By Richard Quinnell, editor-in-chief

The opening salvoes have been launched and the combatants are making feints to test one another’s resolve, but so far, the threat of a U.S.-China trade war remains just that — a threat. Meanwhile, EP readers doing electronics development are justifiably concerned. The results of our recent reader survey show that punitive tariffs and other impediments to free trade in the electronics industry could have significant consequences.

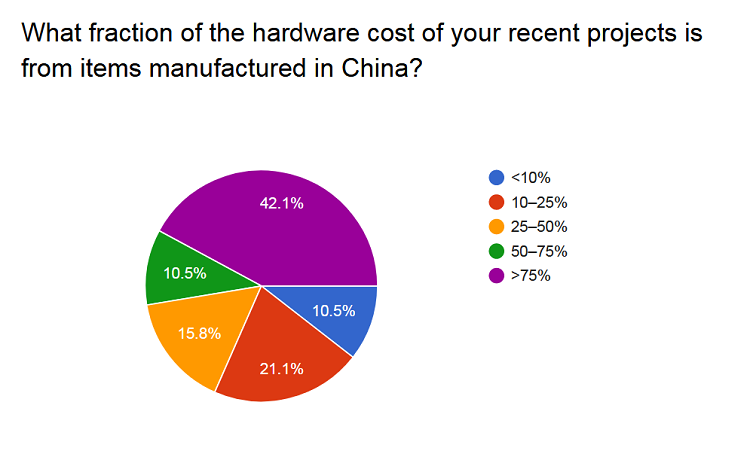

We asked EP readers six questions to indicate how significant a disruption in electronics supplies originating in China would be to their projects. We first explored how much of their project’s hardware was involved. For nearly half of their projects, China-sourced hardware accounted for more than three-quarters of their hardware costs. By anyone’s standard, that is a considerable exposure. A trade war clearly could have a substantial effect.

We next asked about alternatives. The news was not much better here, either. While many reported that there were alternative sources for at least some of this China-sourced hardware, only 20% indicated that most or all of their hardware had an alternate source. And for more than 30% of readers who responded, there were no alternatives for any of that hardware.

Coming at the question from another angle, we asked readers if they used any hardware that was only available from China. Two of three indicated that they did, meaning that a trade war could prompt a scramble to find alternatives for the majority of readers who responded.

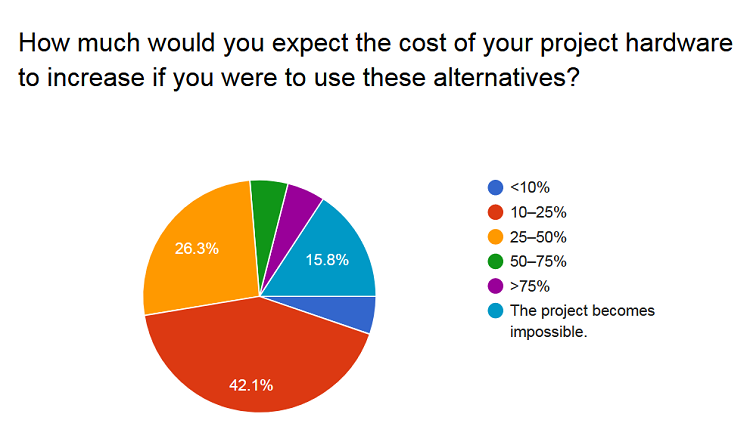

Given the major exposure that readers have to a risk of resources being caught up in a trade way, the next area to explore is cost. We asked readers to estimate how much their project costs would rise if they were forced to utilize alternative sources. The news is only slightly better. Some 70% of respondents indicated that their costs would rise between 10% and 50%. Still, there are an unfortunate few — one in six — whose projects would become impossible if their China-sourced hardware was no longer available.

Clearly, EP reader’s projects would suffer — some substantially — should a full-blown U.S.-China trade war erupt. The continued free-trade availability of components and modules from China is important or even essential to developer efforts. But developers are not the only ones who would lose in such a trade war. Once the war ends and trade stabilizes, the suppliers would continue to feel the effects.

We asked how likely developers would be to return to their prior use of China-sourced components should restrictions be lifted. Only a third indicated that they most likely or definitely would return to their prior use. Another third, however, indicated that they would not likely return, and about one in 20 would permanently refrain from returning to the use of China-sourced material. Thus, suppliers in China could expect to see a long-term reduction in demand when trade eventually resumes.

The one bright note in all of this comes from the software realm. Nearly 70% of respondents indicated that on the software side, anyway, a trade war would have limited impact, requiring that less than 10% of project software be re-written to accommodate changes in hardware supply. Given that software comprises at least half of a project’s development costs these days, that’s good news. Hardware costs may take a hit in a trade war, but software costs will suffer little collateral damage.

It should be noted that, while EP’s survey provides a window into the possible impact of a U.S.-China trade war on electronics development, it should not serve as the basis of major business decisions. Respondents to the survey were self-selected from among EP’s audience and do not necessarily represent a statistically valid sampling of the industry as a whole. The margin of error in the survey’s results is also fairly broad. So don’t bet the farm on these percentages.

Still, these results are an indicator that there is cause for concern. A U.S.-China trade war would likely injure the electronics development industry and have a lingering depressive effect on China’s vendors. As has been often articulated elsewhere in the media, indications here are that everyone loses in a trade war.

Advertisement

Learn more about Electronic Products Magazine