By Junko Yoshida, Chief International Correspondent, EE Times

In recent memory, no topic has generated as much interest and enthusiasm among investors, entrepreneurs, and engineers as highly automated vehicles (AVs). Seemingly almost everyone in the high-tech industry wants to climb onto the self-driven bandwagon — including robotic scientists, AI specialists, chip designers, and sensor developers.

Equally significant, the promise of AVs has energized traditional automakers around the world.

Yukihiro Kato, senior executive director at Denso Corporation, noted in his keynote speech at the International Solid-State Circuits Conference (ISSCC) this year that the automotive industry is experiencing a “once-in-a-century transformation” — driven by advancements in connected, efficient, and automated driving.

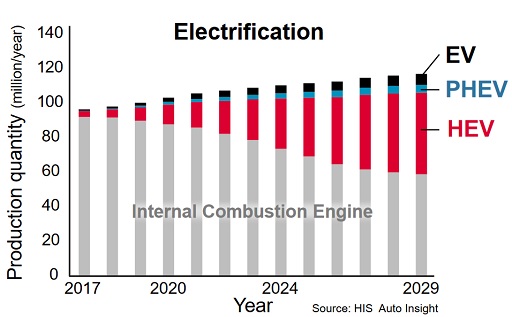

Notwithstanding the high interest, the progress of EV has not matched the predictions made several years ago. The number of pure-electric and plug-in hybrid cars represented barely 1% of the 17 million cars and light trucks sold in the United States last year. Meanwhile, the promise of automated driving — billed as “a lot safer than human driving” — is facing intense scrutiny after a fatality caused by a self-driving Uber in Tempe, Arizona.

Slow progress due to the charging infrastructure and battery concerns for EVs. Image source: IHS Automotive.

Although it can be easy to dismiss the promise of EVs and AVs as marketing hype, few in the tech, auto, and semiconductor industries can afford to sit on the sideline as a wave of AV innovations unfolds before their eyes. A revolution is happening in big data, deep learning, AI processing on the edge, and perception technologies enabled by advanced sensors. Similarly, on the EV front, companies like Infineon, Wolfspeed, and Rohm are among many who see a pot of gold in the promise of wide-bandgap (WBG) semiconductor technologies. They believe that it will help downsize automotive inverters by increasing power density.

Where EVs and AVs meet

EVs, AVs, and connected cars aren’t being developed in silos. Tier-one OEMs are integrating the best of today’s technology innovations by developing electric cars infused with automated driving and connectivity.

The EV’s foremost virtue is a lot fewer moving parts. Its three major components are the battery, inverter, and electric motor. By contrast, an internal combustion engine contains thousands of tiny pieces that must be maintained. From an engineering point of view, the EV matches AV technology perfectly because an AV needs more electrical brainpower to manage vision, sensor fusion, mapping, and path-planning functions while processing an ever-growing volume of software.

Electrification marks a radical transition — from mechanically driven cars to software-driven vehicles — for the auto industry. It opens the door for designers to develop apps that make EVs run more efficiently, for example.

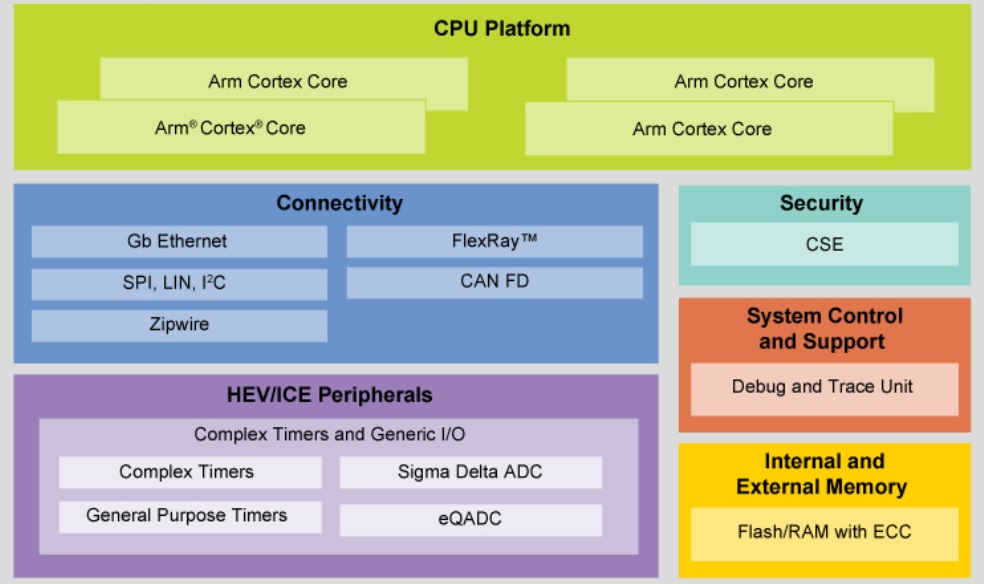

NXP Semiconductors launched earlier this year what it calls “Greenbox,” a platform for car OEMs to develop new hybrid and EV apps.

GreenBox supports the development of HEV and motor control applications. Image source: NXP Semiconductors.

Ray Cornyn, vice president and general manager for NXP’s vehicle dynamics and safety product line, said that designers can use Greenbox to create applications that boost overall energy efficiency in route-planning. One example is an HEV facing a long uphill grade. Cornyn noted that a piece of software using specific route knowledge — obtained by the AV — can enhance the HEV’s battery management up the hill.

Rapid AV advancement

Fueling investment and progress in AV development are new entrants in the field, especially tech companies like Waymo.

Egil Juliussen, director of research for infotainment and advanced driver assistance systems (ADAS) for automotive at IHS Markit, said, “Waymo has been quietly taking the lead [in the driverless market]. They are ahead of everyone else on the field.”

In a safety report published last year, Waymo explained its self-driving software and hardware and how it tests vehicles. Citing the report, Juliussen noted that Waymo’s difference from competing robocars is “designing their own sensor systems from the software point of view.”

After eight years of work on driving software, Waymo has learned to “see what’s around the car far better than others.” Waymo’s ability to tightly couple software mimics the Apple approach, observed Juliussen. This is something that traditional carmakers, who lack software prowess of their own, have difficulty replicating.

In the United States, the AV is not a question of if or even when. The first domino toppled in January, when the state of Arizona granted Waymo a permit to operate as a transportation network company. Early in February, Waymo confirmed its plan to start charging customers for robo-taxi rides in 2018.

After the Uber accident in Arizona in March, Uber, Toyota, Volvo, and Nvidia all announced temporary test-drive suspensions for their vehicles on public roads. But Waymo and GM appear to be moving forward.

Toyota’s e-Palette

Among all car OEMs, Toyota, one of the most conservative Japanese car companies, made the best argument earlier this year at the Consumer Electronics Show for why society needs highly automated vehicles.

Rather than getting stuck in the perennial argument over who gets to drive the car (machine or person), Toyota steered its AV vision along a different road. Their idea is “e-Palette,” an automated vehicle for on-demand shopping and distribution, on-demand food trucks, and hospital shuttles — a veritable on-demand city.

Toyota’s e-Palette demo at CES 2018. Photo: EE Times.

Of course, Toyota Motors CEO Akio Toyoda isn’t alone in defining his company’s challenge as changing from car-making to mobile service. By partnering with Amazon, DiDi, Uber, Pizza Hut, and Mazda, Toyota at least advanced the idea that AVs and EVs aren’t just robo-taxis: They can create a “mobility platform” open to other developers.

Baidu factor

In the global world of EVs and AVs, China is emerging as a big factor. Many analysts believe that Baidu, styling itself as “the Google of China,” could put a dent on the market. The company has shown an ability to harvest big data in China. Its commitment to Apollo, an open platform for highly automated vehicles, reinforces its case.

Built on the success of the original Apollo platform announced last July, Baidu has been moving to update the application. Apollo 2.0 will unite all four of the Apollo platform’s modules — cloud services, software, reference hardware, and vehicle platforms. Baidu claims that Apollo — based on Baidu’s Duer OS — can now autonomously guide a vehicle through basic urban environments, even at night.

Baidu has amassed more than 90 partners, including support from chip vendors of computing platforms such as Nvidia, Intel, NXP, and Renesas. The Apollo platform is designed to lower the bar for car OEMs. Reportedly, 200 car OEMs are in China today. Apollo would enable them to enter the AV market, much as Google’s Android created a huge community of non-Apple smartphone vendors in China.

“We have big data, we provide an open development platform, and we [China] have volume-production capabilities,” said Qi Lu, Baidu’s vice chairman, at the Consumer Electronics Show. More importantly, he said that China provides “a policy friendly to AV [development and testing]” and that, to discourage a wave of fledgling Chinese car OEMs fragmenting AV development, the Beijing government has officially endorsed Apollo, said Lu.

Baidu released “Apollo Scape” in March, billed as the largest open-source training dataset for autonomous vehicle perception, to advance the company’s big data business and promote collaboration with tech and automakers in the West. Apollo is also joining an Industry Consortium, the Berkeley DeepDrive, an alliance of a group of companies, including Ford, GM, and Nvidia, that are investigating technologies in computer vision and machine learning for automotive applications. This consortium will have access to the Apollo Scape dataset.

Phil Magney, founder and principal at VSI Labs, described this dataset as “a tremendous benefit to any company or entity that is developing a camera-based AI-perception system.”

He explained, “Not only is the dataset gigantic, but it is also very diverse, containing images and labels from many complex environments, weather, and traffic conditions. Of course, the larger and more diverse the dataset is, the more capable/useful it is to train a very capable AI perception system.” He added, “Furthermore, this dataset not only has labeled objects, it has pixel-by-pixel semantic segmentation, which means that each individual pixel has a class label. This is much more useful for training perception systems but is also much more laborious/time-consuming to create.”

Obviously, Baidu has invested lots of time and money into this dataset. So why give it away for free? “We believe Baidu is putting massive investments into enabling every company to develop self-driving,” said Magney. “This is because Baidu believes the more adoption of self-driving means there is more money to be made from licensing the Baidu mapping and localization assets among other things.”

AV processor battle

The hottest story among chip companies is the question of who will rule the AV processing platform. Just as Intel dominated the PC platform and Qualcomm rules the mobile front, every chip company sees fresh opportunity in the nascent AV processor market.

Thus far, Intel (Mobileye) and Nvidia are dominant AV platform vendors. Intel has its Go automated driving platform, consisting of Mobileye-designed EyeQ5 for vision, another EyeQ5 for fusion and planning (the chip will take sensory data from radars and lidars), Intel’s low-power Atom SoC for trajectory validation and issuance, and other hardware including I/O and Ethernet connectivity.

Nvidia is pushing its Drive platform, combining deep learning, sensor fusion, and surround vision. One of the SoCs that Nvidia developed for Drive is Xavier, a complete system-on-chip. It integrates a GPU architecture called Volta, a custom 8-core CPU architecture, and a new computer-vision accelerator.

Meanwhile, Renesas Electronics disclosed earlier this year that it is “ready to intersect” with the demand for highly automated vehicles in volume by rolling out its next-generation R-CAR SoC. Although the Japanese company will not start sampling until 2019, the new SoC, the company claimed, will “double deep-learning performance efficiency compared to Intel/Mobileye’s upcoming EyeQ5 SoC.” According to Intel, it will provide 24 TOPS at 10 W.

Competitors in the AV processor race, however, aren’t limited to incumbents. Startups have been springing up, all claiming breakthroughs in the realm of deep-learning processors.

ThinCI (pronounced “Think-Eye”), for example, unveiled last year at Hot Chips details of its high-performance processor, Graph Streaming Processor (GSP), billed as a “next-generation computing architecture.” Asked to distinguish GSP from GPUs and DSPs, ThinCI cited GSP’s abilities in direct-graph processing, on-chip task-graph management and execution, and task parallelism. “We believe our GSP can beat the computing engine in any of those processors,” said Dinakar Munagala, ThinCI’s CEO.

Denso, a large Japanese tier-one OEM and a key investor in ThinCI, revealed last year the launch of a new subsidiary to design and develop semiconductor IP cores for key components in automated driving. The architecture of a new chip is being jointly developed with ThinCI, announced Denso. Denso calls it a data flow processor (DFP) and said that it is “very different from CPUs or GPUs.”

EVs’ future

It’s no overstatement that both public and private institutions around the world are eager to accelerate the evolution of WBG tech into commercial power electronics applications. Many believe that the future of EVs rides on WBG.

Why? Because WBG materials such as silicon carbide (SiC) and gallium nitride (GaN) can greatly improve power-conversion efficiency.

Wider bandgaps allow WBG materials to withstand far higher voltages and temperatures than silicon. This promises greater durability and reliability at higher voltages and frequencies, enabling higher performance for less energy.

Advantages in applying WBG technology in an EV are clear. Increasing energy efficiency reduces the cost of battery packs, shortens charging times, and improves driving range.

The automotive industry already includes EV manufacturers who are early adopters of SiC-based inverters. “We strongly suspect that Tesla is using SiC-based inverters in some of their Model 3 vehicles, for example. Several announcements in Japan including Toyota have been done regarding SiC-based inverters for EVs by 2020 even though it might be for small-volume production,” said Hong Lin, technology and market analyst at Yole Développement. “The market has started; we might now enter the hockey-stick adoption rate.”

On the other hand, SiC adoption in EVs’ powertrain appears to have a long way to go. Yole listed four major hurdles for SiC adoption as “cost, reliability, integration, and supply chain.”

The biggest challenge lies in economy of scale and SiC wafer price. To respond to automotive’s main requirements (cost and reliability), ”high-quality 6-inch SiC wafers are mandatory,” said Mattin Grao, Technology & Market Analyst at Yole. “Only a few suppliers, such as CREE, SiCrystal, and II-VI, are available to offer these substrate sizes and quality. This has caused a shortage in 2017.”

More importantly, “As SiC devices will always be more expensive compared to a silicon device, the carmakers need to get the value out of the system,” Grao pointed out. Automakers need to understand their ROI, determining whether they can absorb the price difference for SiC devices.

There are some hopeful signs, especially for potentially improving the SiC supply chain.

Infineon and Cree, for example, recently agreed on a long-term agreement for the provision of SiC wafers. Yole sees Infineon securing with Cree a 6-inch SiC wafer supply as critical. “Getting access to high-quality SiC substrates is definitely key in this industry,” said Grao.

Yole, however, cautioned that not every automotive OEM, at this point, is sold on SiC over silicon. “Not all OEMs have been able to prove SiC performance in their demonstrators,” said Grao.

Until more carmakers — beyond Toyota, Tesla, and BYD — are convinced to include SiC technology in a next-generation product line, its market will remain unpredictable.

Advertisement

Learn more about Electronic Products Magazine