BY PATRICK MANNION

Contributing Editor

The power grid can be divided into five main areas of concern: generation, conversion, distribution, storage, and monitoring. As Hurricanes Harvey and Irma made clear, the one aspect that is often the most overlooked is the one that could help the most in times of crisis. That one is storage, and new approaches and technologies to enhance storage are emerging as renewable energy starts to offload and even proactively contribute to the grid.

From an electronics point of view, power grid storage can be viewed almost like a smoothing capacitor in a power supply: At times of extra load, the stored charge keeps the power supply steady. One of the main differences, however, is that in the case of the power grid, the “load” is able to give back to the source when it is used in combination with renewable energy sources. It is this symbiotic relationship that makes power grid storage different from power supplies or classic battery applications such as flashlights or electric vehicles. This relationship has also contributed greatly to increased development of grid storage technologies.

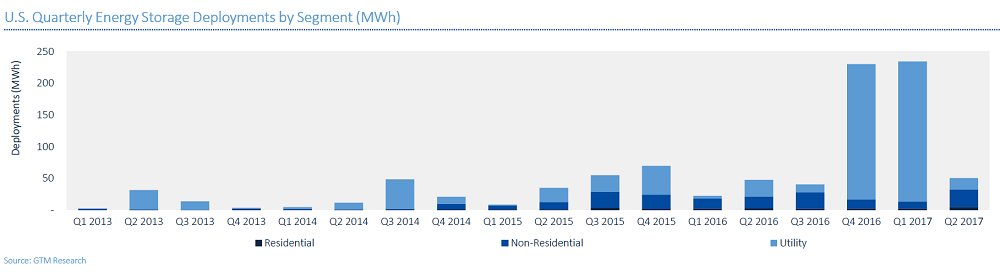

From new chemistries to refining charge/discharge profiles and closer health monitoring of the system, the emphasis on enhanced grid storage efficiency has increased along with the number of deployments. According to GTM Research, the U.S. deployed 50.4 MWh of energy storage in Q2 of 2017, up 6% year over year (Fig. 1 ).

Fig. 1: In Q2 2017, the U.S. deployed 50.4 MWh of energy storage, up 6% over the same period in 2016. Behind-the-meter deployments rose 140% quarter over quarter. Image Source: GTM Research.

Behind-the-meter deployments — that is to say, non-utility deployments such as residential and commercial — rose 140% quarter over quarter. Breaking it down further, the residential market rose 89% from Q1 2017, while the non-residential market grew 151%.

Overall, according to the study, behind-the-meter deployments accounted for 63% of deployments in MWH terms, “which results from the fact that the majority of utility-scale systems were short-duration, with a discharge duration of 30 minutes or less.”

Battery energy storage systems and renewables

The relationship between battery storage and renewable energy is tight. As energy is generated locally using solar, wind, or thermal sources, among others, that energy can be stored for use later (time shifting). Also, power that isn’t used can be sold back to the local utility. However, for data centers and businesses, having the locally stored energy is increasingly critical in case of emergencies.

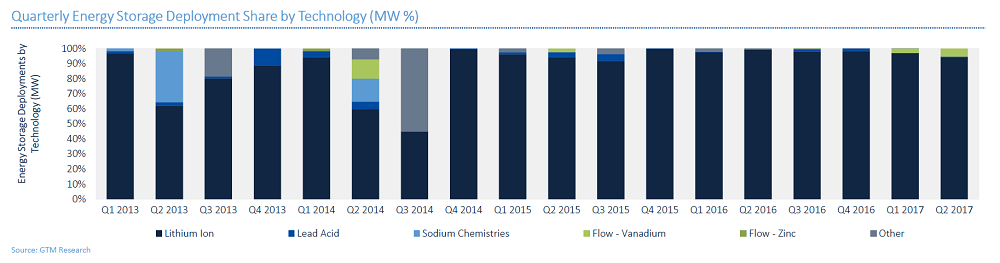

For utilities, battery energy storage serves the purpose of the power supply capacitor: It firms the power delivery, providing peak power on demand. This requires high in-rush current capability, so lead-acid (LA) batteries have been popular as they can be over-specified while keeping costs down. However, new battery technologies are catching up, so LA batteries accounted for just 0.5% of the market in Q2 2017. Also, utilities require long life and reliability, features that are lacking in LA batteries.

As a result, the most popular storage mechanism by far is lithium-ion (Li-ion). In fact, Li-ion comprised 94.2% of the market in Q2 (Fig. 2 ).

Fig. 2: Lead-acid is on the decline, and vanadium redox flow is on the rise, but lithium-ion is the clear go-to chemistry for grid-based energy storage, whether behind or in front of the meter. Image Source: GTM Research.

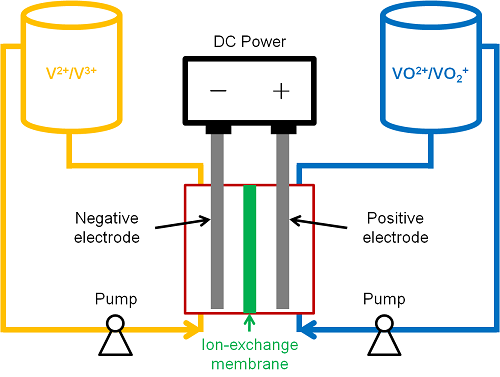

Still, new chemistries, such as vanadium redox flow (V-flow) batteries, are interesting due to their stability over long periods. Unlike traditional batteries that require an interaction of two chemicals that change state to produce electrical energy, V-flow batteries are charged and discharged by a reversible reduction-oxidation reaction between the two liquid vanadium electrolytes of the battery (Fig. 3 ).

Fig. 3: V-flow batteries are challenging Li-ion for large-scale on-site industrial deployments as they can last up to 20 years and have an almost infinite number of charge-recharge cycles. Image Source: Stanford University.

The stability, in part, derives from the fact that the electrolytes are stored in separate tanks and not in the battery itself. It’s also nontoxic, intrinsically safe, and can last 20 years or more.

The battery comprises two chambers, positive and negative, separated by an ion-exchange membrane. Using pumps, the two chambers circulate electrolytes containing the vanadium in different valence states. Energy is stored by providing electrons, and energy is released by losing electrons, all through the membrane.

UniEnergy Technologies (UET) is one of at least three companies that are commercializing V-flow technology, and it most recently announced a deployment in Hawaii, a state that gets 56% of its energy from renewable resources, including hydroelectric and geothermal. UET will deploy a 100-kW/500-kWhr version of its ReFlex energy storage system at the Natural Energy Laboratory of Hawaii (NELHA) Gateway Center in early 2018. This is part of the state’s effort to partner, share resources, and attract companies interested in testing evaluating storage systems on the island of Hawaii.

“The UET advanced vanadium ESS can provide many benefits such as improved grid stability through frequency, voltage, and reactive power control as well as dispatch capability of distributed renewable energy,” said Gary Yang, CEO of UET, adding that the technology is “long-lasting, safe, recyclable, and cost-effective.”

UET has deployed elsewhere, including a 2-MW/8-MWhr installation at the SnoPUD Everett Substation in Washington State.

Tesla accelerating Li-ion deployment for BESS

While UET emerges from startup phase to deploy V-flow at scale, Tesla is accelerating its push into BESS with Li-ion technology. Its Powerwall (residential) and Powerpack (commercial) technology are both offered as a means of providing support during power outages, or as full-scale, off-grid solutions when used with renewable energy sources. A typical 14-kWhr Powerwall battery costs $5,500, with an additional $700 for support equipment, though the inverter is built-in. The typical installation cost is $800 to $2,000.

Now on version two, the larger Powerpack system has been dropping in price as deployments increase and the technology advances. The most recent announcement by CEO Elon Musk will see a 100-MW system being deployed in South Australia. It will be used to store energy from a wind farm in Jamestown and could potentially power up to 50,000 homes. Tesla has also deployed at Mira Loma substation in California to help the local grid during peak demand.

Like other solutions for grid storage, the Powerpack can perform:

- Peak shaving, wherein the battery discharges at times of peak demand to avoid or reduce demand charges

- Load shifting, which shifts energy consumption from one point in time to another to lower energy costs

- Emergency backup (standalone or tied to a renewable energy source)

- Demand response, wherein it discharges instantly in response to signals from a demand response admin to alleviate peaks in the grid load

These capabilities can be applied to support the grid, but they require a level of real-time monitoring, communications, and control that can only come about through effective application of acquired data. This level of support is happening in the form of the much-discussed IoT, which, together with the integration of BESS and renewable technology, will make for more efficient use of current energy sources.

The enhanced capabilities, along with falling costs, will also making a stronger economic case for the increased use of alternative energy sources where applicable.

Advertisement