BY ROGER H. GRACE,

President,

Roger Grace Associates

www.rgrace.com

Last week’s CES clearly indicated the ever-growing, mainstream role of electronics in automobiles — where several years ago there were no automakers at the event, this year there were 10, from Audi to Volkswagen. Many automakers were demonstrating their novel and advanced Infotainment and display systems as well as safety systems using radars, lasers, and cameras to enable so-called “self-driving cars.”

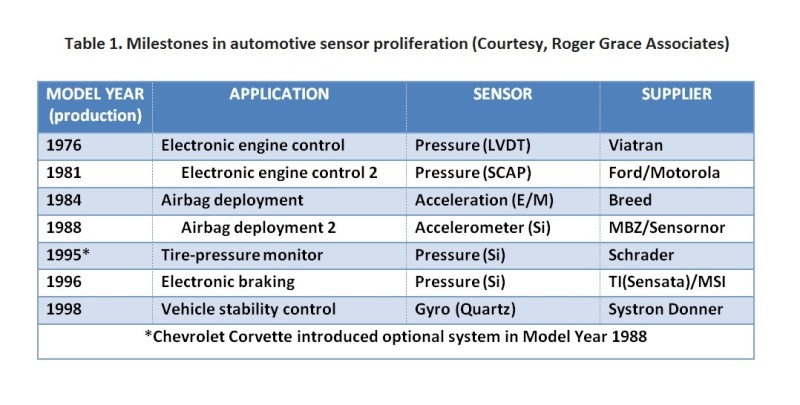

The explosion of automotive electronic systems began in earnest in the mid 70’s. The need for a cleaner burning engine mandated by the US Environmental Protection Agency (EPA) was the catalyst to the introduction of electronic engine control (EEC) using an LVDT pressure sensor. The first MEMS sensor to be introduced into automotive vehicles was in 1981 with the Ford/Motorola Silicon Capacitive Pressure Sensor (SCAP). Further US Federal regulation brought an electromechanical acceleration switch as part of the supplementary restraint system (SRS) in 1984. This device was later replaced by a MEMS-based unit in 1988 made by Sensonor (www.sensornor.com) and outfitted in a Mercedes Benz. A summary of automotive sensor milestones is provided in Table. 1.

Since their first introduction in EEC, automotive electronic sensor application opportunities have grown significantly. Several market research organizations track the auto sensor market; among the more recent reports are Gartner’s Semiconductor Forecast Database, Worldwide, 2Q14 Update by Nolan Reilly et alia , June 25, 2014, and Strategy Analytics’ Automotive Sensor Demand 2012 – 2021 by Mark Fitzgerald, Jul 08 2014. The following market data has been gleaned from these reports.

In 2013, an average of 42 sensors were installed in vehicles worldwide, with high-end vehicles (such as BMW 7XX, Audi 8, MBZ E Class) having over 100 individual sensors; an average of 47 sensors is expected by 2017. These sensors typically work with microcontrollers and embedded systems, which will grow from 30 units in 2013 to 48 units in 2017, networked via up to 20 communication buses.

As I predicted in my article in the 2002 AMAA Proceedings (bit.ly/1IE6mKX), over 70 potential applications exist for these devices today. Many of them found their initial application in high-end vehicles where extra cost is less a factor than providing performance/convenience differentiation. Steady auto sales increases, compounded by continuous introduction of new safety, convenience, and performance functions, is creating a market for automotive sensors projected at $25.5B in 2017 versus $18.38B in 2013.

Car sensors today

Today’s high-volume applications include manifold absolute pressure (MAP) sensors, airbag accelerometers, tire-pressure monitors, and yaw-rate sensors. A MAP device measures the pressure in the intake manifold and feeds the information back to a computer, whose programmed algorithm determines the optimum air/fuel mixture to minimize pollution and maximize fuel economy. The adoption of these systems was facilitated by the mandates of the US EPA. Major players in the MAP market include Bosch (www.boschautoparts.com), Delphi (www.delphi.com), Denso (www.globaldenso.com ) , Freescale (www.freescale.com/automotive) and Kavlico (www.kavlico.com).

Airbag accelerometers were introduced in 1984, also by federal mandate. Today, virtually all vehicles are equipped with at least one of these devices, the majority MEMS-based, and some vehicles use as many as 12 to also monitor for front, side, and rear crashes. Major producers of crash accelerometers include Analog Devices (www.analog.com) , Denso, Freescale, and Sensornor/Infineon (www.sensornor.com).

Tire under-inflation poses safety issues — it creates excessive tire heat and wear, increasing the likelihood of a blowout — as well decreasing fuel economy. The United States National Traffic Highway Safety Administration (NHTSA) dictated the introduction schedule for these systems starting in model year 1995 and the dominant monitoring solution is MEMS-based. Bosch, Freescale, Melexis (www.melexis.com) , Siemens (www.siemens.com) , Sensata/Schrader (www.sensata.com),Amphenol NovaSensor (www.amphenol-sensors.com), and Murata(www.muratamems.fi) aggressively compete for this application.

Yaw rate sensors, which measure the rate of rotation about a central axis, are important in determining vehicle location (used in conjunction with a Global Positioning System) or vehicle orientation as it begins to roll over or go into an uncontrolled skid. Analog Devices, Bosch, Denso, Freescale, and Murata and have introduced MEMS-based solutions for rollover, navigation, and vehicle dynamic control applications.

Future applications

Many vehicle manufacturers and first tier automotive system suppliers are working earnestly on myriad new sensor-based applications for next generation vehicles. Of major interest are sensors for alternate fuel vehicles, such as diesel, hybrid, electric, natural gas, and hydrogen.

As emission legislation becomes more demanding, diesel-powered vehicles have adopted several new systems which require specialized sensors. Noteworthy are sensors that measure in-cylinder pressure for diesel engines. Optrand (www.optrand.com) is currently in development of these robust sensors using a fiber-optic-sensing approach which survives temperatures up to 350°C and operates in the pressure range of 30,000 psi bar with an accuracy of 1%. Using a piezoresistive strain-gage technology, Sensata (www.sensata.com) , in conjunction with Beru, has developed an in-cylinder pressure sensor that is currently used in VW production vehicles.

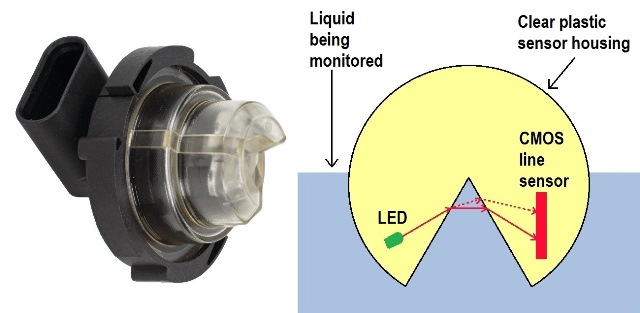

Additionally, selective catalytic reduction (SCR) systems are used in the exhaust after-treatment application. A typical SCR system has 14 sensors including 10 temperature sensors, 3 pressure sensors, and 1 urea quality sensor. The urea-quality sensor checks for the necessary urea concentration as well for the presence of unwanted liquids. TT Electronics’ (www.ttelectronics.com) solution, the AdBlue sensor (fig.1 ), provides an accuracy of ±3.0%, a measurement range of 0% to 50% (Urea in water) over a temperature range of −40°C to 60°C. Measurement Specialties (www.meas-spec.com) and SUN–A Corp. (www.sun-awks.co.jp) also provide these devices.

Fig. 1: To monitor the Urea concentration in selective catalytic reduction (SCR) systems, TT Electronics' AdBlue sensor uses optical techniques; the angle at which light from an LED is deflected depends on the chemical content of the liquid filling its prism.

Hydrogen-fuel-cell-powered vehicles are beginning to enter the market; in California, Hyundai and Toyota will offer fuel-cell-powered vehicles with 250 to 300-mile driving ranges by mid-2015. A key component of fuel cell vehicle systems is tank-pressure monitoring. American Sensor Technology (www.ast.com) is one company that provides an extreme-environment pressure sensor that uses piezoresistive strain-gauge technology, and are available in a 300 psi format for the low side and 3,000 psi for the high side of the Hydrogen fuel tank systems. Theses sensors are able to withstand the corrosive nature of the Hydrogen media at temperatures to 145°C and have ± 1.0 % accuracy. These sensors are currently installed on large transport vehicles and in beta test in a European Mercedes Benz rental fleet.

System integration by packaging

Recently, Amphenol NovaSensor in conjunction with Cooper Standard (www.cooperstandard.com) introduced their “Quick Connect” product, which integrates a pressure sensor into a connector. The piezoresistive pressure sensor operates at 150 psi and is used in a fuel rail application. It is an example, I believe, of a major trend in automotive sensor technology: functional integration. Since packaging typically accounts for about 75% of automotive-sensor costs, what better way to reduce cost than to integrate the sensor into the connector?

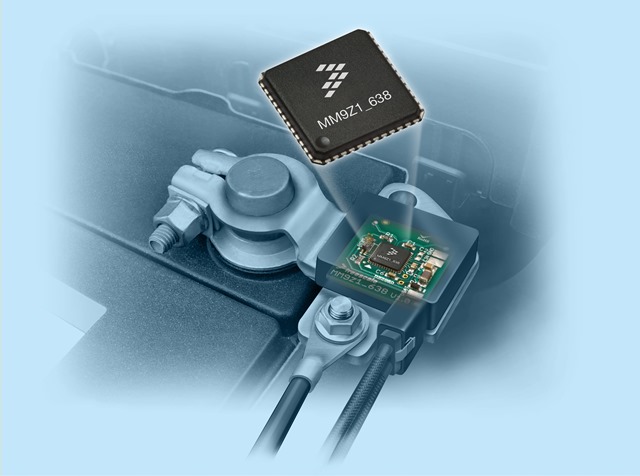

In 2014, Freescale (www.freescale.com) introduced a smart battery-monitoring sensor, the MM912_637, compatible with 12-V Lead and 14-V Lithium-ion batteries. It determines the battery’s state of charge, state of health, and state of function by measuring the battery current, voltage, and temperature and feeding the data to a microcontroller with embedded battery performance algorithms. It provides early warning of unusual battery discharge and wear-out (fig. 2 ).

Fig. 2: Shown inside a battery-cable connector, Freescale’s MM912_637 battery-monitoring sensor measures battery current, voltage, and temperature. Using a microprocessor with embedded application algorithms, it provides early warning of battery discharge and wear-out.

Autonomous and entertaining

Another of the more interesting and exciting future applications is sensors for autonomous vehicles. A broad spectrum of sensors for long-range applications of up to 250 meters for adaptive cruise/emergency-breaking control use microwave radar operating at 75 and 46 GHz. For shorter ranges, sensors for lane changing/blind spot sensors (24 GHz radar and cameras) and parking assist (ultrasonic and camera) are in the system designers’ portfolio to increase vehicle safety.

Daimler’s Mercedes-Benz F015 concept car was revealed at CES 2015. It was self-driving with touchscreen walls and seats that rotate to create a “cocoon on wheels.” USA Today reported that Audi “stuffed a few journalists into a Q7 loaded with what it called ‘piloted driving’ gear and they made the 500 mile trip from Silicon Valley to Las Vegas in time for the show with minimal driver intrusions.”

Many of the systems demonstrated in the previously mentioned CES 2015 have adopted gesture recognition to control functions, providing Infotainment systems in vehicles to enhance safety and convenience of use. In a manner similar to in-home or mobile phone applications, automakers are adopting systems that use accelerometers, ultrasonic, IR, and other sensor technologies to control the various functions of a vehicle.

In looking at these current and future automotive electronics, Sven Beiker, Executive Director of Stanford’s Center for Automotive Research (www.cars.stanford.edu) made this astute observation: “The automobile is already an incredibly connected piece of technology; however it is only talking to itself. Modern times’ automobiles may consist of well over 100 sensors and up to 100 microcontrollers that are networked with one another via up to 20 communication busses, but the thing is that automobiles are not talking to one another.

“If you want, you might say the car is a pretty smart but introverted thing. The next step will be to make them more extroverted, that is, share their smartness with other vehicles and a centralized infrastructure. So we need to teach cars to be more social through vehicle-to-vehicle and vehicle-to-infrastructure communication.”

Indeed, the near future seems to offer some very enjoyable, safe, and exciting driving for all of us.

About the author

Roger H. Grace ()is president of Roger Grace Associates, a Naples Florida–based strategic marketing consulting firm specializing in high technology, which he founded in 1982. His background includes over 45 years in high-frequency analog circuit design, application engineering, project management, product marketing, and technology consulting. a pioneer in the field of MEMS, Mr. Grace has specialized in sensors and ICs for over 35 years, and his clients include the international “Who’s Who” of corporations, federal labs, and government agencies. He received his BSEE and MSEE (as a Raytheon Fellow) from Northeastern University and was its Engineering Alumni of the Year in 2004.

Advertisement

Learn more about Roger Grace Associates