By Carolyn Mathas, contributing writer

Breakthroughs abound across a number of LED technologies, and each segment has its own strengths, weaknesses, and level of maturity. MiniLEDs, microLEDs, and quantum dots are fiercely challenging incumbent LED technology, and for all of their gains thus far, a look at each of the segments shows that for the most part, they’re just not there yet.

MiniLEDs

As a backlight illumination source, miniLEDs represent a higher number of LEDS but ones that are smaller than those currently used, enabling thinner displays and improved local contrast, similar to that provided by OLEDs. In automotive applications, they are meeting industry demands for very high contrast and brightness, conformability to curved surfaces, and ruggedness. MiniLEDs are easily manufactured in existing fabs already achieving increased production output and die-bond accuracy.

There are still challenges. For smartphone apps, miniLEDs face a strong incumbent in OLEDs as their cost to performance ratio relegates them to high-end segments. Direct-lit miniLEDs enable local dimming; they can be used for curved displays, and the cost of a resulting TV is expected to be approximately 20% to 30% lower than an OLED version. However, as the number of LEDs used increases, heat dissipation becomes problematic. Also, more local dimming zones require a higher number of LEDs, increasing the number of ICs. As a result, a major challenge exists in that costs are actually rising to improve performance.

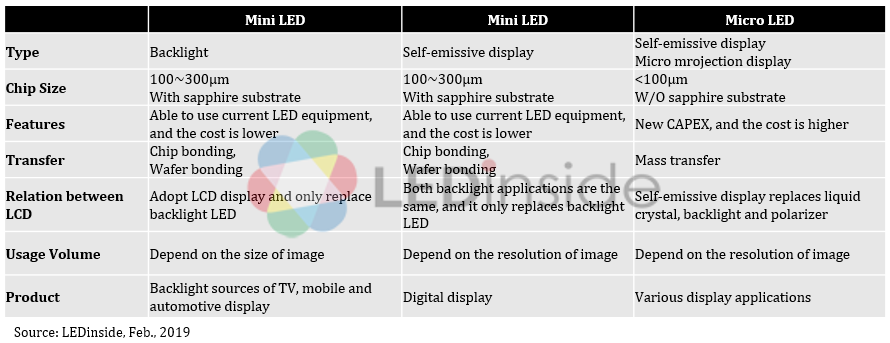

A comparison of miniLEDs and microLEDs. (Image: LEDinside)

MicroLEDs

By comparison, microLEDs are more disruptive than miniLEDs in terms of performance, technology, and infrastructure. MicroLEDs match incumbent OLED technology in terms of response time and viewing angles and exceed OLED in brightness, ruggedness, and power consumption.

“From the perspective of a display designer or OEM, the technology is not available yet,” said Eric Virey, senior technology and market analyst at Yole Développement. “Even after the remaining challenges are solved, the supply chain must be built. So while we might see some devices featuring impressive microLED displays within the next couple of years, volumes will be limited. High-volume consumer products are still two to three years away at best. By then, competitive technologies such as OLED or electroluminescent quantum dots will have evolved. Performance is one thing, but cost-compatibility is critical.”

As the technology improves, there are credible cost reduction paths for microLEDs to compete in the high-end segment of various applications such as TVs, augmented reality (AR), virtual reality (VR), and wearables. For smartphones, OLED cost means pushing microLEDs toward the limits of the technology in terms of die size.

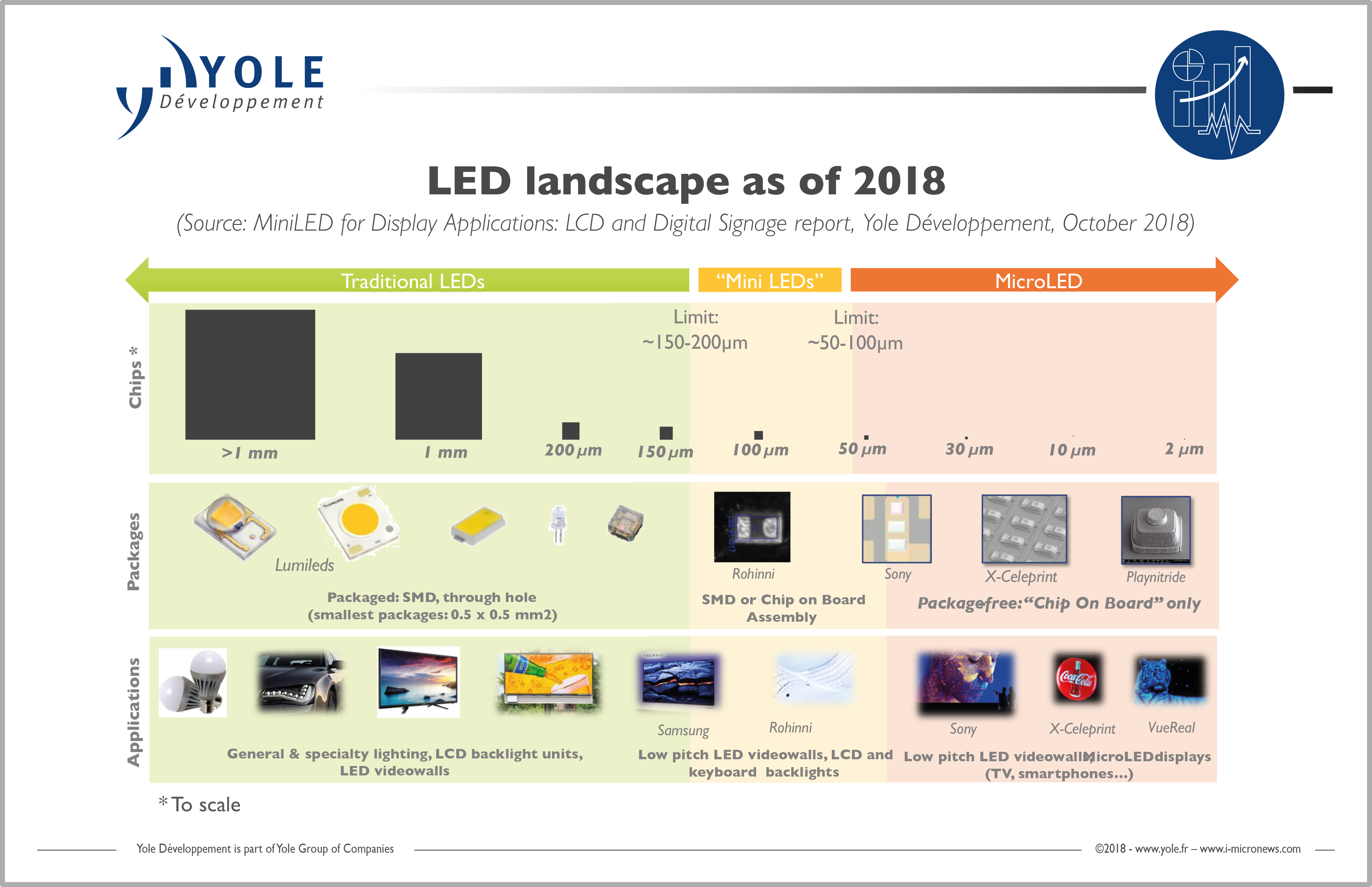

Image: Yole Développement

Image: Yole Développement

One supplier making significant advances is Plessey Semiconductors. The company’s microLED displays for headsets are achieving 10 times the resolution, 100 times the contrast ratio, and up to 1,000 times the luminance of traditional OLEDs with just half the power consumption. Plessey demonstrated the first AR/VR glasses powered by microLEDs at CES in 2019, and Vuzix plans to ditch OLEDs in favor of Plessey’s microLEDs in its next generation of smart glasses.

Plessey claims that its microLED displays deliver 10 times the resolution, 100 times the contrast ratio, and up to 1,000 times greater luminance than OLED technology. (Image: Plessey Semiconductors)

Quantum dots

Three types of quantum-dot technologies exist at various stages of development:

- Color-conversion quantum dots is a “plug-and-play” technology used by Samsung in its “QLED” TVs and Vizio in its “P-Quantum” series. A sheet of quantum dots is added into the backlight of an LCD display and the dots convert the blue light from the LEDs into very pure blue, green, and red light. This improves the color gamut, display energy efficiency, and/or brightness.

- Electroluminescent quantum dots, or EL-QD, is more disruptive and there is no color conversion from LED to quantum dots.

- QD-OLED combines OLED and QD color conversion, using blue OLED pixels to excite patterned quantum dots positioned on top of the OLED to convert the red and green pixels. It achieves better brightness and efficiency at a lower cost than OLED technology with color filters.

Samsung Display recently confirmed that it is developing large QD-OLED panels for TVs, a combination of quantum dots and OLED technologies. Using blue OLED emitters behind a layer of quantum dots, QD-OLEDs deliver higher brightness, a wider color range, and potentially lower production costs. However, Samsung recently announced an investment review committee to be held in April 2019. The committee will be tasked with making a decision regarding Samsung’s plans to produce QD-OLED TV panels. If approved, mass production is anticipated by the end of 2020 or the beginning of 2021. The question is, being that Samsung planned pilot production in 2019, is this a plan to stay on track, or could this be a bit of a delay?

Also, in the microLED segment, Plessey and Nanoco Technologies are partnering to shrink the pixel size of monolithic microLED displays using Nanoco’s cadmium-free quantum-dot semiconductor nanoparticle technology. Plessey will integrate Nanoco CFQD quantum dots into selected regions of blue LED wafers to add red and green light. The result is shrinking today’s smallest pixel size by an impressive 87%, enabling the production of smaller, higher-resolution microLED displays and enhancing color rendition and energy efficiency in AR/VR devices, watches, and mobile devices.

Going it alone?

Depending on the LED flavor and how much the technology veers from existing materials, processes, and supply chains, it makes sense to partner up for more rapid development and to curtail cost. “Building partnerships for innovation and product development is vital, especially for overcoming key technological bottlenecks,” said Roger Chu, research director, LEDinside. “Without partnership, those niche technologies might not be successfully developed.”

He continued, “At present, it is widely believed that by getting microLED chips and mass-transfer technologies ready, manufacturers can successfully produce microLED displays. However, microLED is not mature yet and still faces many bottlenecks in different manufacturing processes. Therefore, it is necessary for manufacturers in related fields to work together and invest in technology development.”

Yole’s Virey agrees in the OLED and EL-QD realm. “The OLED or the EL-QD materials are dispersed into an ink, and displays are literally printed on the transistor backplane. We’re seeing a lot of independent quantum-dot material companies developing their own materials, but many of the leading display makers such as Samsung, TCL, or BOE have their own internal efforts and are also working with the independent material companies. Collaboration is critical. Each material needs to be precisely engineered to work well with all of the others.”

Virey further points out that, with microLEDs, the manufacturing processes and infrastructures are very different, bringing together two industries, LEDs and displays, with very little in common. Processes and tools don’t exist yet, and setting up the supply chain will require collaborative work between LED makers, tool makers, display makers, and a variety of microLED startups that are often ahead in developing some of the critical technology bricks.

A recent example of collaborative efforts is the recent announcement from the EV Group and Plessey to bring high-performance GaN-on-silicon (GaN-on-Si) monolithic microLED technology to the mass market for AR applications.

With innovation comes surprises

According to Virey, he’s seen at least two surprises in the industry to date. “Over the last two to three years, microLED graduated from the status of a ‘crazy idea that will never work’ to that of a credible display technology candidate. Think about it: To make an 8K microLED TV, one needs to assemble close to 100 million tiny LEDs the size of a bacteria with a 1-µm accuracy and without a single error. And to make it economically viable, you need to be able to do that in just a few minutes.”

Virey added, “When the idea was first discussed, the best assembly technologies on the market would have taken months or years to assemble just a single TV. Now, many massively parallel transfer and assembly methods have been developed by various companies that are bringing the economics of microLED close to reality. There are still a lot of challenges ahead, but it doesn’t sound crazy anymore.”

He also cites Samsung’s QD-OLED technology. “Frankly, I don’t think that anybody seriously had it on its radar just 18 months ago, but the company might already be on the verge of building a first fab. This fast time to feasibility stems from the fact that Samsung had already invested separately a lot of time and money on the two major technology bricks required to enable QD-OLEDs: OLEDs and quantum dots. Samsung had already made a lot of progress independently on each of those technologies until it realized it could realistically combine them into a third one.”

Challenges still abound, yet the LED market is evolving rapidly. Many companies including Apple, Plessey, Samsung, AUO, and others are pushing ahead. Many prototypes and new capabilities will be announced in the near term, yet from the view of a display designer or OEM, patience is still required.

Advertisement

Learn more about Electronic Products Magazine