros and cons” for the mil/aero OEM. On the positive side, the OEM buyer can stockpile the parts needed for the expected remainder of the program life (hopefully). Moreover, the buyer knows that these parts come directly from the manufacturer and are “the genuine article,” not counterfeit.

This is, however, an expensive and risky investment. Financial capital needs to be committed up front to procure all the available devices but there is no guarantee that they will all eventually be needed. Additionally, all the parts will have a single date code (the date on which the parts were assembled into the packages). In future years the OEM manufacturer will be using parts with date codes from the LTB date which could be years old as time progresses. Moreover, solderability and moisture intrusion/contamination will be real issues and a direct result of the care taken in storage.

The Grey Market

In some instances a mil/aero OEM cannot acquire enough needed parts in the LTB procurement, which will force them to look to the grey market. However, this is never a good idea. The risks are just too high. Nonetheless, some companies do use this option. What should they expect?

When purchasing from the grey market, a mil/aero OEM must verify part authenticity by making sure that there is an unbroken chain of possession for the parts to verify authenticity. Otherwise there is the possibility that the parts are counterfeit. This can occur even when a Certificate of Conformity (CoC) is provided. CoCs are fairly easy to copy and there have been cases where a copy of a valid CoC is used to pass off multiple lots of questionable parts.

A New Design

If the prime/CM cannot obtain genuine replacement parts, they will be forced to redesign and requalify their board. Added to this will be a delayed delivery of the finished product to the end customer.

Obsolescence Mitigation (OM)—the Maxim Alternative

Clearly none of the above three alternatives is an ideal, welcome solution. There is, however, a fourth alternative for Maxim parts. Maxim offers a special, collaborative program between Maxim's mil/aero group and the military and aerospace customer. A key point here is that Maxim still needs to be making the wafers. Clearly, this program does not work if wafer manufacturing has ceased.

The OM program supports virtually any Maxim plastic part, leaded or lead-free, in any plastic package. It includes commercial, industrial, automotive, and medical devices. It does not include military hermetic devices since they already have their own long-life initiative.

The OM process is quite straightforward. Maxim posts obsolescence notices with GIDEP (pronounced “guy-dep”) which are picked up by various material supply-chain solutions firms like ILS and published to their subscribers. When a customer identifies that a needed Maxim part on their bill of material (BOM) is going obsolete (LTB), then they must contact the Maxim mil/aero group before the part(s) are no longer manufactured. Maxim cannot initiate this interchange. Maxim's mil/aero group does not know which mil/aero customers have purchased the given LTB part because the majority of mil/aero shipments go through distribution. Instead, Maxim must rely on the customer to start the discussion about the LTB part.

The mil/aero customers work with Maxim to define both the customer's total program life in years and the expected total IC demand. Maxim calculates the total number of wafers needed to support that total demand and then increases it to anticipate yield loss, program extensions, and similar unforeseen issues.

The customer then places an order for the first year's demand, defined as the total agreed volume divided by the number of years. Once that first order is received by the factory, the wafers are set aside. While a customer is not obligated to procure a given volume in any given year after the first year, the minimum order quantity (MOQ) is 500 pieces during any subsequent year when parts are ordered. There are no storage fees and the customer may cancel at any time. Any price increases will be in line with any other future price increases for like packages and assembly flows.

The full document can be freely obtained from the downloadable PDF below

Advertisement

Learn more about Maxim Integrated