Lyon, France – November 13, 2013: Yole Développement announces its “Diamond Materials for Semiconductor Applications” report. Yole Développement’s report provides a complete analysis of the different diamonds materials including their characteristics, equipment and manufacturing processes, applications in semiconductor devices, main players. Also, this report is to guide short- and mid-term strategic decisions in the business, which is relatively small today, but has huge long-term market potential.

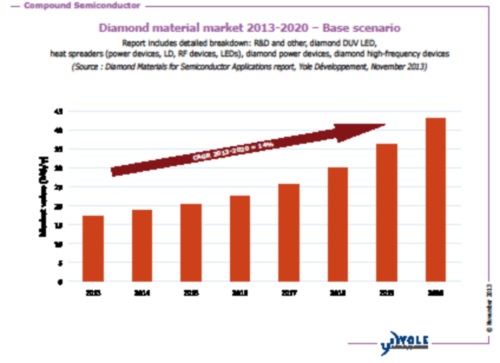

$43M diamond material market in 2020 will be driven mainly by passive devices

Diamond materials have been in development for more than 50 years. Besides the traditional tooling applications (drilling, cutting…), the interest in diamond continues to grow for optical and thermal applications, and for new applications in semiconductor devices such as high-power devices and high-frequency devices able to work at elevated temperatures.

In fact, diamond’s unique physical and electrical properties, which include: the highest known thermal conductivity, a wide band gap, excellent electrical insulator properties, very high breakdown voltage and very high carrier mobility, make diamond an excellent candidate for electronic devices with ultimate performance.

However, the costs of diamond, as well as the remaining technology barriers limit the diamond material market to only a few applications and some high-end devices.

The diamond applications in electronic devices, such as high-voltage power electronics, high frequency high-power devices, and high-power optoelectronic devices (laser diodes, LEDs), are the scope of the report.

Both passive (heat spreaders) and active (diodes, transistors) diamond solutions are considered in the market quantification.

Despite the high costs of high-quality materials, a large number of players are involved in the 2013 diamond materials market and its largest segment – R&D activities. Two scenarios for 2013-2020 diamond material market growth are presented in the report. “According to the base scenario, the diamond materials market for semiconductor devices will surpass $43M and will be represented mainly by heat spreaders used in high-power device thermal management,” explains Milan Rosina, Market & Technology Analyst, Compound Semiconductors, at Yole Développement.

Access to high-quality diamond material is key for diamond device development

Electronic applications, such as Schottky diodes, transistors, etc., require high-quality single crystalline CVD diamond, which has superior characteristics such as high carrier mobility, long carrier lifetimes, high breakdown fields and high thermal conductivity.

High quality low-defect diamond wafers produced from diamond crystal made by High-Pressure High-Temperature (HPHT) method are only a few mm in size. In comparison, the competing semiconductor materials such as SiC are already available in wafer sizes up to 150 mm. For future diamond-based active devices, it is crucial to increase the wafer size above 2-inch with the defect density 100 cm-2 and below. Different approaches to achieve free-standing wafers from thick diamond films are under development. A mosaic type method is currently approaching 2-inch wafer size, but the defect density needs to be reduced. According to Yole Développement technology roadmap for single crystal diamond wafers, low-defect 2-inch wafers can be commercially available around 2016-2017.

The Microwave-enhanced Chemical Vapor Deposition (MWCVD) approach for crystal growth is more promising than HPHT, because of its potential for scaling. As shown in the report, MWCVD is also the most promising technique for thin-film growth. High-quality thick diamond films can be grown by homoepitaxy on single-crystal diamond wafers.

The heteroepitaxy of diamond on iridium enables diamond films of up to 4-inch in size, but further development is needed to obtain a well-controlled and reproducible manufacturing process.

Besides the technology challenges related to single wafer material manufacturing, electronic applications of diamond in electronics are heavily hampered by the fact that n-type doping is still relatively difficult to obtain due to the lack of an efficient donor. As p-type doping of normally insulating diamond can now be reliably achieved using boron, many activities have been focused

upon the fabrication of unipolar devices. The first expected active diamond power devices will be Schottky diodes.

Although polycrystalline films have inferior electric and thermal properties compared to single crystal material, they are available in larger dimensions and at lower costs.

As shown in Yole Développement’s report, they are used mainly in applications as heat spreaders (and many non-electronic applications, such as optical windows etc.). Future cost decrease and performance improvement of diamond films relies strongly on the CVD equipment used. Therefore a strong effort from equipment makers like Cornes Technologies (Seki Diamond), Element Six, Plassys-Bestek, sp3 Diamond Technologies… is focused on the development of CVD reactors with a larger deposition area, higher growth rate, lower electricity consumption and better film quality. An “integration” of diamond film directly into a wafer (used for the fabrication of electronic and opto devices as done for instance in Group4 Labs’ GaN-on-Diamond approach) has great potential to reduce the cost of heat management solutions for high-power and high-frequency applications.

Earlier market entry will help to secure better position in the future huge market

The differentiation between diamond material suppliers is mainly due to technology. Although many players are today able to supply diamond materials, only a few of them can supply a high quality material providing higher differentiation compared to lower performance but also less-costly non-diamond alternatives. Actually, less than 3 companies per material type can consistently deliver high quality products. Many players have significant R&D activities underway to develop new products and access dedicated R&D funding, as well as to hold any technological advantages they have over the competition.

The recent acquisition of Group4 Labs by Element Six (a member of De Beers Group) indicates the trend to maintain the key technologies within a select group of players, providing them a well-established position in the diamond material market. As learned from history, the development and optimization of diamond technologies is complex and takes many years. During this period, the historical diamond players will acquire a significant technological and IP advantage which may be hard for new players to overcome and make it nearly impossible to enter the market in the future.

The developers/manufacturers of high-performance devices such as high-power and high-frequency devices and high-power optoelectronics rely on the reproducible supply of high-quality materials.

Leading European and Japanese companies, especially those involved in the power electronic business are still quite conservative with regard to using diamond-based devices. This provides an opportunity for other companies, which may take leadership in this market segment and progressively develop their market share in power electronics by avoiding the direct competition within the established technologies.

Author of the report

Milan Rosina works as an analyst at Yole Développement for compound semiconductors market & technologies. Before joining Yole Développement, he worked as a research scientist and a project manager in the fields of photovoltaics, microelectronics and LED. He has more than 12-year scientific and industrial experience with prominent research institutions and an utility company.

Advertisement

Learn more about Yole Développement