By Patrick Mannion, contributing editor

Apple CEO, Tim Cook, said it best: Autonomous vehicles are the “mother of all AI projects.”1 Despite the technical challenges, or maybe because of them, semi-autonomous and autonomous vehicles are on the march across Asia, Europe, and then the U.S.

Tell that to engineers immersed in current automotive or mission-critical hardware/software development, and they scoff. Tell it to sci-fi buffs and enthusiasts, and they say it’s just a matter of when and how. Tell it to a friend or family member, and they say, “No thanks.”

The skepticism of engineers and consumers is well-founded, given the matrix of problems associated with implementing semi-automated vehicles, from real-time object detection and recognition to communication and security. Add in news reports of failures, and it’s hard to convince users of their benefits.

However, the sheer magnitude of the challenge is also its attraction, as is the possibility of saving lives once the problems are worked out. There’s also the attraction of the monetary rewards to be made by solving the matrix of technical challenges, as well as opening up new ways of thinking of automobiles — as sources of data and a conveyor of new services — instead of simply seeing them as a mode of transportation.

Opportunity spurring accelerating activity

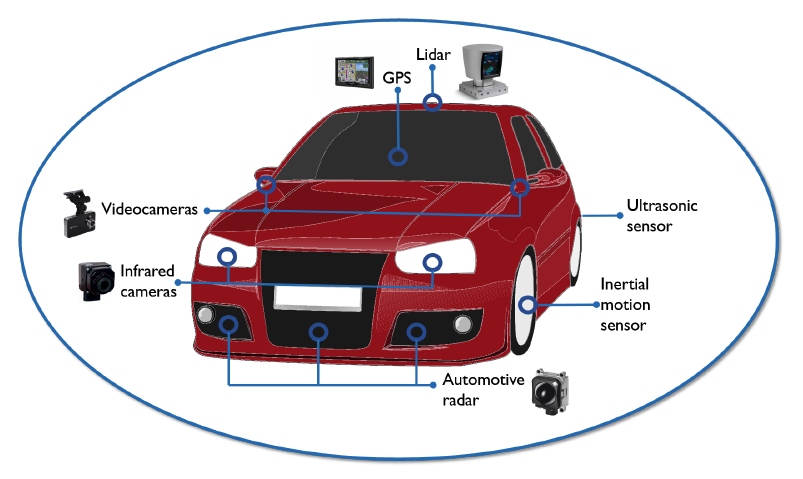

According to research firm MarketsandMarkets, semi-autonomous vehicle shipments will increase from 3.17 million units in 2016 to 7.84 million by 2021. The number of autonomous vehicles will rise from 0.18 million in 2025, reaching 1.01 million by 2030. For the purposes of the report, the firm segments semi-autonomous as having adaptive cruise control, lane keep assist, intelligent park assist, adaptive front lighting, blind-spot detection, and emergency brake assist, among other features. Under autonomous, it includes radar, LiDAR, ultrasonic, cameras, engine control units, fusion sensors, steering assist, control processing units, and ranging, to name a few (Fig. 1 ). Geographically, Asia-Pacific will dominate in semi-autonomous, followed by Europe and the U.S., according to the report. Fig. 1: Vehicles will get smart as soon as designers and developers get even smarter about how to integrate all sensing options.Image: University of Texas, Austin.

Fig. 1: Vehicles will get smart as soon as designers and developers get even smarter about how to integrate all sensing options.Image: University of Texas, Austin.

A report by McKinsey points to a move away from direct car ownership to car sharing, or using the best mode of transport for the task at hand, on demand: “In the U.S., for example, the share of young people (16 to 24 years) that hold a driver’s license dropped from 76% in 2000 to 71% in 2013, while the number of car-sharing members in North America and Germany has grown by more than 30% annually over the last five years.”

The combination of changing user patterns, the preference for using mobile devices versus driving, and the growth of autonomous features has sparked a flurry of activity in the smart-vehicle arena. Google’s Waymo, the current leader in self-driving technology, has partnered with Lyft while it does battle with Lyft’s direct competitor, Uber, which it accuses of illegally acquiring technological secrets. At the same time, Lyft has a partnership with GM to start deploying thousands of self-driving electric cars in 2018. Along the same vein, Waymo has partnered with Avis to have Avis take care of its fleet of autonomous vehicles. Apple has done likewise with Hertz as it plans its own autonomous vehicle moves.

These moves are in parallel with those of almost every automotive company — including BMW, Audi, Chrysler, Mercedes-Benz, and Ford — that is rapidly expanding the role of technology, to the point that the way forward for growth for the automobile industry may be the addition of services on top of the transportation function.

Ford has already pointed in this direction with the recent hiring of Jim Hackett as its CEO. Hackett was leading the Ford Smart Mobility LLC group, exploring ways to add value to the “smart mobility experience.”

For companies like Ford, the opportunity lies not just in selling cars, but also in acquiring data about, and selling services to, the vehicle occupants. The vehicle itself becomes simply a conduit for those services. This echoes recent statements by Intel’s Brian Krzanich, who flat out said that it’s all about the data and its analysis. “Data is the new oil,” he said.

The types of data vary: There’s data that’s worth mining on the user and their driving habits, location, and physical and mental states. There’s also data from the vehicle to other vehicles (V2V) and to infrastructure (V2I) as part of the emerging applications for advanced driver assistance systems.

How that data is to be secured and used is an issue for security and privacy experts. How that data is acquired and communicated is where designers of automotive systems come in, along with the components that go into those systems.

Object detection and ranging options

For autonomous vehicle object detection and ranging, it seemed that LiDAR was the way forward, with Velodyne leading with its familiar “coffee-can”-style instruments since 2005. LiDAR’s advantages over radar include the ability to grab a high-resolution 3D map of the surrounding area, but it has to deal with ambient light variations, including those caused by fog. Radar has the advantage of being RF-based, so it can see objects, regardless of ambient lighting, and it can also see “around” objects using radio reflections.

While Velodyne initially seemed to own the LiDAR space, the introduction of smaller, low-cost solid-state and micro-electromechanical systems (MEMS) LiDAR in the $250 range in late 2016 has changed the calculus. A good example of the new device is the S3 from Quanergy. Now a full 360° view around a vehicle can be generated using four $250 solid-state LiDAR devices, one placed at each corner of the vehicle, for a total cost of $1,000. This compares favorably to the $70,000 to $85,000 for a classic Velodyne system, with its awkward mechanical rotating can.

However, Quanergy is not alone, with many startups offering other relatively low-cost LiDAR options. Innoviz, out of Israel, has promised $100 solid-state LiDAR by the end of 2018.

To compare solutions, designers need to look at field of view (FoV) in the vertical and horizontal direction, range for a given reflectivity, and resolution. The latter two are inversely related: The longer the range, the harder it is to achieve a given resolution.

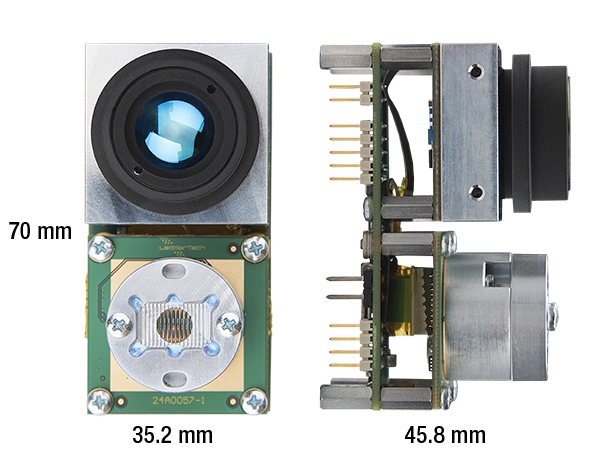

For Quanergy’s S3, the FoV is 120° both horizontally and vertically. It has a range of 150 m at 8% reflectivity, and at 100 m, its accuracy is ±5 cm. The sensor measures 9 x 6 x 6 cm. Innoviz’s initial product, the InnovizOne, measures 5 x 5 x 5 cm, has a range of 200 m, an FoV of 100° horizontal and 25° vertical, and a depth accuracy of 2 cm (Fig. 2 ). Fig. 2: The InnovizOne is a solid-state LiDAR product for vehicles that can detect at distances up to 200 m, with a depth accuracy of

Fig. 2: The InnovizOne is a solid-state LiDAR product for vehicles that can detect at distances up to 200 m, with a depth accuracy of

While Velodyne initially eschewed solid-state technology, it has since come up with its own version of a solid-state LiDAR. The Velarray sensor measures 125 x 50 x 55 mm and can be embedded into the front, corners, and sides of vehicles for autonomous or ADAS-enabled vehicles. The Velarray uses Velodyne’s own ASIC design and features a horizontal and vertical FoV resolution of 120° and 35°, respectively, with a range of 200 m. It quotes price as being “in the hundreds of dollars.”

There are other LiDAR options for designers, too. For example, LeddarTech has broken down the ranging problem and focused on the algorithms, which it has implemented in a proprietary LeddarCore IC, though it also offers a full system (Fig. 3 ). Fig. 3: LeddarTech has packaged its proprietary LiDAR ranging and detection technology into an IC around which designers can add their own light source, optics, and detectors. Image: Leddartech.

Fig. 3: LeddarTech has packaged its proprietary LiDAR ranging and detection technology into an IC around which designers can add their own light source, optics, and detectors. Image: Leddartech.

Designers can take the IC and develop their own custom-value add for specific applications by adding a light source, optics, and detector.

While LiDAR is dropping quickly in cost, making semi-autonomous and autonomous vehicles more cost-effective, radar is also making headway, particularly with respect to the size and performance characteristics now achievable as it moves into the millimeter-wave bands in the 7x-GHz range (see Sensors and transducers go wireless and get smarter). This makes for smaller devices, and the wider bandwidth allows for finer resolution.

The improvements in both LiDAR and radar do not mean that one will win at the expense of the other. Instead, the goal now is to use both, along with cameras and other available sensing technologies, to have a more comprehensive and optimized solution for maximum safety and performance at optimum cost.

That said, the optimum smart-vehicle design doesn’t operate in a vacuum.

Communication makes vehicles smarter

Though the on-board sensing and safety mechanisms in a smart vehicle are extensive, all smart vehicles must be able to communicate with and incorporate input from their surroundings. This includes V2V, V2I — such as traffic lights, emergency services, and location-based services — or both (V2X). The challenges here are many, but chief among them is latency. The advantages of getting it right, along with safety, include better traffic flow, leading to lower fuel consumption.

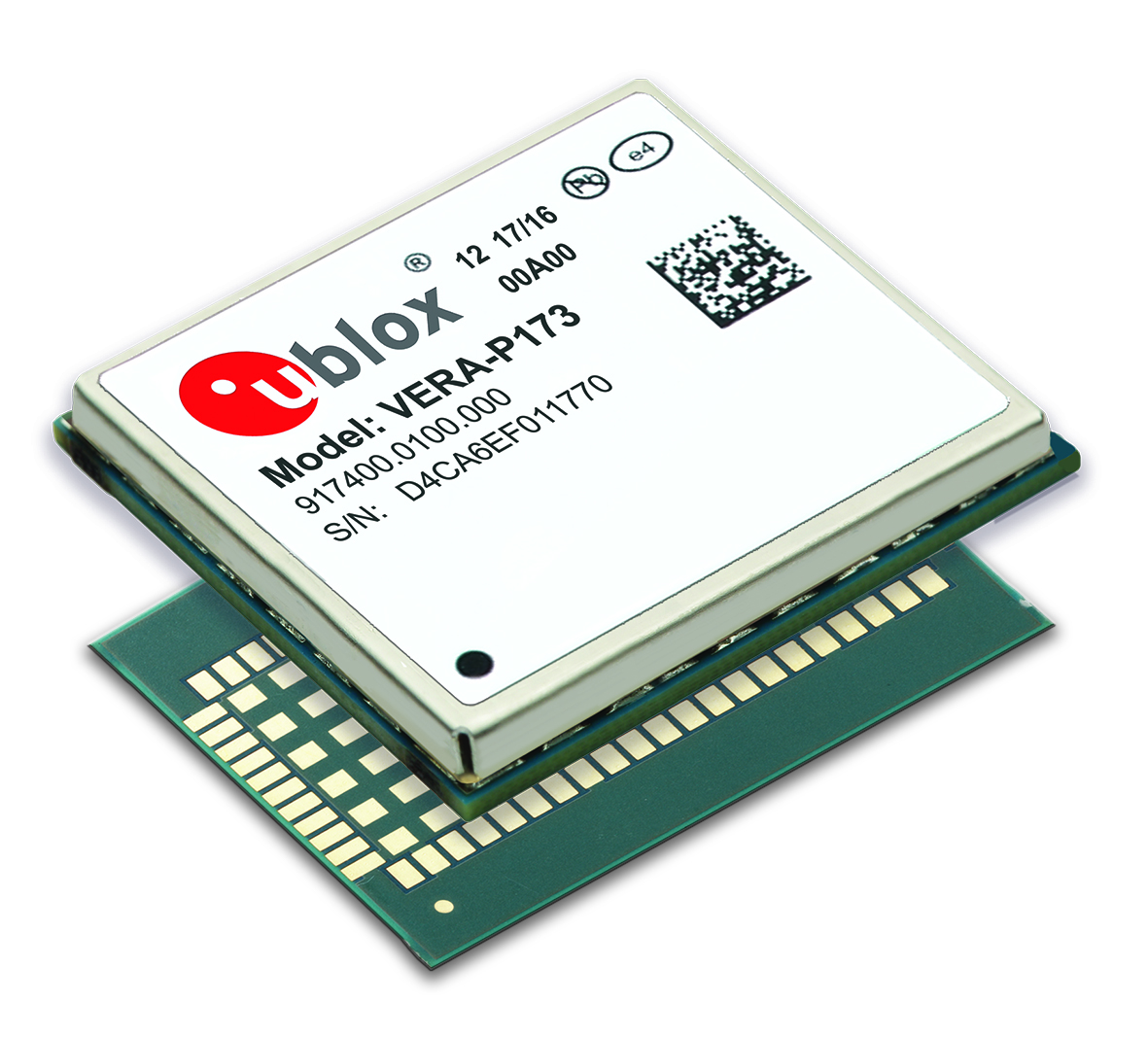

The underlying communications interface for V2X is IEEE 802.11p, which is a variant of Wi-Fi for wireless access in vehicular environments (WAVE) in the 5.9-GHz band. It is optimized for fast response times (low latency) in the tens-of-milliseconds range, as well as longer range. Fig. 4: The VERA-P173 from u-blox provides V2X communications for smart vehicles using IEEE 802.11p, a variant of Wi-Fi for WAVE.Image: u-blox.

Fig. 4: The VERA-P173 from u-blox provides V2X communications for smart vehicles using IEEE 802.11p, a variant of Wi-Fi for WAVE.Image: u-blox.

To design for V2X, the options are to either design from scratch or to opt for a module. The latter saves time and cost with respect to design and meeting regulatory compliance. A good option is the VERA-P1 series from u-blox. It measures 24.8 x 29.6 x 4.0 mm and is compliant with WAVE and ETSI ITS G5 for the U.S. and Europe. It has a range of more than 1 km (line of sight), with a receive sensitivity of –97 dBm and an output power of –10 to 23 dBm. It operates over the temperature range of –40°C to 95°C.

Reference:

1: Bloomberg Technology, “Tim Cook Says Apple Focused on Autonomous Systems in Cars Push”

Advertisement