By Warren Miller, contributing writer

A recent report by Robert Bosch GmbH states that it will build a $1.1 billion chip-making plant specifically for devices used in self-driving cars. Though this might come as a surprise to some, it’s an indication of how important the traditional auto industry is taking the fast-growing autonomous vehicle market. This expansion into chip fabrication is also an indication of just how competitive companies like Bosch are viewing the market. The ability to differentiate autonomous vehicle device offerings seems to be important enough for Bosch to make the biggest investment in its history. What else does this say about how competition may play out in this fast-growing market?

We all know that self-driving cars are on their way; the economics just seem to be too overwhelming for them to stay away much longer. Autonomous vehicles are projected to be worth $7 trillion a year by 2050, according to a study by Strategy Analytics and Intel. If these dollar figures aren’t compelling enough, the study adds to them that over 500,000 lives could be saved between 2035 and 2045 by safer, self-driving cars. The savings that result from the improved public safety that autonomous vehicles provide could amount to over $250 billion over that same time period.

Market economics and public safety will drive the market for self-driving cars, but which companies are going to dominate this market? Based on the marketing messages you have been bombarded with, you would probably guess Google, Tesla, or maybe even Uber. These players seem to have the vision for what self-driving cars can deliver — perhaps even literally — to their customers.

Google gets a captive audience for all things Google while you are commuting to work, and it will use Google maps to find the best route. You can be sure that as you drive by the new restaurant, a coupon will pop up and offer you a lunchtime discount. Was that really the best route, or did the restaurant just win the drive-by offer to Google? The cross marketing and sales potential will be another market driver that probably wasn’t included in the Intel report.

Uber — and whoever comes after — may provide a replacement taxi service. With self-driving cars and trucks, they can also provide delivery services. The larger the network of autonomous vehicles, the more efficient they are — routes can be optimized, truck loads shared and balanced, and fuel use optimized. Economies of scale will definitely determine success in this segment.

Tesla may take a different approach — wanting to sell you the car and the associated storage and charging system. Think of Tesla as the hardware company with a standard operating system that other companies can expand on, add apps to, and target specific markets — kind of like the PC of autonomous vehicles.

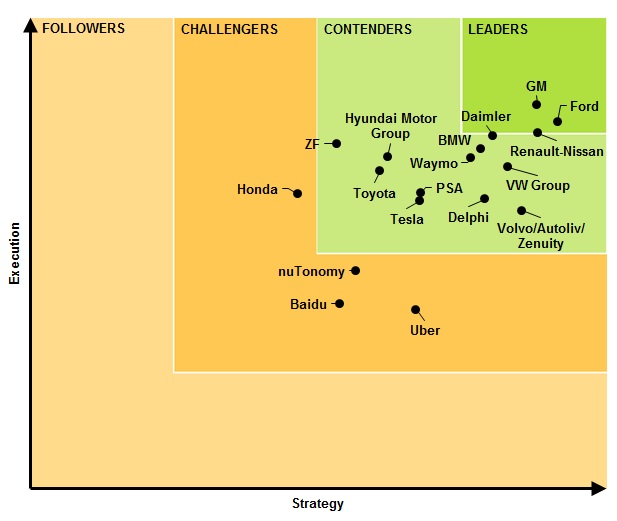

This all seems plausible — until you look at some actual data regarding who is really ahead in the autonomous vehicle race. A 2017 recent study by Navigant Research categorized autonomous driving systems based on several measures, including technology, production capability, sales, marketing, and other standard measurements of potential success. The resulting “leaderboard,” as provided below, shows that the set of leaders and close contenders is full of traditional car companies.

It’s probably not surprising that using traditional measures, the established car companies are in the lead. Production, sales, marketing, and dealers are all important, but we have seen significant examples in the past of disruptive technologies and business models that can accelerate past the entrenched establishment to take market leadership positions. Perhaps this market will be different; can big car companies really grab onto this new technology and business model and continue to stay ahead of the challengers? I’m hoping that we see an exciting race in this market, but I won’t be surprised if we see a couple of fiery crashes and forced pit stops. Once the lawyers come out onto the track, things could really get exciting.

Advertisement

Learn more about Electronic Products Magazine