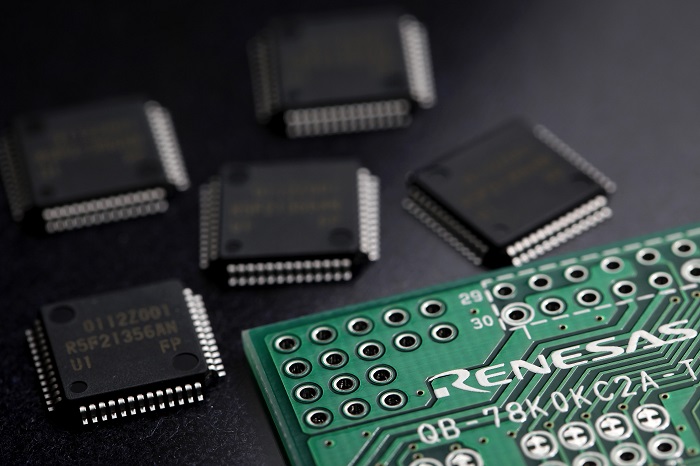

Japanese semiconductor manufacturer Renesas is in the final stages of a $3 billion acquisition of U.S. analog and power management chipmaker Intersil. Should the deal be completed (which is expected by the end of August), it’ll represent the latest accord in a series of consolidation agreements that have shrunk the semiconductor industry.

Earlier in the year, Renesas had stated its interest in making a deal with a U.S. chipmaker, though there was no clear indication about what direction the company wanted to take. Now, the strategy behind its thinking has become a bit clearer: this deal with Intersil is not meant to serve as a boost to Renesas’s profits, but, rather, it will position the company closer to the number one automotive chipmaker: NXP Semiconductors.

You see, both companies have reasonable exposure to the automotive industry, but not enough to be competitive; at least, not enough stake as separate entities. Together, Renesas and Intersil will sit at the forefront of an industry that is projected to explode in the coming years. Chipmakers in the automotive industry are expected to be called on to provide the solutions necessary to support a range of new and updated technologies for future automobiles, including infotainment systems, hybrid and plug-in electric vehicles, and autonomous driving systems.

In short, the timing is right — for both sides.

It is worth pointing out the similarities this Renesas-Intersil deal has to the 2015 agreement between NXP and Freescale. At the time the latter deal was agreed to, both companies held decent influence in the microcontrollers market, but when they paired together, they became the world’s leader as an automotive chip supplier.

The Renesas-Intersil agreement is also quite similar to the much larger $30 billion deal between Analog Devices and Linear Technology, as both companies supplied high-margin analog and mixed-signal chips, and they also served many of the same end markets. Consolidating the two yielded many cost synergies that have proven profitable for both sides.

As for this ongoing trend in the chipmaker industry, there is no clear indication that merger and acquisition agreements will cease, or otherwise slow down, any time soon. There are still plenty of decent-sized chipmakers on the market, including ON Semiconductor (which, it should be noted, has decent exposure in the automotive market as well) and Maxim Integrated. On a smaller level, there’s also Semtech, MACOM, IDT, and INPHI. Regardless of whether a deal is a merger or an acquisition, it allows companies to remove duplicate sales as well as administrative and R&D functions in an industry that is terribly fragmented. It brings focus to the company’s overall strategy and a clearer path to profit.

For designers, electrical engineers, and the like, what will be interesting to pay attention to is the end markets these companies target when they agree to their acquisition, because this will clearly indicate where future R&D dollars will be spent in the coming years.

Advertisement

Learn more about IntersilRenesas Electronics America