By Majeed Ahmad, contributing editor

The news about Dialog Semiconductor PLC snapping up Silego Technology Inc. came just when market analysts had started claiming that we are done with the mergers and acquisition wave that rocked the industry for nearly three years.

Now is the time to digest the new assets and make them work, they would argue while pointing to the fact that there aren’t many attractive acquisition targets left anyway. However, while it’s true that the merger and acquisition activities are way down this year, the Silego deal is a testament that the underlying dynamics of these activities are still in play.

So this op-ed piece aims to find out what this mad scramble is all about, especially when industry watchers have mostly seen the acquisition frenzy in the semiconductor business from product synergy and operational efficiency standpoints.

It is, of course, one way of seeing this unprecedented era of chip business consolidation. But when you see this from a technology vantage point, it all comes down to the underlying design architectures and the quest to reinvigorate them in order to remain relevant while new markets like automotive and data centers emerge.

An architecture revolution

What we have on the technology front is an architectural revolution in which semiconductor firms are trying to find a new niche before they are being designed out. Chipmakers have to move beyond their legacy architectures because they can’t make money from them anymore.

The hardware architectures used to stand for around a decade or more before being phased out. Take, for instance, hardware suppliers like Intel, which continued to optimize their architectures while they gradually became commoditized. But now the rules of the game are changing amid new market forces: automated vehicles, high-performance computing (HPC), etc.

Another domino effect that new markets like automotive and data centers are creating is the emergence of multiple chips with multiple brains. That’s unlike the PC era, when the main CPU reigned supreme, or smartphone designs, wherein a single application processor dominated the overall circuitry.

In other words, these new markets require a different set of platforms, and that mandates new design architectures. Therefore, what we see now is the re-architecture of chips. And buying a design house is a more viable way to hit the ground running instead of carrying out a massive redesign work in-house. Dialog’s ownership of the CMIC architecture from Silego could boost its power management designs.

Dialog’s ownership of the CMIC architecture from Silego could boost its power management designs.

Anatomy of the Silego deal

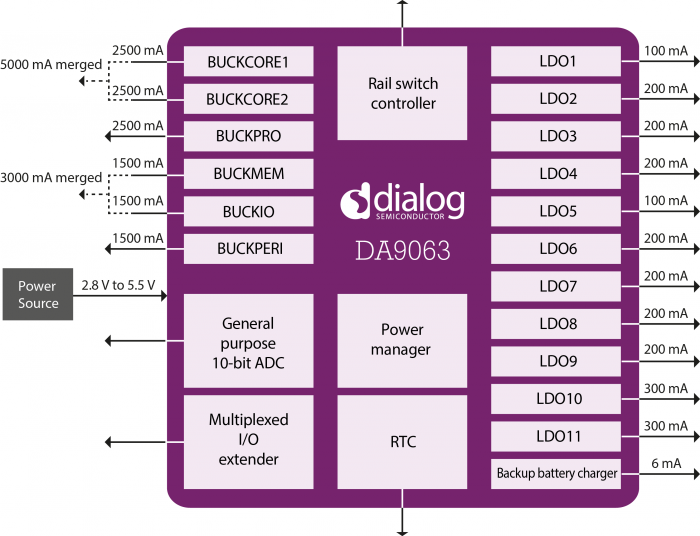

Dialog’s acquisition of Silego is a case in point. Power management is Dialog’s specialty as a chipmaker; it’s well-known as a supplier of power chips for Apple devices like the iPhone and iPad. The Anglo-German chipmaker has also made headlines recently for its failed attempts to acquire Austrian sensor design house ams AG and microcontroller supplier Atmel.

On the other hand, nearly 75% of Silego’s business comes from selling power systems in notebook and tablet designs. And according to media reports, Silego is also an Apple supplier. Fitbit, GoPro, and Samsung are among other known buyers of Silego’s power management chips.

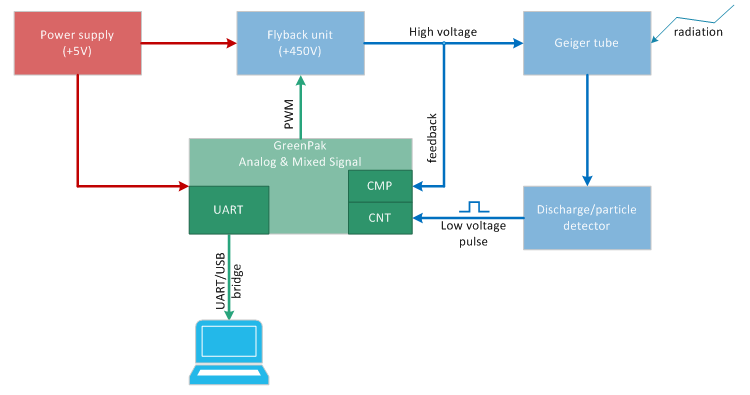

Its recent launch — the SLG46580 GreenPAK — is especially targeted at power systems for wearable and handheld devices. It integrates voltage monitoring, power sequencing, reset functionality, and configurable low-dropout voltage regulators (LDOs) in a single chip.

What’s new and unique about Silego’s approach to creating power chips is an architecture that it calls configurable mixed-signal ICs or CMICs. These highly integrated solutions combine analog, digital, and non-volatile memory in a programmable software-generated environment.

The CMICs look a bit like ASICs except that they can be created far more quickly using a software-programmable platform. Moreover, apart from the time-to-market advantage, CMICs eliminate a number of passive, linear, and discrete components from power designs. An architectural view of Silego’s CMIC power design.

An architectural view of Silego’s CMIC power design.

Therefore, while Dialog’s $300 million purchase of Silego hasn’t been seen as newsworthy, it’s an important development that underscores the significance of new chip architectures. It also telegraphs a positive signal for semiconductor industry startups.

The companies, large and small, are part of this architecture reset in the semiconductor business realm. In the end, it might not matter how big the deal is. The catch could really be about the architectural gains from an acquisition. So we may see more deals like Dialog snapping up Silego.

Advertisement

Learn more about Electronic Products Magazine