By Ryan Martin, principal analyst, ABI Research

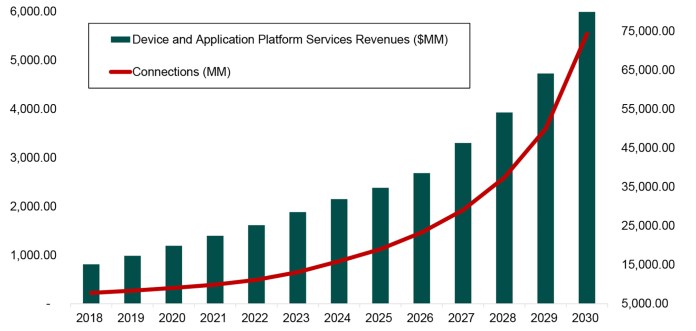

As manufacturers integrate information technology (IT) and operational technology (OT), they rely on industrial internet of things (IIoT) platforms dedicated to smart manufacturing to manage their devices, connectivity, infrastructure, and data. These IIoT platforms also help manufacturers to implement applications, derive insights, and deliver those insights to the correct stakeholders. More than $75 billion will be spent on these solutions annually by 2030.

IIoT device and app platform revenue (Image: Digital Factory Data, Worldwide, ABI Research)

Selecting the right IIoT platform for a project can be a challenge with a variety of platforms in the market that offer different features. However, there are several attributes, ranging from protocol adaptability and connectivity to robotics integration, to consider when making your decision.

What is an IIoT platform?

It seems almost every company that has built a piece of software for digital industries calls itself a “platform.” Consequently, IIoT platforms come in a variety of flavors to meet a range of needs. The most suitable definition, however, is that of an Application Enablement Platform (AEP).

AEPs provide a solution for importing data, but they often require partners to provide gateways. Some AEPs, such as Siemens MindSphere, Emerson Plantweb, and PTC ThingWorx, provide a “one-stop shop” that can take data from devices and work like an operating system with an app store. If app development remains open, applications can be built by the AEP provider, from partners (which may also be called platforms), end users, or independent developers, much like smartphone app stores.

Some one-stop shops focus more on the extraction of data and getting data to the cloud, while others focus more on delivering the data to other manufacturing and enterprise systems.

There are also IIoT platforms that specialize in a specific piece of application enablement or microservice, such as adapting protocols and processing raw sensor data at the edge. Platforms that do this include Litmus Automation’s Intelligent Edge Computing Platform and Foghorn’s Lightning Edge AI Platform.

What are the key criteria?

Requirements vary widely based on a project’s needs, but the following criteria are a good starting point to distinguish a platform’s completeness and position:

- Protocol adaptability and connectivity. Ability to connect to devices and equipment with protocols from multiple manufacturers; universal architectures, such as OPC Unified Architecture (UA); and other forms of connectivity, such as cellular.

- Edge intelligence. Support for complex event processing (CEP), machine learning (ML), and high-performance stream processing that sends actionable analytics to computing devices close to the sources of data. These capabilities are important because computing is increasingly moving to the edge to support latency-sensitive wireless applications like robotics automation, real-time video streaming, and wireless remote control.

- Digital twins. Ability to create, manage, and support digital twins for product development, production planning, products-as-a-service, asset monitoring, performance optimization with artificial intelligence (AI), simulation, and real-time 3D asset visualization. Ultimately, this information is used to establish a digital thread, which is a digital history of record that spans a product’s inception to the end of its useful life.

- Augmented reality (AR)/mixed reality (MR). Ease of deploying and scaling flexible AR/MR experiences and applications connected to devices on the platform. These experiences can be used for remote troubleshooting and support, process improvement, and reducing human error.

- Robotics integration. Ability to connect to industrial and collaborative robots from multiple manufacturers to extract data.

- Support for other transformative technologies. Includes AI, blockchain, and low-code, no-code app development.

No single firm can meet the needs of all customers, so most IIoT suppliers have partner ecosystems. This includes everyone from industrial gateway providers like Cradlepoint, MultiTech, and Dell to major industrial powerhouses like Siemens, Rockwell Automation, ABB, and Bosch. The newer entrants into the mix are the hyperscalers.

Cloud views

Most AEPs view cloud infrastructure as a commodity that Amazon and Microsoft dominate with Amazon Web Services (AWS) and Azure, respectively, but increasingly, these are the two companies encroaching on their territory.

AWS, for example, is working with Volkswagen (VW) to consolidate data from its 122 manufacturing plants to better track the arrival of parts, vehicle assembly, and the overall effectiveness of assembly equipment. VW will use AWS IoT Greengrass, AWS IoT Core, AWS IoT Analytics, and AWS IoT SiteWise to collect, assimilate, and analyze data from the plants. The data collected will support ML models that provide predictive maintenance and optimize operations.

Microsoft, for its part, has a strategic relationship with Hitachi and recently extended its partnership with PTC and Rockwell Automation to offer Factory Insights as a Service, a cloud-based solution sold on a modular, use-case basis. Factory Insights as a Service combines many of the key product components of PTC (ThingWorx, Kepware, Vuforia) and Rockwell Automation’s FactoryTalk InnovationSuite with Microsoft’s Azure IoT Hub and Azure IoT Edge, so manufacturers can more easily standardize and scale applications across sites.

The cloud allows information to be easily and quickly shared, improves compliance, and makes it easier to replicate and scale manufacturing optimization.

AEP providers rarely specialize in cloud infrastructure, and those that do rarely specialize in industrial data extraction. For a long time, this did not really matter because manufacturers were characteristically predisposed to keeping data on-site. Now, with the increasing need for remote visibility and system-wide digitalization, the cloud is critical.

What’s next

Many manufacturers are asking for pre-built applications that solve specific business challenges with the fastest return on investment (ROI). This is why Siemens developed its

Xcelerator portfolio, Emerson provides Plantweb “templates,” and GE Digital sees customers purchasing industrial applications supported by the GE Predix platform rather than purchasing the platform only and building their own solutions.

The general expectation is that, after adopting pragmatic applications and use cases to drive core reliability and cost factors, manufacturers will expand their IoT scope to additional equipment and processes to optimize performance.

In industries like food and beverage and pharmaceuticals, where more than 80% of issues are known problems, there is a lot of low-hanging fruit, such as valve, pipe, and tank monitoring. In industries like automotive, which are complex yet highly automated, the opportunity is to integrate with other platforms to improve statistical process control (SPC), for example.

Future determinants of success for IIoT suppliers come down to the openness of the ecosystem, low-code/no-code app development, cloud integration, and “as-a-service-ification.” These tenets will become more pronounced as the broader IIoT ecosystem graduates from monitoring to monitoring-and-control–style applications, but for now, they remain important differentiators to distinguish the leaders from the followers and laggards.

Ryan Martin covers new and emerging transformative technologies, including augmented reality, analytics, and the internet of things. He currently leads the firm’s manufacturing, industrial, and enterprise IoT research.

Advertisement

Learn more about Electronic Products Magazine