Austin, Texas (May 30, 2013) – The market for smart grid sensors in North America is expected to grow dramatically during the next two years, according to a new study published by IMS Research, now part of IHS Inc. (NYSE: IHS).

The report, entitled “The North American Market for Smart Grid Sensors – 2013,” shows a major change is occurring in the feeder line sensing market in North America, with emerging technologies being offered from a series of new entrants to the market.

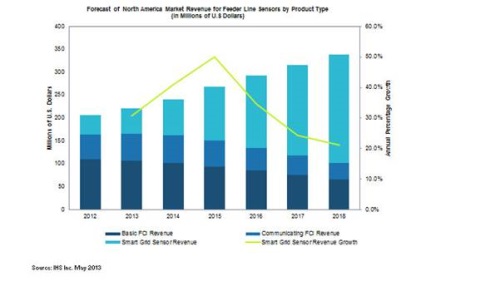

By 2014, IHS predicts that the smart grid sensors market will more than double in size from estimated 2012 levels, with annual revenue topping $100 million for the first time in 2015.

The report, entitled “The North American Market for Smart Grid Sensors – 2013,” shows a major change is occurring in the feeder line sensing market in North America, with emerging technologies being offered from a series of new entrants to the market.

By 2014, IHS predicts that the smart grid sensors market will more than double in size from estimated 2012 levels, with annual revenue topping $100 million for the first time in 2015.

“The market for feeder line sensors is undergoing radical change now,” said Michael Markides, associate director of the Smart Utility Infrastructure Group at IHS. “Older devices are being replaced by next-generation technologies that are offered by new market entrants. There are numerous takeaways from this, including the continued growth in distribution-level electronic devices, the continued push toward decentralizing grid intelligence and automation, as well as showing the evolving habits and behaviors of utilities in North America as they adopt new technology from a set of new vendors.”

Currently, market growth for smart grid sensors is coming from the replacement of older-style fault circuit indicators (FCIs). These older devices have been sold for decades to utility companies, which have been installing them on vulnerable overhead lines. But new technology, which is rapidly meeting the existing price point of the older technology, is swiftly gaining market share.

“This year is a transitional time for the feeder line sensor market,” Markides observed. “New suppliers are taking share away from traditional sensor suppliers, through product offerings which are future-proofed, easily upgradeable, and more dependable and accurate at detecting faults on overhead lines than legacy FCIs.”

While the short-term forecast shows dramatic growth for the new generation of smart grid sensors, long-term market growth is expected to be buoyed by the implementation of Volt/VAR Optimization (VVO) schemes across North America. Utilities are currently implementing varying levels of VVO in North America, even though significant market growth of VVO equipment (including sensors) is not expected until 2015.

“The emergence of better fault-detection technology, the unbundling of ‘siloed’ utility organizations and budgets, and the expected surge in VVO installations are all converging together to create a significantly strong market forecast over the next five years for smart grid sensors,” Markides commented. “By 2018, IHS expects smart grid sensors to have grown to well over $200 million in revenue annually.”

“The North American Market for Smart Grid Sensors – 2013” is a continuing part of IMS Research’s comprehensive smart grid portfolio. The portfolio includes dedicated studies on utility metering, grid sensors, and distribution automation, which the firm has been studying for more than 15 years. The report includes tables on product types, communications, applications and market share, along with in-depth analysis and explanation.

Advertisement

Learn more about IHS iSuppli